(continued from Persistently Worthwhile Dealer, though extra of a continuation from Bitcoin)

November twenty first 2013, 3:00 AM EST

It’s going to go to 0. We’re gonna lose every thing. I wish to die.

I get up in chilly sweat and clutch my chest. I see value hasn’t budged–nonetheless $800. It was all in my head. I see our fairness approaching $500,000–more cash than I’ve ever managed in my life. Why is making more cash extra demanding? It’s as a result of now I’ve extra to lose. I wish to promote all of it earlier than it inevitably collapses. I do know you Bitcoin, I understand how you use.

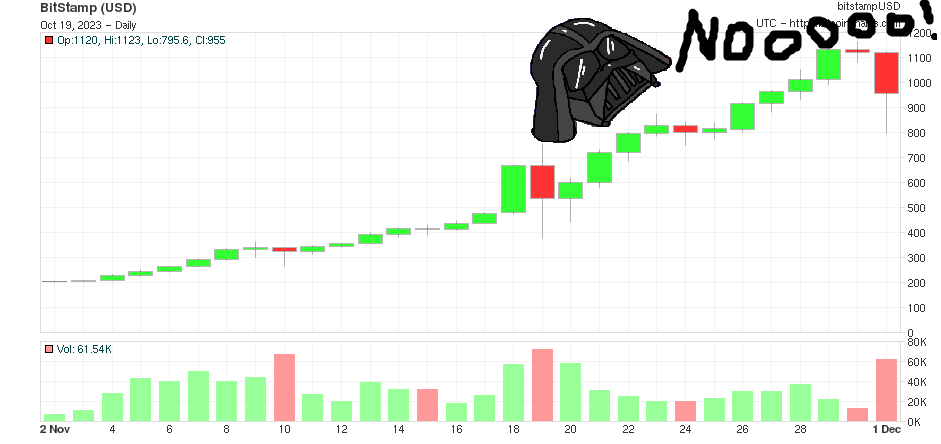

Okay, chill out. I’m struggling to deal with my shit. I blame that silly Bitcoinity alert. It triggers each time bitcoin has a destructive transfer. The alert is completely set to the voice of Darth Vader screaming

It’s my wake-up alarm in periods of elevated volatility and it’s the one sound alert I might discover. It repeats till you shut the notification in your browser. I’m dwelling by means of Anakin’s anguish. He misplaced the love of his life. I’ve misplaced my unrealized $USD income. Identical factor. His ache is my ache. I hate this.

Waking up abruptly out of deep sleep to see $100,000 in fairness loss felt about as demanding as you could possibly think about however it isn’t even the worst half. The worst half resides in such a heightened state of anticipation that you just *assume* you hear the alert when it’s not really occurring. Half the time I heard it in my desires, solely to get up and discover out nothing had occurred but. Buying and selling a 24/7 market is buying and selling in Hardcore Mode–you’re by no means really off-duty and it might probably begin to screw together with your head. No matter I’m doing–consuming dinner, speaking to pals, coaching on the fitness center–I can’t really immerse myself as a result of the worth is at all times on the again of my thoughts. I’d carry my laptop computer in every single place and make these contingency plans to seek out the closest Starbucks or McDonalds if I needed to commerce on the fly.

This Coin Fund is ruining my life high quality however nonetheless I carry it like a badge of honor. I’m the man doing my job, regardless of how depressing it makes me really feel. I’ve been a horrible sleeper for my total life anyway, I’m used to it. I can do that. I can daytrade shares too. I’ve to earn a living.

FOUR HOURS LATER.

Test value. Nothing. Only a dream once more. I’ll by no means, ever get that sound out of my head. Would possibly simply be greatest to stand up at this level. For breakfast, I’ve a cup of espresso with a facet of adderall.

July twenty eighth 2013 (THREE MONTHS AGO)

It’s the summer time, which I hate since you’re shoulder-to-shoulder on the trains and the air sticks to you. My good friend Tommy has a telephone name along with his cousin, Rivers, one of many high builders at a promising bitcoin startup referred to as BitInstant.

Rivers: Hey Tommy, very long time no chat. You’ve been knowledgeable inventory dealer for a pair years now. I’m making an attempt to start out a bitcoin buying and selling fund, is that one thing you’d be eager about?

Tommy, being lower than 3 years into his skilled buying and selling profession and never having ever traded bitcoin earlier than, didn’t really feel tremendous assured in spearheading this enterprise on his personal.

Tommy: Certain… however can I carry another person on?

