(continued from Full Transparency)

Round this time, I bought the brand new version of Jack Schwager’s Market Wizards, now titled Hedge Fund Wizards. My pal Coulsen informed me to skip to the top and browse one of the best chapter: “Stepping in Entrance of Freight Trains.” It featured the one prop dealer (from First New York Securities) in the entire Market Wizards collection. Right here’s the intro paragraph:

Jimmy Balodimas breaks all the principles. He sells into uptrends and buys into downtrends. He provides to losers and cuts his winners brief. He’s a predominant brief in a market that’s up nearly all of days. By any of the usual tips for buying and selling success, Balodimas shouldn’t survive within the markets, not to mention thrive. But he is among the most profitable merchants at First New York Securities, the prop buying and selling agency at which he started his profession 15 years in the past, and he has by no means had a dropping yr.

Oh and he beloved to brief CMG (Chipotle). Why? As a result of… They promote tacos!Not microchips. Not the remedy to most cancers. Not electrical vehicles. Tacos. It’s dumb and reductionist however who can argue with a dealer who prints cash?

I’d take into consideration this chapter on a regular basis. Right here was this quad-2 ache sponge who disregarded all of the cliches about profitable buying and selling and simply did what he wished (and did it effectively). It’s not that we wished to emulate his actual fashion however we have been fascinated by his defiance of the buying and selling orthodox. It was stated in our coaching supplies which you can’t make a profession fading developments (the “onerous cash”, it was known as) or doubling down on losers. This man’s existence and his 15 yr observe document proved in any other case.

Each buying and selling desk has wildly various however typically archetypal persona varieties and this Balodimas man was positively a sort you’ll discover. Keep in mind once I stated MBC employed a bunch of ringers when the Joint Enterprise began? Certainly one of them, Hanzo, was a very long time colleague of Avery and Victor, courting all the best way again to their days at Datek. He too, appreciated to fade every part.

The Ten Merchants You’ll Meet on a Prop Desk

1. The Contrarian — Hanzo

Hanzo’s each day modus operandi was to run an 80%+ brief e-book stuffed with market main names like PCLN, FB, AAPL, AMZN, TSLA and… CMG. They promote tacos! turned our personal little rallying cry at any time when we noticed Hanzo shorting extra CMG. He would journey CMG brief for 300 factors towards him and all of us thought this was an indication of his unbelievable conviction. Hanzo at all times traded countertrend, believing that the flip was proper across the nook. He would tout his beloved DeMark indicator, which at all times appeared to be pointing in the direction of the The Massive Market Crash™.

Regardless of the market is doing, wager on the other–that’s the Contrarian mantra. Each single prop agency you’ll be part of has no less than one. An in depth cousin of The Contrarian is The Doomer. The Doomer will swear on the truth that (insert sitting president right here)’s America goes to hell, we went up “too far & too quick”, and it’s all as a result of the Fed and the PPT are falsely propping up the market. They’ll spam the group e-mail with 1929 analog charts, movies about Weimar Republic, and Bloomberg articles of Michael Burry’s “$1.6 billion wager towards the market”. They’re unbearable. To Hanzo’s credit score, he appeared like a nice man who would spare us the doomer propaganda. All of us appreciated him. He was extra prone to speak to you about his son’s golf sport or his travels in Korea. He made us really root for the large crash.

Though the market went towards him, Hanzo may commerce round his positions effectively sufficient to reset a few of his costs, which is an indication of respectable talent. A contrarian with out the buying and selling chops in all probability would’ve been fired shortly however Hanzo managed to remain above water and stick round. Nonetheless, we at all times puzzled… would Hanzo ever catch the large transfer? Would he change his thoughts? Would there ever be a bridge too far in a runaway bull market that may flip off his lights? Everlasting contrarianism is a troublesome approach to commerce. We by no means noticed The Massive Market Crash™ that Hanzo’s DeMark indicator had promised.

