(continued from Threat Restrict Exceeded)

Let me let you know a narrative a couple of dealer named Franklin Chase.

Franklin Chase began buying and selling at Datek Securities a while within the mid 90s1. He established himself as one among their greatest merchants and after making hundreds of thousands, he then left to commerce his personal cash. Franklin had a great really feel for a way the dotcom shares moved. He dedicated to his analysis and understood share constructions and company financing at a time when most buyers solely involved themselves with headlines and momentum. That’s to say, he knew most of those dotcom corporations had been complete shit.

One hectic buying and selling morning in November of 1999, Franklin noticed a weird transfer in one of many shares he was intimately acquainted with–a inventory referred to as China Prosperity Worldwide Holdings or “CPIH”, a international constructing and building firm. The inventory shot up 1000% in a single day–leaping from $1 to $10 & 1/sixth2. This was attributed to a current commerce agreeement permitting China to affix the World Commerce Group (WTO).

A month in the past, CPIH had issued a press launch that they might be becoming a member of in on a state-enterprise enterprise referred to as Century Imaginative and prescient Community, which might deliver Web entry and video-on-demand to Chinese language households. Traders had been skeptical and the preliminary value spike died off inside a couple of days. They didn’t have any financing or operations, nothing however a non-binding LOI. Past all of that, CPIH had huge dilution potential–convertible notes alone might quadruple the share rely. Franklin knew this as a result of he had shorted that preliminary spike weeks in the past and lined for a pleasant acquire. It’s time to return to the nicely, he figures. The following morning, the inventory opened on a fats hole up at $14. What an incredible alternative. Franklin acquired quick.

One hour passes. His preliminary entry isn’t so good.

The inventory trades to a excessive of $30, leaving Franklin down 100% on his quick. However his preliminary place sizing had been conservative and he trusts his analysis. Certainly, this should be the purpose the place consumers have been exhausted. $1 to $30 on a inventory with 104 million shares excellent and tons of convertible dilution on prime of it–that’s madness.

One other hour goes by. $50. If $30 was madness, then WTF is that this?

Now Franklin’s getting mad. That is uncontrolled. How can the NASDAQ permit this to occur? Okay ‘don’t lose your thoughts’, he reminds himself. You’re a professional and you’ve got dealt with worse. You possibly can’t be *that man* and get scared on the very prime. Simply wait.

A half hour passes and the inventory refuses to decelerate. It prints $80. EIGHTY DOLLARS! Now price over a billion {dollars} in market cap, absolutely diluted. It closed at $1 few days in the past!

As Franklin deliberates whether or not to capitulate on his quick place, the bid instantly yanks out on CPIH. The inventory virtually instantly plunges again to $50 inside minutes. Franklin feels he’s noticed the turning level and he provides extra to his place, bumping his quick common value over $30. CPIH ultimately closes at $32 1/sixteenth.

Franklin tries to loosen up himself earlier than going to mattress. The strain could be overwhelming generally. He’s a buying and selling veteran who’s been via a couple of nasty quick squeezes. That will have been the worst he’s ever encountered however fortunately CPIH collapsed on the finish of the day and the momentum is sort of definitely damaged. They at all times find yourself going decrease, it’s by no means any completely different.

The following day arrives. Time to wake and test the worth.

Unattainable.

$200. Franklin doesn’t know what to do. He can’t transfer. It seems like his coronary heart has stopped however someway he’s nonetheless alive. How might this occur? An preliminary 5% place would possibly blow up his total multi-million greenback account. He traded his ass off for years at Datek–probably the greatest goddamn merchants they ever had…one commerce and none of that may even matter anymore, all the cash will simply disappear.

A cellphone name rings. He snaps out of the daze and picks up the cellphone.

“Hey Frankie… we’re going want you to publish one other million by the top of the day or we’ve got to cowl you out.”