The following work day, we’re having lunch. I had an upsetting morning–made some unhealthy trades which might be nonetheless rankling at me. I’m scarfing down a greasy cheeseburger oozing with nasty sauce and grilled onions, every chunk providing a second of respite from my extremely vital inside voice. And the humidity.

Tommy: P-To, my cousin is in search of merchants for some form of bitcoin fund. Need to meet him?

By this time, I had stopped actively buying and selling bitcoin. There was an incident that pissed me off–the only site-operator of Bitfinex, Raphael Nicolle, had cancelled considered one of my free-money ‘blissful print’ trades just because he might and he didn’t even notify me. That sneaky fuck. I don’t belief anybody or something in crypto.

Me: Certain. Why not?

That weekend, we discovered ourselves at “Silicon Alley”, a cradle for tech startups out within the Flatiron District. Rivers gave us a tour of BitInstant after which launched us to the corporate’s founder and CEO, Charlie.

Charlie: So the place do you assume bitcoin goes finally? I say $100,000 at the very least.

He thinks this faux web cash is price $100,000? GMAFB. That will carry it over the market cap of all of FAANG mixed, regardless of no money movement and no fundamentals. This man resides in dreamworld. Too cocky. Simply reinforcing my impression that bitcoin is a cult of fanatics and I don’t belief cult-like conduct in my markets.

Charlie: Let me know the way the buying and selling goes, I may be afterward. I might speak to the Twins and see in the event that they wish to make investments too.

Rivers exhibits us out, says he’ll get in contact. A couple of months go and value stays stagnant round $100. I don’t assume a lot about it till I see that the biggest alternate, Mt. Gox, had suspended withdrawals after which admits to incurring “vital losses” because of crediting uncleared deposits–large crimson flag #1. Then afterward, Silk Road gets shut down and bitcoin drops 30% in a day–large crimson flag #2. I ponder whether or not bitcoin is only a fad that can fade away because of all of the belief points and the dearth of a regulatory security web.

October fifteenth 2013

The leaves have turned and it’s now autumn. Bitcoin survives waves of destructive information and rallies again over $150. Rivers reaches out for one more assembly. He’s now not at BitInstant. Charlie is out of the image as a result of he’s acquired “greater stuff to cope with”–no matter which means. Rivers is now beginning a brand new multi-project enterprise referred to as Coin.Go. He has some severe backers: an inheritor to a centuries-old Manhattan financial institution, a man named MM, and the CEO of the main ASIC miner firm, a man named Zuo. Rivers needs us to start out buying and selling as a “proof of idea” for a future crypto hedge fund.

We had a gathering. Fundamental settlement was this: we might take 20% of the income since that was the hedge fund business commonplace, ranging from immediately. There was no paperwork. Rivers requested for our pockets tackle and transfered over 400 bitcoins, which on the time was round $70,000. He left technique and fund aims totally as much as us–simply do no matter we predict will earn a living. We don’t actually have a method apart from “beta with leverage”: maintain the core of 400 cash and experience the prevailing market transfer, use leverage to commerce round it and improve returns. Our main purpose was to create a observe report that might beat purchase and maintain returns. We didn’t have any well-defined methods, we’re simply going to make all of it up on the fly. We didn’t have an official identify however we informally referred to as this enterprise The Coin Fund.

November fifth 2013

It’s beginning to get attention-grabbing as value marches previous $200 for the primary time since March. Shortly after that, BTC-China and Huobi get away to new highs whereas the U.S. exchanges lag behind. We make a plan to go 200% lengthy when Bitstamp breaks new highs, considering U.S. markets must catch up. $250 is the important thing quantity. We determine to assist break it out ourselves and see what sort of momentum we might get.

There’s a big order block at $250 slowly being cleared out. I monitor the second when it’s near decrementing to 0 and I purchase one other 400 cash, doubling our fund’s place and going 200% lengthy. You realize that intense feeling of gusto that hits you proper if you dimension right into a place? It hit us laborious. All of a sudden you need *the transfer* that rather more. COME ON, GIVE US THAT MASSIVE BREAKOUT CANDLE TO $275.

It trades to $251 after which it’s again beneath. Some fool merchants stack the $250 provide once more. They’re not seeing what we’re seeing, that this could go MUCH MUCH greater.

An hour later, it drops to $230 on quantity. Oops. Bought forward of ourselves.

Is it a faux breakout? It’s laborious to inform. We have now daytrader mind–that means if breakouts don’t go immediately, we simply hit out of the scale rapidly. The right cease degree is $200 however that’s too massive a loss to abdomen. We determine to play it protected and take off the levered lengthy for a paper lower.

24 HOURS LATER.

Bitcoinity has a special value alert sound for when the worth goes up.