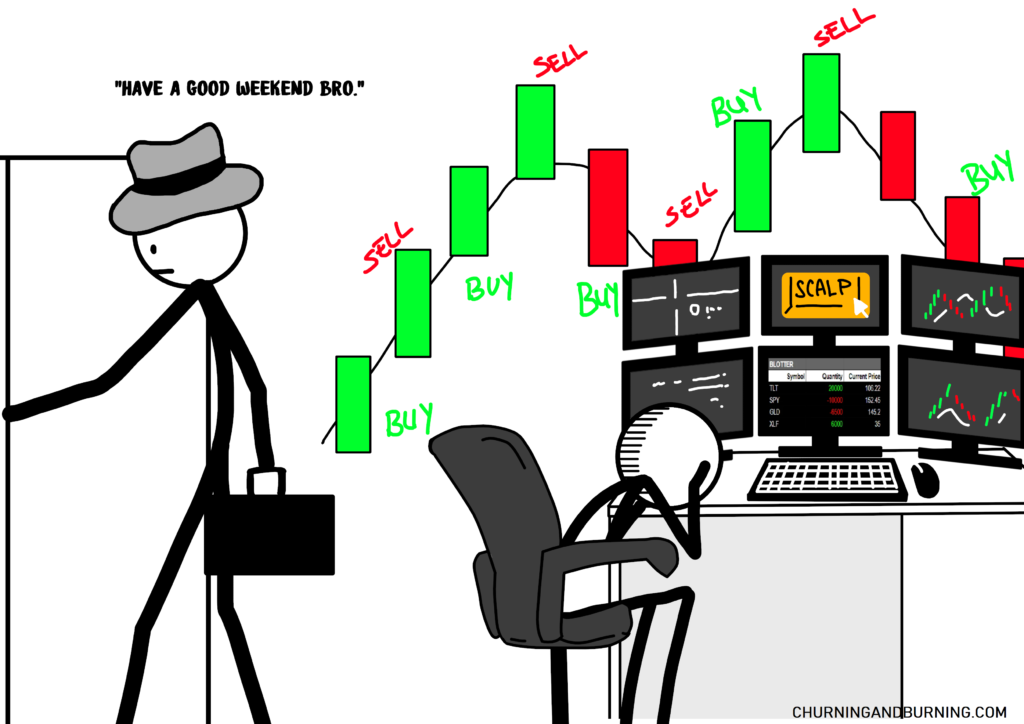

2. The Spazz — Laser

Laser traded on the Austin primary department however he had an NYC prop background courting again to the late 1990’s. I by no means met him in individual however I really feel like I knew Laser simply by the TIX Window, as I’d see him overtrade the shit out of every part with loopy dimension. Breaking information and sudden value spikes would draw him in like a moth to a flame.

At MBC, we have been form of choosy about our value location. Consolidation, breakout, and development was the psychological mannequin we adopted and we didn’t need entries too far-off from the bottom (consolidation). Nobody wished to be the man who paid the highs or hit the lows to provoke a place. Then you definitely had Laser, who had no qualms about getting in ANYWHERE and with dimension. He simply didn’t give a fuck. Inventory has a 5 level spike in 30 seconds and there are not any ranges to maintain danger tight? Ebook is approach too skinny? Laser’s recklessly clearing the supply with 20,000 shares. Then he’d be out in 10 seconds. Then he’d be in once more. Then he’d be out once more. Then in. Then out. In. Out. Then he’d flip brief.

I couldn’t discern the rhyme or purpose to most of his trades, as they typically appeared random and impulsive. Each prop agency has a Spazz clicking out and in all day and also you surprise if it’s an indication of debilitating playing dependancy. Laser really made cash however he solely netted about 10% of his gross earnings, by far the least environment friendly dealer on the agency . I can solely think about him at 4pm… fully out of psychological capability and staring lifelessly on the degree II, fluids slowly leaking out of his mind.

3. The Whale — Mr. West

The Whale is normally the man that everybody else on the agency is at all times speaking about as a result of he swings probably the most cash, like Spark Merling at Y5. We like to be railbirds for the most important merchants and to gawk at their enormous wins and losses–it’s why “PnL Porn” typically will get probably the most eyeballs on-line. Mr. West wished to advertise his agency’s radical transparency so he would add anybody who requested him on the blotter. In some ways WTG’s danger taker tradition was a mirrored image of his personal large danger tolerance.

Mr. West states that his finest potential is to take ache and that large numbers don’t hassle him. He’s a basic quad 2 dealer (excessive danger/swing timeframe). The Whale can’t really feel alive with no large wager in danger.