Jesus Christ. How far am I going to take this, he thinks. My child’s school fund? My spouse’s 401k? He thinks nevertheless it doesn’t really feel like pondering, it’s extra like this determined cloying for any morsel of rationality in his personal thoughts. Then he notices his display screen… CPIH has dropped again all the way down to $120 whereas he wasn’t even wanting. The unfold is so broad, buying and selling it feels suicidal. Cowl and really feel like you may’t stay with your self if it goes down extra. Add extra and really feel such as you’re tightening your personal noose. The one pure plan of action, given his frame of mind, was to simply do nothing. His destiny was within the palms of the market gods.

CPIH trades sideways within the low 100’s for a lot of the day. Close to the closing bell, it drops one other 20% and closes at $80. Even with a big intraday correction, Franklin continues to be holding onto a 150% loss. The whole buying and selling day unfolded in what felt like gradual movement–every minute watching the ticks felt like ten in actual time. He hadn’t even seen he by no means acquired one other cellphone name regardless of by no means having posted any extra capital. Concern has consumed Franklin like by no means earlier than. What if it opens at $300? Appears farfetched till you keep in mind it closed “weak” at $32 1/sixth different day and nonetheless discovered a approach to squeeze once more to $200. That additionally appeared implausible on the time. Perhaps he wakened in a universe the place chances don’t exist anymore.

The following day arrives and Franklin doesn’t do any of his standard prep work. He’s leaning over his desk with each palms outstretched, praying this can be over quickly.

CPIH opens a lot decrease. The corporate has issued a remark about not commenting on uncommon market exercise. CPIH trades again all the way down to $30. The day after that, CPIH trades again close to $10. Franklin covers right into a blended common someplace within the teenagers. From the brink of margin name to survival.

Me: After which what occurred?

Hanzo3: Nicely he lingered for a bit… took a protracted break. He got here again, tried to commerce somewhat bit, and struggled… he would say issues like ‘I simply don’t really feel like I’m in management anymore’. Ultimately, he stop buying and selling.

That’s the story of Franklin Chase, as advised by one among his colleagues from again within the day. A great dealer who acquired caught on the mistaken aspect of a wild transfer, acquired fortunate sufficient to get better from it, however might by no means commerce once more after that. His thoughts was by no means the identical.

Hanzo begins to level at me whereas sipping from his beer, like he’s signaling for me to hear fastidiously.

“Pete. You’re like a jet fighter who crashed. You gotta get again within the pilot seat and fly once more. Don’t let it linger.”

Ought to I Keep or Ought to I Go?

In all honesty, I don’t suppose that FNMA loss shook me that onerous. It didn’t get to the purpose the place I questioned with each fiber of my being whether or not I needed to commerce once more, whether or not I might commerce once more–like what had occurred to Frankie. That loss felt so preventable; it was fully in my management. Commerce it the best way it was meant to be traded as a substitute of worrying about measurement and PnL. It wasn’t a lesson I needed to study the arduous approach. I used to be already one of the crucial risk-conscious and accountable merchants on the agency. If there was a betting pool on who would have essentially the most spectacular blowup on the MBC Desk, I’d have been one of many final merchants picked.

I spent the following few days buying and selling at house and scalping FNMA’s echo swings. For the remainder of the week, I tallied one other $30,000 on my private account. My private internet price truly elevated regardless of the massive loss wiping out my February MBC paycheck. I had already heeded Hanzo’s recommendation to “get again within the pilot seat” and I hadn’t even spoken to him but.

Phrase had unfold about what had occurred. Merchants on the desk textual content me like I simply acquired recognized with most cancers–“sorry about what occurred, you’ll get via it“. I don’t know how you can reply aside from thanks? Since I hadn’t heard any phrase about being fired, I assumed they might nonetheless hold me and let me commerce out of the drawdown.

I began to consider my choices. I took stock of myself: I had cash now. I had profitable methods. I had the Bitcoin Fund. I had a community of merchants I knew to change concepts. The prop buying and selling enterprise mannequin was not one thing that I wanted to make a dwelling anymore. It was only a query of: do I wish to keep on simply to be there? I mulled over the great and the dangerous.