It’s the sound of the Street Runner–the one from the Looney Toons.

Our first likelihood to point out some form of worth add as “professional merchants” and we piked it. Goddamnit. Whereas watching value climb to $300, I used to be beside myself.

The Coin Fund initially doesn’t have well-defined roles however one begins to develop: I’m the top dealer and Tommy is principally my therapist. We have now telephone calls to debate “technique” aka “me bitching about my emotions”.

November tenth 2013

I’m itching for a buying and selling alternative as a result of I do know the Coin Fund wants to point out relative efficiency. I don’t wish to appear like a ineffective fool. After which whereas watching late night time NBA video games… I hear it.

Value drops almost $100, from $362 to $269. It’s time to get to work and purchase these dips. I race to my laptop computer and purchase 200 BTC within the $270-$280s and get us again to 150% lengthy.

A day later, value recovers to $350. I scale out and reinvest the USD revenue into the BTC stack.

That is it. That is the technique. I can’t be the uber-trader who will get 500% lengthy and holds all of it to the moon however I could be the scalper who trades the dip, minimizes his holding durations, and add 5-10% increments. There’s nothing fallacious with that. Our stack will increase from 400 BTC to 500 BTC utilizing the margin buying and selling income.

November 14th 2013

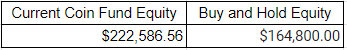

There’s a bi-weekly Coin.Go assembly the place we focus on our efficiency. Tommy has a spreadsheet print-out evaluating our present fairness to that of a theoretical purchase and maintain account.

The numbers present that we’re including alpha regardless that we all know it’s simply beta with leverage. Rivers, MM, and Zuo are happy. They’re all getting loopy wealthy off their very own private holdings too. Everybody’s blissful. Then the dialog meanders into one thing else as a result of these bitcoin-obsessed technocratic futurists must share their unusual new concepts–one thing about an unmanned yogurt store run by robots that function funds by means of the blockchain, which was supposedly an instance for a real-life use case of bitcoin.

I’m jacked up on adderall and I can barely pay attention as I stare on the Bitcoinity web site, watching each tick. In the meantime, Tommy is getting sucked into the bitcoin cult. He loves this yogurt store thought. He’s been telling his personal dad and mom to speculate into bitcoin. He’s compromising his objectivity by consuming the Kool-Support. We’re short-term merchants, we’re alleged to be agnostic about long-term future costs as a result of no person is aware of what’s going to occur that far out. I’m involved.

November 18th 2013

Each $100 transfer in btc that occurs, I lie in mattress anticipating one other large dip. After which I might scalp it once more. However there are not any dips. Bitcoin is now approaching $700. Our fairness is now near $400,000. It’s laborious to not look again with remorse that I didn’t maintain my margin longs from $280. Or $250.

We’re on the MBC desk at 7pm and everybody else has left. I’m glued to my seat whereas watching the chart and market depth. I inform Tommy to stay round as a result of my spidey-sense is tingling. The development is rushing up and that often means one other large pullback coming. We order Chinese language meals for supply. We wait. It rips by means of $700 and touches $750. Means too frothy.

Half hour later. They begin to machine-gun the bids. It begins.

It’s my Pavlov’s bell for ache. I felt pained seeing our USD fairness drop however one of the best ways to deal with it was to delve deeper into short-term buying and selling mode and make some good scalps off the volatility. The following 36 hours, I traded my ass off.

Our stack will increase from 500 to 600 cash when the mud settles.

I don’t keep in mind when precisely it occurred–it would’ve been at the present time within the workplace, may’ve been the subsequent day or day after that, it’s all a blur–however an intense dialog occurred. We confronted a troublesome choice and our feelings had reached a boiling level. Or at the very least *my* feelings did.

Tommy makes an attempt to motive with me whereas I foam on the mouth. He calmly replies he has not, in truth, drank any Kool-Support. He reiterates the plan–maintain a core of 400 cash it doesn’t matter what, the unique quantity that Rivers gave us. He asks me what’s going to really feel worse–giving again some income or lacking the subsequent 100% transfer as a result of I panic bought?

I don’t reply immediately. I take a deep breath and tempo round for a bit. I do some intestine examine.

Fuck, he’s proper. We will’t promote it but. I’m simply unsure sufficient the highest is definitely in.