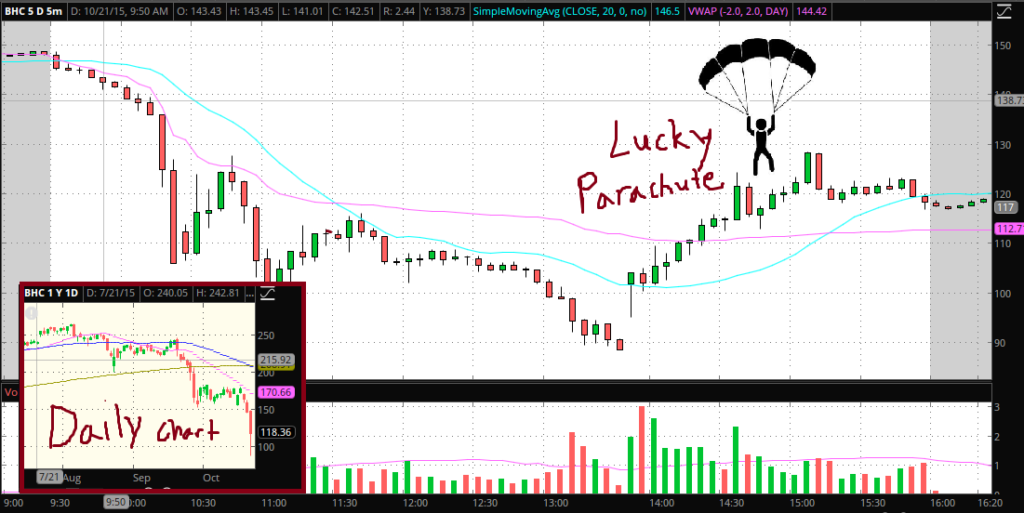

There was this time hedge fund darling VRX (Valeant Pharma, now BHC) tanked and had Mr. West fishing for the underside. He purchased an enormous quantity of shares at $120, solely to observe it go to $88 and be caught greater than $3 million. On the useless low, VRX halted for a “optimistic information announcement” after which re-opened for an enormous bounce again to $128. I name this the fortunate parachute. Now… us rational folks may simply do the smart factor and take our fortunate parachute–we’ll loosen up or promote completely into the bounce at break even or marginal achieve. Perhaps simply re-evaluate the scenario later when there’s extra readability. How can anybody sleep at evening with thousands and thousands on the road on a possible fraudulent inventory? Not Mr. West, he held all of it.

It didn’t finish effectively. Mr. West ended up taking a $6 million greenback loss a number of days later as Valent administration have been unable to convincingly defend towards the accusations. VRX reached a low of 73 earlier than yr’s finish after which finally went to single digits.

It’s at all times tempting for a brand new dealer to assume they’ll simply observe The Whale. He should know one thing. He should know it’s going to finally flip round. However the less complicated, tougher fact is that no one is aware of something. Mr. West took way more ache than anybody and would normally draw down obscene quantities. It’ll go the opposite approach when he finds himself on the precise aspect of the commerce and he’ll make it again however 99.9% of merchants couldn’t deal with his PnL swings. New merchants ought to by no means attempt to observe The Whale indiscriminately.

I lastly met Mr. West throughout a company pleased hour when WTG’s administration traveled out to NYC. Mr. West already knew our names, in all probability after asking Victor who MBC’s finest younger merchants have been. He had an excellent approachable vibe–the gregarious businessman with a mushy Texan drawl. We had a heartfelt dialog about danger and I requested him: How was he capable of maintain enormous these positions and assume large image and never shit himself? What’s his secret?

His reply: “I simply compartmentalize.“

4. The Poker Participant — Heath Wilson

There’s been plenty of notable crossovers between buying and selling and poker over the previous couple of many years, with many identified trade guys together with poker as a part of their origin story. Jeff Yass began SIG partially from poker winnings within the Nineteen Eighties. Then he employed Invoice Chen, who wrote The Arithmetic of Poker. Aaron Brown, Chief Danger Officer of AQR, began his profession in skilled poker. Poker gamers take care of possibilities and assume in bets, two necessities for profitable buying and selling. Poker gamers can be whole degenerates vulnerable to danger administration failures. Vivid Buying and selling employed excessive stakes professional Brandon Adams in 2008 and he lost millions betting on biotech clinical results.

A number of merchants at MBC, myself included, may lay declare to some success at smaller stakes. However Heath didn’t do small-time kiddy pool play… he performed actual excessive stakes. He then switched to equities buying and selling full-time and have become WTG’s prime dealer in guide PnL in 2013. His main technique was to commerce off his personal mathematical fair-value pricing mannequin and reap the benefits of dislocation away from “truthful value” in the course of the opening imbalance interval.

A number of years later, I’d see Heath’s title whereas trying up World Collection of Poker outcomes. He beat Daniel Negreanu heads-up in a $100k excessive curler occasion to win his first WSOP bracelet and accumulate $2.7 million.