Good issues if I stayed at MBC Securities:

- I might commerce with much more shopping for energy.

- Pr0Trade is an effective platform

- That is the most effective place to commerce imbalances and particular scenario methods

- Can use Pr0Pie create automated buying and selling methods

- At WTG, you at all times have that ‘all-in, not my cash’ card to money in when there’s a giant uncommon transfer out there4

- My associates are there

- Sooner web connection

Dangerous issues if I stayed at MBC Securities:

- I’m now in a six-figure drawdown and need to make all of it again to get my subsequent paycheck

- I at all times have to surrender 50% of my earnings.

- The Knight Direct platform sucks

- I suck at buying and selling imbalances so perhaps the optimistic is moot

- I suck at constructing automated methods so perhaps the optimistic is moot

- My present methods are very lean on shopping for energy so it’s all simply surplus

- I don’t like drawdown, I’m a grinder who needs numerous inexperienced days. When am I ever going to “go all-in” and benefit from the chance mannequin at WTG? It’s largely a dream state of affairs

- Commuting to Midtown sucks

- Should hold pretending to hearken to Avery’s morning conferences

- I didn’t like the emotions of buying and selling on a desk and competing with everybody’s PnL and being hyper-aware of each single commerce and place on the market–I might by no means appear to recover from that heightened nervousness

- The sentiments of disgrace and guilt over shedding some huge cash

I leaned in the direction of leaving. I already had ideas about leaving earlier than any of this had occurred and now I had monetary incentive. However I didn’t wish to be hasty so I made a decision to take a weekend to consider my choice. My MBC buddies had invited me out to an Friday night pleased hour sesh and perhaps I’d really feel higher being across the group once more. There’s the place Hanzo made a shock look and advised me the story about Franklin Chase over a pint.

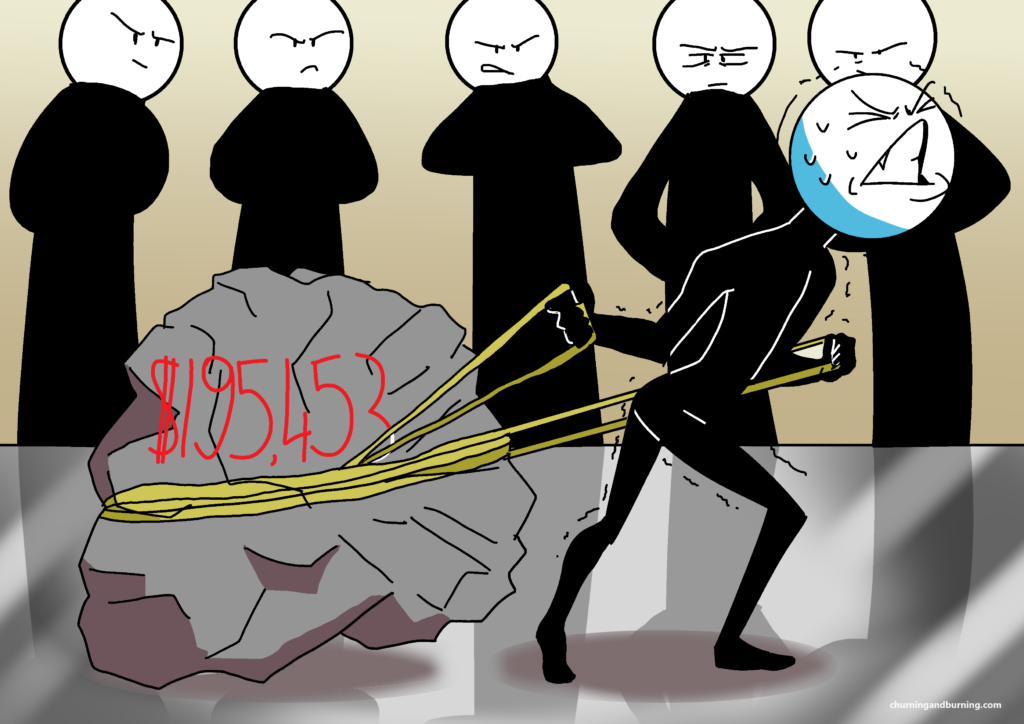

I began enthusiastic about that story. What can be my model of the psychological jail that Franklin discovered himself in? I imagined myself on the buying and selling desk, dragging round this huge boulder of disgrace.