We agree to carry 400 cash till additional discover. The following few days are stressed. What if that transfer was the highest and it simply has a demise candle out of nowhere any second now? That is when it acquired actually unhealthy. I’d lie in mattress awake for hours after which drift into this hyper-surreal dream state and listen to that horrible

Then I’ve these nightmares: I’m at my display screen and I’m seeing bitcoin commerce close to $1 after some form of horrific infinity dump. Each alternate has gotten GOX’d, you possibly can’t even load the web page, it’s so unhealthy. Bitcoin was revealed to be a rip-off all alongside and someway, I slept by means of all of it. Now our fairness is at $0. Devastation.

Then I get up once more. It’s effective. It’s really at $100,000. Identical to Charlie had informed me all these months in the past. We’re mega-millionaires.

After which I understand *that* was additionally a dream after which I get up once more. I’m experiencing pure delirium. I don’t know what’s actual anymore.

The say in bull markets, the market climbs a wall of fear. I didn’t get what that meant till now.

November twenty third 2013

$800. New all-time highs and development nonetheless in tact. Cease worrying, attempt to get some sleep.

Day after day, I’d speak by means of my “worries” with Tommy. He ought to simply purchase an extended chair for me to lie on and begin billing me for his time. He’d guarantee me: bitcoin is the best factor ever. It’s going to go greater. Does he actually consider that? Or is he a bitcoin vacationer posturing for the sake of maximizing income? I don’t know something anymore.

November thirtieth 2013

Development accelerates once more and the bitcoin group is just too blissful and stuffed with themselves. I don’t prefer it.

I do know what often occurs subsequent. It’s time to embrace the darkish facet of the pressure.

December 1st 2013

Again to $800. Our fairness peaks close to $700,000 and swings again close to $600,000 on this pullback. We’re day merchants who hate dropping greater than $1000 in a day and we had been now experiencing 6-figure fairness swings. It may be a shock to the system. However at this level, my nerves have been solid within the fireplace. I’m dealing with my shit just a little higher. Deep breaths, Pete. You bought this.

I’m going 200% lengthy within the low $800s and flip it for a fast scalp when it bounces again over $1000.

December fifth 2013

After that $800 take a look at, it begins grinding again as much as the highs at $1100 inside a couple of days, similar to all the opposite pullbacks.

It’s simply consolidating right into a excessive and tight flag proper beneath $1150 for hours and hours and hours. You realize what occurs if you see that form of value motion–one other breakout is imminent. I’ll hear the BEEP BEEP! any second now.

It’s 4AM. I hear one thing.

It’s not a dream. It’s actual. It’s again within the mid $800s, regardless that I used to be positive it will go greater. This doesn’t appear proper. It has not yanked twice on the identical degree like that. I forgo shopping for the dip this time and I wait as an alternative. It’s completely different this time, I can really feel it in my bones. I do know what to do now.

Tommy. We’re promoting it. If I’m not proper about this being the highest, we will simply re-buy again over $1150.

He doesn’t reply. I’m spamming his Gchat whereas he sleeps. I make the unilateral choice to dump all our bitcoin on the micro-bounce to $1000. Higher to express regret, not permission. I really hope I’m fallacious and bitcoin reverses again up. It’ll pressure us to purchase it again greater and we preserve getting cash on the uptrend. That’s a greater situation than the bull cycle being over for months, presumably years, or presumably ceaselessly.

It doesn’t maintain $1000. Afterward it breaks beneath $800 with conviction and the flood gates open.

It’s over. It doesn’t make new highs for the remainder of the 12 months.

December seventeenth 2013

It feels good to lock it in and maintain money whereas $1000 acts as resistance. I really feel a complete load taken off my thoughts. I take every week off from the graveyard hours and have Tommy scalp the dips as an alternative. Let him cope with Darth Vader. Even with bitcoin buying and selling again to $700, 40% off the highs, our fairness finally surpasses new highs with nimble and adept dip-scalping.

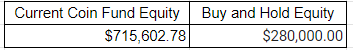

We have now our final Coin Fund assembly earlier than I journey again dwelling to California for Christmas trip. We present them the present spreadsheet.

I virtually wish to take a bow in entrance of all of the Coin.Go companions–“You’re welcome!” This expertise began my dependency on stimulants and possibly took years off my life however yeah, you’re welcome.

However I didn’t wish to come throughout as ungrateful. I wished the dialog centered on new methods to earn a living as a result of I had one.

Rivers: Nice job guys. So if you happen to assume bitcoin has peaked, what’s the plan now?

Me: There’s a money lending function on Bitfinex. It’s a P2P lending platform the place you lend USD to different merchants who want it for the margin. Charges are loopy in the meanwhile–you may make 1% a day lending at peak demand. Overlook buying and selling, lending is free cash!

(to be continued in The Pot Shares, thanks to all my readers!)