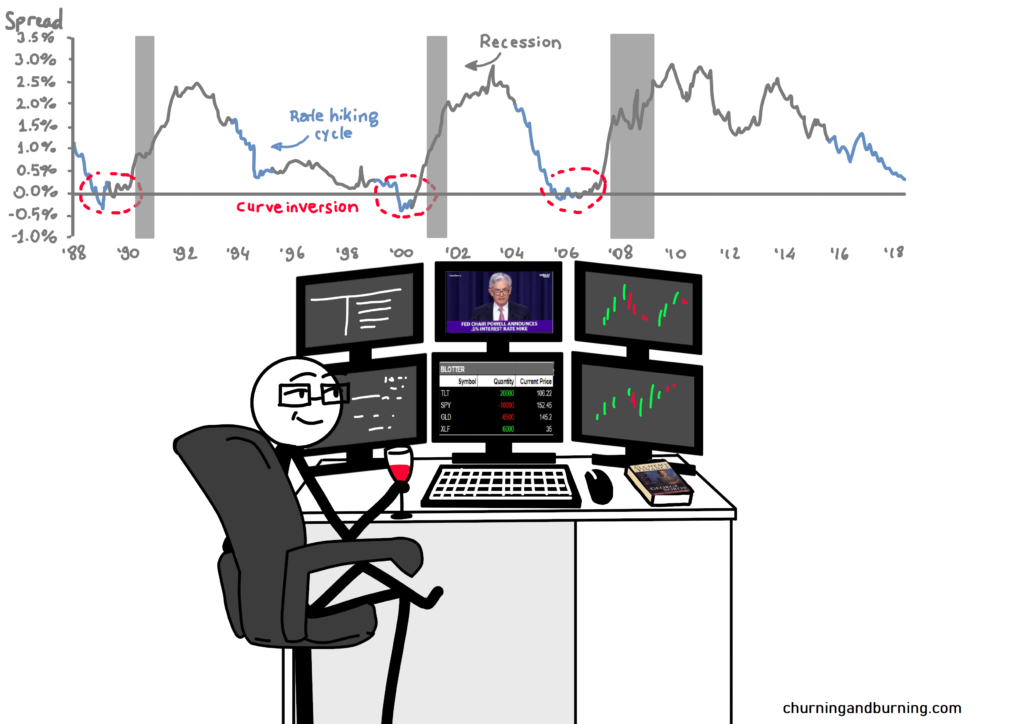

5. The International Macro Man — Rowboat

Most day buying and selling companies had easy, unsophtisticated methods. “I purchased as a result of it went up” is principally momentum in a nutshell. You don’t actually need to jot down an essay about your commerce concepts. When the digital age began within the Nineteen Nineties, the quintessential daytrader was a man from Lengthy Island with a metropolis school diploma.

On the opposite finish of that spectrum, you had International Macro guys like Rowboat. Rowboat was a bloke from the U.Ok. with an enviable background: blue-blood boarding college, status college, 5+ years in bulge bracket, after which hedge fund dealer. Macro Guys discuss large image stuff: Historic asset relationships with rates of interest. Central banking mountain climbing and easing. Politics and worldwide commerce. Debt disaster, foreign money disaster, housing disaster, power disaster, rest room paper disaster. They could use the phrase “reflexivity” so much. They’ll passionately spin every part they know into into some grand cause-and-effect principle that sounds good however they’re simply speaking up their e-book. International macro is definitely actually onerous–for instance, Peter Thiel, with all his connections and limitless sources, couldn’t win at that game. Rowboat, posh background and all, completed the yr in a -$228,000 gap, useless final amongst 100+ merchants at WTG and MBC.

Curiously sufficient, it was round this time that I seen Rowboat and Tuco have been getting fairly shut. They’d discuss and share concepts. Tuco began buying and selling the “large markets” fairly than MBC’s shares with information circulation. He’d brief GLD and GDX on a regular basis as a result of this across the spot gold bubble had burst. He’d commerce plenty of SPY choices. He fully pivoted away from “tight-risk” daytrading methods in favor of macro-driven place buying and selling, with principally inconsistent outcomes. He informed me he had plenty of arguments with Victor and Avery, as they wished him to “watch for affirmation ranges” whereas he didn’t thoughts taking extra ache and averaging in.

6. The Glitch Hunter — Riggs

Value dislocation, particular conditions, arbitrage, public sale methods (imbalances). The very best WTG merchants have been the Glitch Hunters who excelled at buying and selling no less than a type of 4 classes. It required extra outside-the-box considering versus directional buying and selling, the place a dealer has to guess the place the market goes.

These buying and selling methods may look like secrets and techniques that no worthwhile dealer needs to be speaking about. And there have been positively good merchants at WTG who wished to cover every part they did. However Riggs really gave us a real-time have a look at what he did. And let me inform you this: simply because you already know or see “the key”, doesn’t imply you may execute it your self.