Take a look at me now. I went from rising star to primary loser. Daily I’m buying and selling with desperation and distress as a result of solely once I’m out of this drawdown will the disgrace and guilt go away. In the meantime the remainder of the desk thrives whereas I wrestle. The trainees have nicknamed me ‘TNT Pete’ for my blowups–each at them and on the buying and selling blotter. I don’t deal with setbacks nicely. I’m not constructed like that. My buying and selling course of now begins at a rotten place–so badly do I wish to rid myself of the boulder that I begin to take extra threat on a regular basis. I’m going to go balls deep on YOLO choice bets and I’m going to stay my hand out for each falling knife and ceaselessly dig this endless gap even deeper. I’m buying and selling on tilt and scrambling my buying and selling mind ceaselessly. I’ll flame out and my identify will solely be whispered across the desk like cautionary story–the headcase who couldn’t get out of his personal head. Similar to Franklin Chase.

No, that may’t be the best way ahead. That’s when the choice grew to become clear. I had reached my psychological cease with prop buying and selling.

Why let the dangerous vibes linger? Transfer on and begin recent. You have got the posh of being at your excessive watermark in your retail account. You possibly can surf the upper highs in your PA’s PnL and similar to that–what simply occurred had by no means occurred. That was all another person’s cash. That is your cash and you recognize you’ll be extra cautious sooner or later with it.

In order that was that. This pleased hour was now my de-facto goodbye celebration. I needed everybody a fond farewell–“better of luck and don’t blow all of it up like I did.” I despatched my resignation e-mail to our ground supervisor CJ and advised him I simply needed to depart quietly.

That weekend, I made a wholesome try and decompress for as soon as. I ran for a couple of miles alongside aspect the Battery Park boardwalk. I stayed off the adderall. I’d attempt to concentrate on the current, narrating myself doing little issues like laundry or consuming a sandwich… after which similar to *that*, I’d simply discover myself replaying the loss in my head. It nonetheless doesn’t really feel actual that I truly did that. I’d cringe once more. Fucking fool. However that’s regular, I feel. Time will make it go away.

Then I get a cellphone name from an individual I hoped wouldn’t name me.

Victor: Pete, I heard you’re leaving????

Pete: uhhh.. yeah I made a decision I’m going to commerce my very own cash. I simply need thanks for giving me the–

He interrupted me. Earlier than you do something Pete, it’s a must to hearken to what I’ve to say. He’s making an attempt to vary my thoughts and get me to remain. He went over all the standard speaking factors–bionic buying and selling, deeper pockets, assist workers, and the competitors of being on a stay buying and selling desk. These are issues that may push me to be an important dealer, he says. There was one thing mentioned alongside the traces of… “the merchants who go away by no means make as a lot on their very own.” I get it. I didn’t wish to argue. However I had already made up my thoughts.

Victor might sense he was shedding me together with his customary speaking factors. He began to lift his voice, which occurs so much on the ground however by no means in any of our one-on-one conversations. It was at all times all the opposite merchants who acquired this extra stern aspect of him. Don’t be silly. Don’t get quick sighted a couple of six determine drawdown when your future is eight figures, he’d say. Keep at MBC Securities and fulfil your limitless potential.

I winced. I felt dangerous. I advised him no and I hung up.

That’s the top.

(that is the penultimate chapter in Prop Dealer Sequence and can conclude with Epilogue, the place you get to seek out out what occurred to all of your favourite aspect characters from MBC Securities. Thanks for studying if you happen to made it this far).

The publish Stopping Out first appeared on Churning and Burning.

The publish Stopping Out appeared first on Churning and Burning.