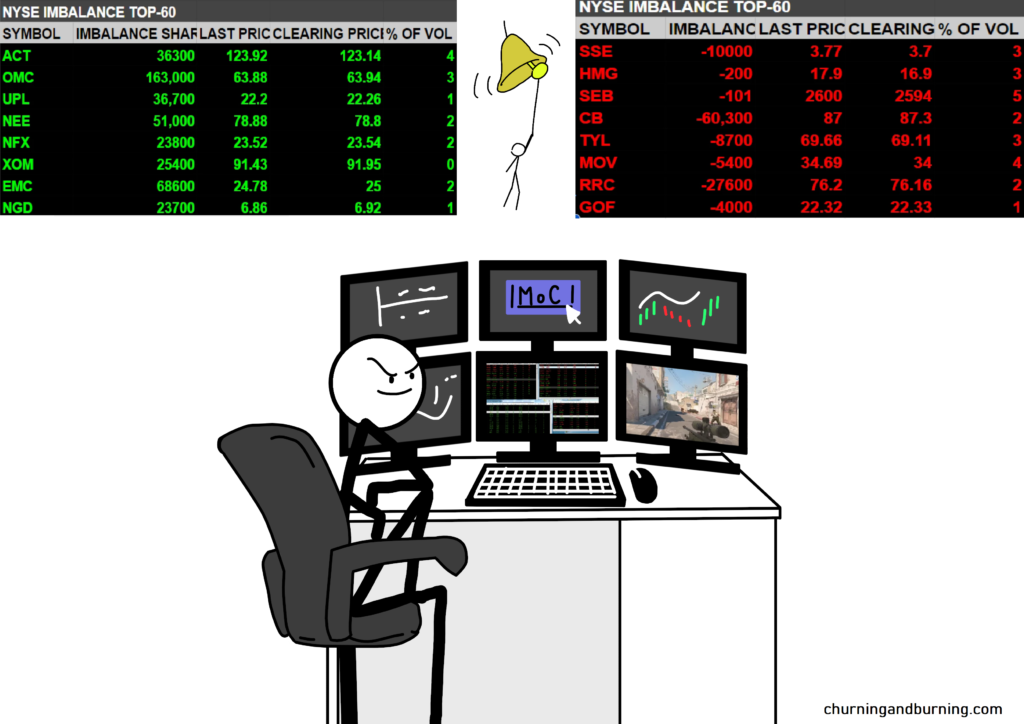

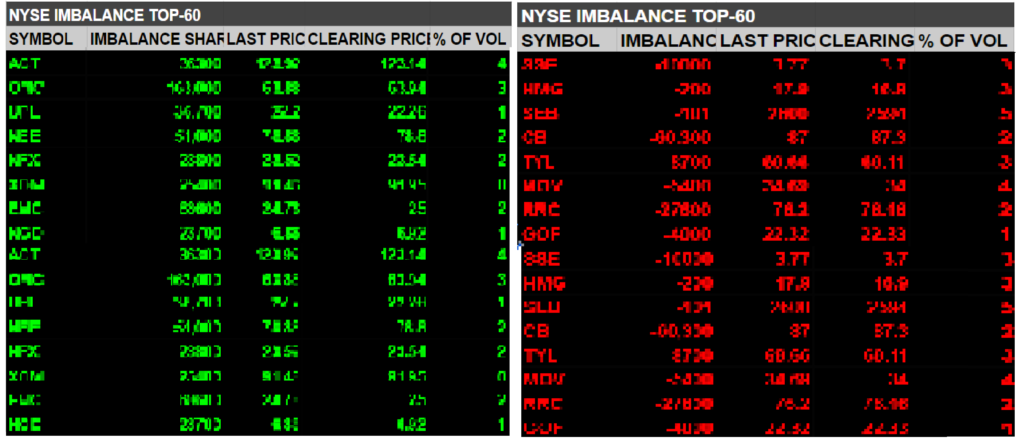

We have been all tremendous hyped for the Russell 3000 Re-balancing date on June twenty eighth. We have been informed lately have been probably the most worthwhile for everybody, that WTG makes thousands and thousands on lately. There was no formal coaching program on imbalance buying and selling, all we got have been a couple of free tips like: “search for an imbalance massive relative to the typical each day quantity” and “wager within the route of the imbalance for closing print” (purchase the online buys, promote the online sells). Then we might enter a custom-made “flip cease” for every place, which might set off a cease as soon as an imbalance flipped from internet buys to internet sells (or vice versa). Something that doesn’t “flip” is executed at market on shut (MoC).

So 3:45 hits and the NYSE imbalance filters begin to fill in.

That’s what every part seems wish to me… and I notice I don’t have the primary clue what I’m doing. The TIX window explodes with executions from anybody buying and selling the re-balance. Riggs is already in 15 positions earlier than I even take my first one.

So I determine, why don’t I simply attempt to copy Riggs actual time executions within the TIX Window? He’s the skilled professional who’s been doing this for a very long time. I attempt my finest to reflect his positions. Clockwork and Eagle and Mesut get into some positions due to quantity??? I don’t know. Perhaps they’re simply guessing. So am I. I’m completely clicking buttons.

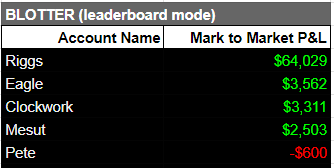

By 4:00pm, 98% of all positions print. Riggs should’ve unwinded no less than 70 completely different positions. The TIX window simply spams all of his wins as this happens. $2k right here. $500 right here. $200 there. $3k there. Some prints happen as late at 4:05 and people are the sickest prints that required the specialist discovering extra shares to pair out the imbalance. $8k wins. $10k wins. Me, I had about 25 positions and uh… it appeared like I both picked all of the shitty ones or I received in too late. On the finish of the day, the blotter regarded like this:

I would’ve been the one one who really misplaced cash. I even received caught with a pair positions that I needed to manually unwind as a result of I didn’t correctly execute the MoC order. I felt like a complete loser whereas everybody else was capable of positively expertise the push of the Russell Re-Balancing.

There’s at all times an data hole once you attempt to emulate a prime dealer–what they know, how a lot of that they’ll talk to you, and the way a lot of it you may perceive (after which functionally execute it). I didn’t perceive sufficient to win.

7. The Quant — Clayton

10 years in the past, automation was the following large factor. WTG created a backtesting platform known as Pr0Pie that didn’t require coding potential. That was the imaginative and prescient for Mr. West and Victor—elite guide merchants would use their elite sample recognition skills and convert them into worthwhile algorithms or gray containers (automated indicators that may be manually traded).

In observe, we solely examined what we knew. We’d attempt to code for chart patterns like bull flag over VWAP or tape conditions we may scalp, like massive bid at complete quantity. As you may anticipate, most of that didn’t go wherever. I spent a ton of weekend hours making an attempt to backtest bizarre half-cocked concepts however I didn’t see the outcomes to pursue them any additional. I additionally spent a ton of time on Pr0Pie pulling historic knowledge on imbalances to attempt to crack that code.

There was one man in Austin, Clayton, who specialised in automation. He was a dropping dealer till strictly dedicating himself to automated buying and selling. His technique was considerably much like Heath’s, he had a mannequin that may discover value dislocation in the course of the closing imbalance on AMEX shares. The one distinction was that Clayton executed on automation whereas Heath nonetheless executed manually. Some individuals simply have that Quant DNA and it’s nearly A) discovering your edge and B) having the precise instruments and infrastructure to succeed.

A superb rule of thumb on whether or not you are supposed to be a Quant, is whether or not you want stats and excel greater than a chart or tape and clicking the button.

8. The Man Who Trades As soon as A Month — Soup

Soup was a brand new member of the NYC department, one other ringer employed after the beginning of the Joint Enterprise. He spent 15 years in conventional finance, principally fairness analysis. He would present up as soon as a month to make a commerce. It went one thing like this:

Finish of the present month: Leg into 2 longs and a pair of shorts with a VWAP algo (two pairs trades)

Begin of the following month: Shut all positions. Revenue.

That may be it, he’s performed. You wouldn’t see Soup once more till the top of the month. This made a shocking sum of money.

My principle is that Soup was leveraging his information of “how issues work” from conventional finance and entrance working an institutionally-driven inventory sample—like he discovered some “poker inform” for Constancy Complete Asia Dividend fund’s month-end executions and he made this edge his complete profession. He’s the lazy dealer’s final dream.

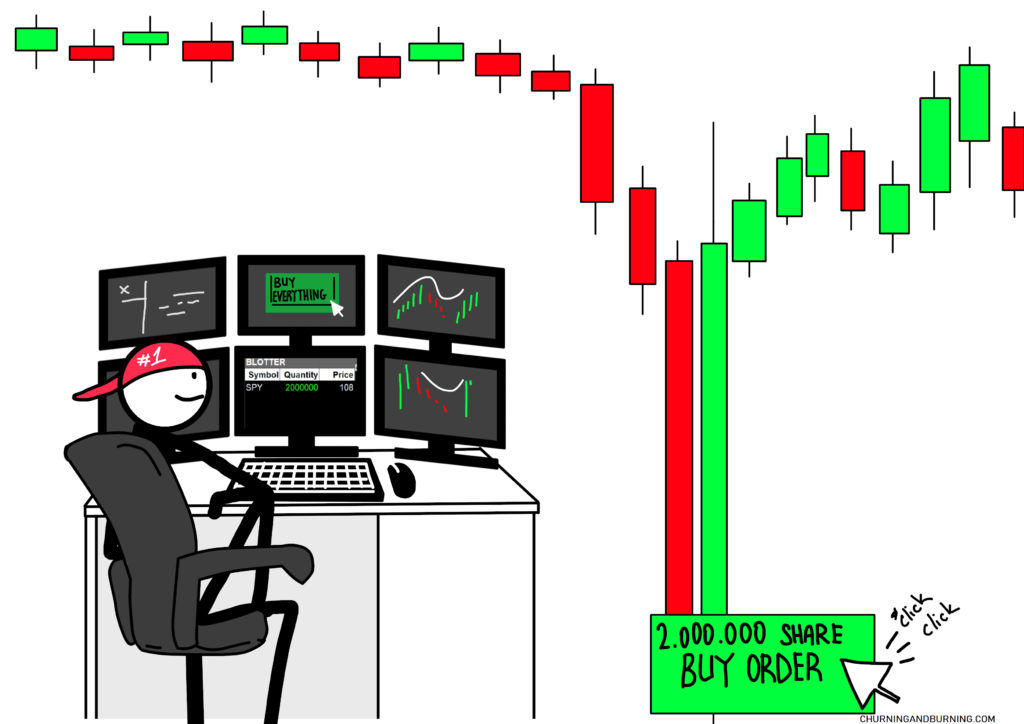

9. The Quantity One — Hopeland

Each buying and selling agency value its salt ought to have a #1 man, ideally a homegrown dealer, who you may level to and say “Yep. He’s him. He’s particular.” That indicators {that a} agency can prepare a prime dealer and supply him the deal construction and setting to have him stick round. For WTG, their man was Hopeland.

He by no means made the journey to NYC and he by no means added me on the blotter, so I by no means met him. I solely know the tales.

- Through the WTG’s finest day ever, the 2010 Flash Crash, Hopeland made $19 million.

- At any time when I speak to merchants from different companies, I at all times ask them who their Quantity One dealer is. Then I ask, what do they commerce effectively? The reply is at all times “every part”. Hopeland was a top-3 guide dealer and in addition doubled as a top-3 automated dealer within the month-to-month PnL experiences. It’s uncommon to be good at each. He traded inefficiencies. He traded directional. He traded particular conditions. He did all of it. Within the current day, he now runs his personal WTG-backed hedge fund.

- I requested somebody behind the scenes at WTG how he would describe Hopeland’s mindset on markets. His phrases: “Zero Worry. Embodied the phrase ‘not my cash’.”

TAKEAWAYS

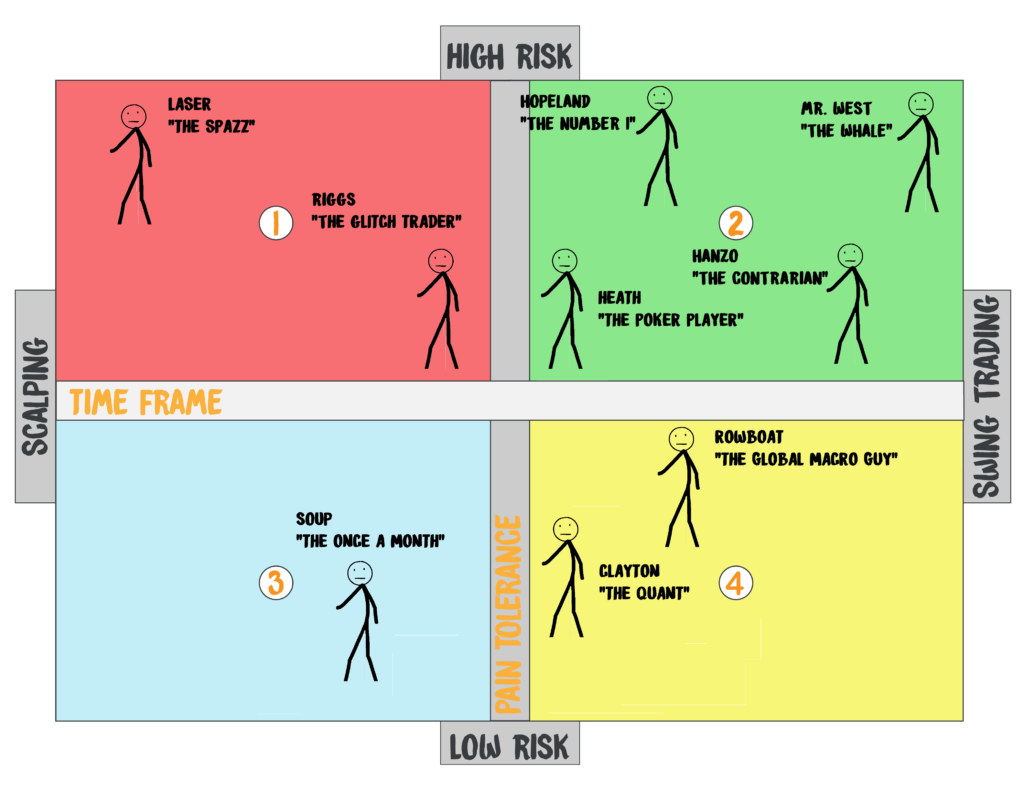

The Ache-Time Matrix once more, this time with the WTG and Joint Enterprise merchants.

So what can we take away from this? It’s tempting to assume: hey, why don’t I simply emulate the dealer with the best absolute PnL? It is likely to be an okay place to start out however preserve expectations in examine as a result of that dealer’s methods will not be the methods for you. Or he might have increased danger tolerance than you do. Right here’s my recommendation to you:

- In case you’re simply beginning out, discover as many profitable merchants as potential, from all completely different backgrounds, to have in your buying and selling circle. Determine what individuals do effectively, why they’re capable of do it effectively, and attempt to make their commerce your individual. It has to make sense to you.

- When you begin to know what you’re doing, slim all the way down to extra like-minded merchants with a number of “technique overlap” to have in your inside circle. These are the fellows you speak to about crucial issues: your buying and selling system’s core ideas and your A+ setups. Everybody else is for emotional assist or gossip or laughs, possibly a brand new concept every so often.

- Self-awareness is essential. Generally you begin down a path and it’s simply approach off from the precise finest path for you (and solely now, after some struggle scars, are you able to sense it). You might need developed a circle of discretionary inventory scalpers and three years later you notice you need to have been speaking to foreign exchange quants. In case you assume a sure fashion of buying and selling is a foul match, then pivot. My good friend Mesut by no means actually meshed with the MBC momentum orthodox, however he discovered his area of interest beneath Riggs with particular scenario pushed buying and selling. You may’t win at this sport till you discover the issues you may excel at.

Sorry, I ended at 9. There’s nonetheless another.

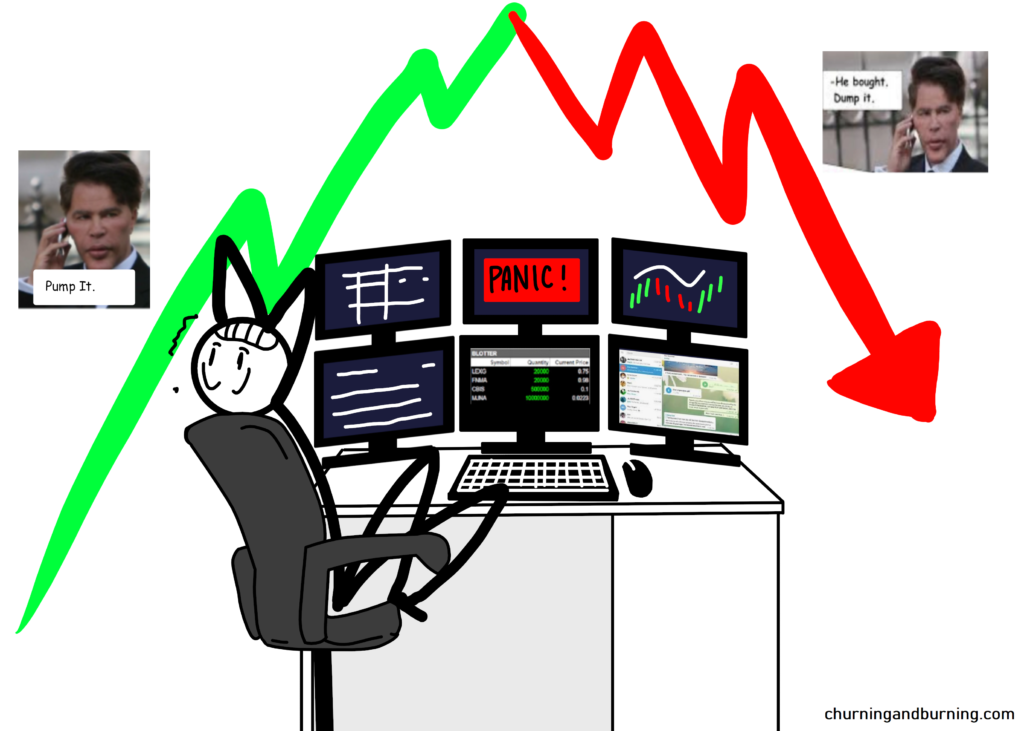

10. The Penny Inventory Dealer — Me

They’re way more well-liked at this time however again then, there wasn’t sufficient quantity for prop desks to commerce micro-cap actively. They have been seen as extra of a darkish artwork. Earlier than my time at MBC, there was a man who would simply spend his complete day accumulating 20 micro-cap positions. Throughout my first yr, there was one other man who would commerce sub-$1 biotech’s as his main technique. After which a yr after I left, there was one other man who tried to nook low float shares. There’s at all times one Penny Inventory Man on a desk.

I by no means tried to be a Penny Inventory Man. I suppose that was my base of data that started with my retail account however I joined MBC so I may commerce all types of shares and techniques. I wished to be an imbalance crusher similar to Riggs. I wished to hero purchase market capitulations similar to Hopeland. The vast majority of my each day quantity was nonetheless on mid/large-cap shares. However as 2013 unfolded, I needed to be the man on the desk who would assume the mantle of Penny Inventory Man. Why? As a result of in late Could, Fannie Mae goes parabolic… AGAIN.

And I do know precisely what it will occur subsequent.

(to be continued in Fannie Mae)