Video Transcription

Hey Hey, What’s up, my buddy?

Welcome to The Final Candlestick Sample Buying and selling Course.

On this course, you’ll learn to determine high-probability buying and selling setups.

A few of you could be considering…

“I’m new to buying and selling would this assist me, I don’t know about candlestick patterns, and I don’t know technical evaluation”

Don’t fear, as a result of on this course I’ll stroll you thru step-by-step from A to Z on the right way to commerce candlestick patterns.

Even you probably have no buying and selling expertise, by the tip of this session, I can guarantee you that it is possible for you to to commerce candlestick patterns like a professional.

Sounds good?

Let’s start…

What’s a Candlestick Sample?

A candlestick sample is actually a way of studying a worth chart.

It originated again in Japan that’s the historical past, and the important thing part of a candlestick chart is that it reveals you 4 issues.

- The opening worth.

- The excessive of the session.

- The low of the session.

- The closing worth.

Once I use the time period session, it might probably imply various things…

When you’re Candlestick charts on a day by day timeframe, it means the excessive of the day.

Candlestick charts on the one-hour timeframe it means the excessive of the one-hour session.

It could imply various things…

Relying on the timeframe you’re , we’ll cowl that in additional element later.

How one can Learn Candlestick Sample?

Bear in mind there are solely 4 issues;

- The open

- The excessive

- The low

- The shut

this:

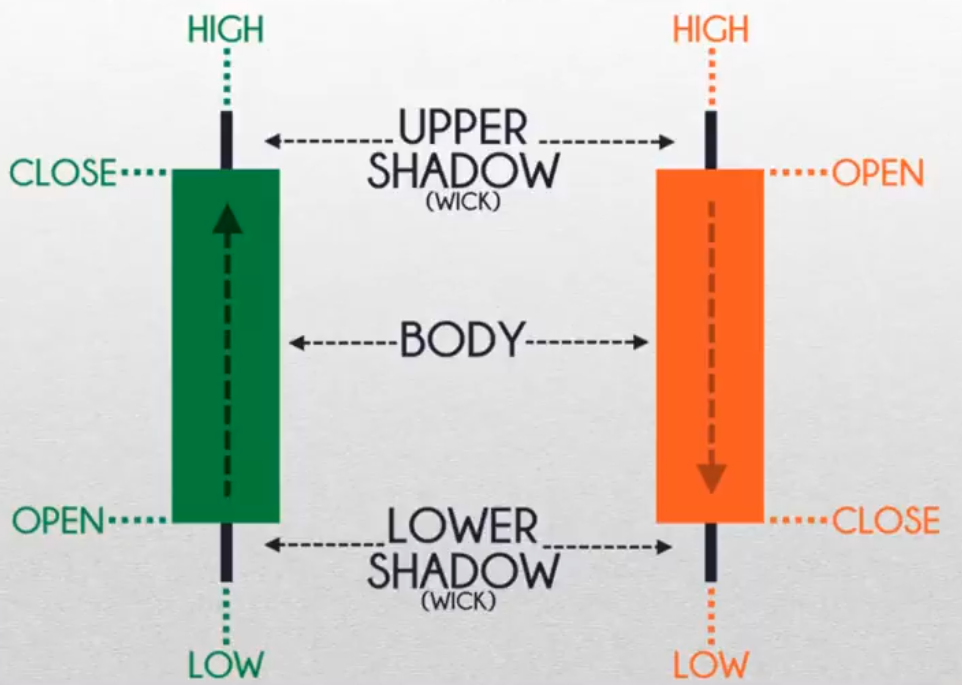

You may see that the candles are sometimes two colours both inexperienced or purple or maybe may be black or white.

Typically you’ll be able to even change the colour in order for you, however typically, the commonest coloration is inexperienced and purple.

Whenever you see a inexperienced candlestick sample it signifies that the value has closed greater for the session.

Bullish Candle

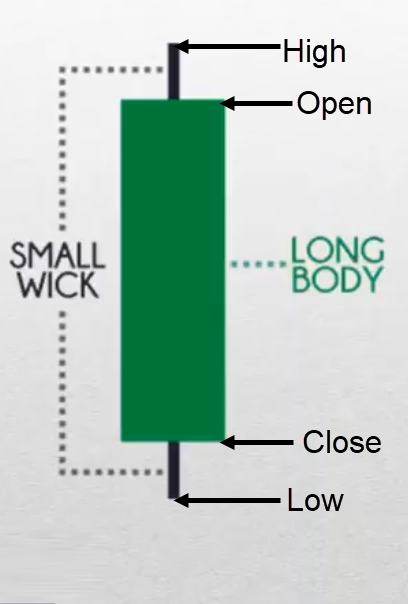

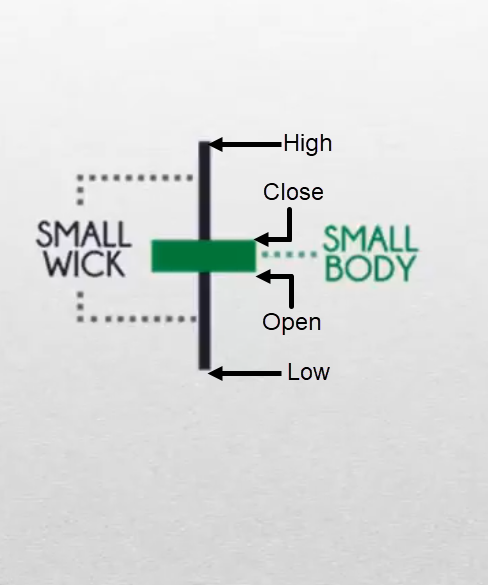

You may see that that is the opening and shutting worth are these traces over right here:

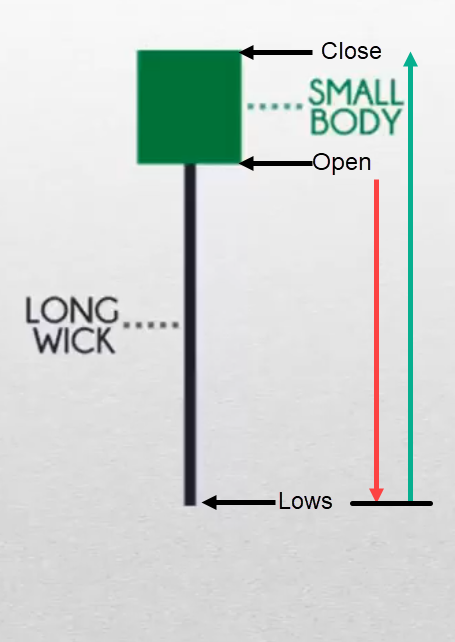

Whenever you see the black shadow, we name it the wick.

The higher wick is the very best of the session, and the decrease wick is the bottom of the session.

Bearish Candle

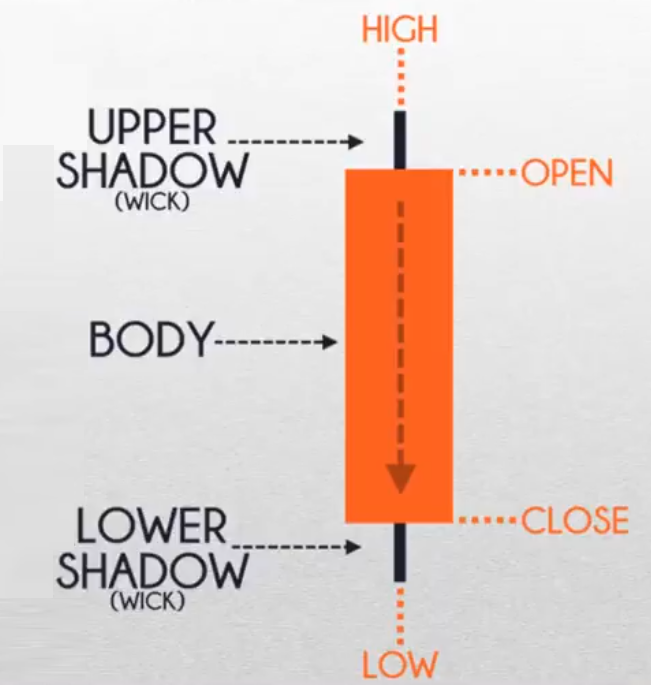

The purple coloration bar is named the bearish bar.

The open is on the reverse aspect, it’s now on the high of the candle.

The shut is on the backside.

You may see the low of the session

The bottom and the highs of the session is right here over right here:

Distinction Between a Bearish Bar and a Bullish Bar

The principle distinction between a bearish bar and a bullish bar is that the open and shut are already reverse sides.

The worth has closed decrease for the session and the open needs to be above the shut.

Depth Information of Candlestick Patterns

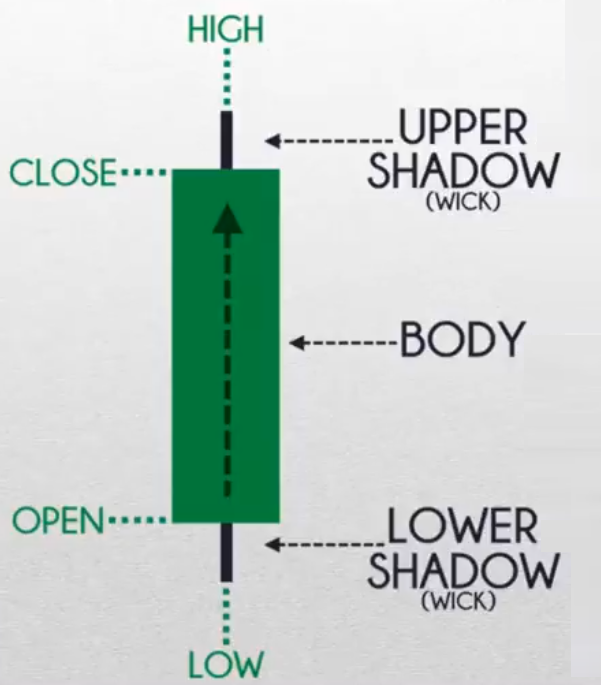

The very first thing you’ll discover in a candlestick, there are two major parts particularly:

The physique is the inexperienced portion and the black shadow is known as the wick.

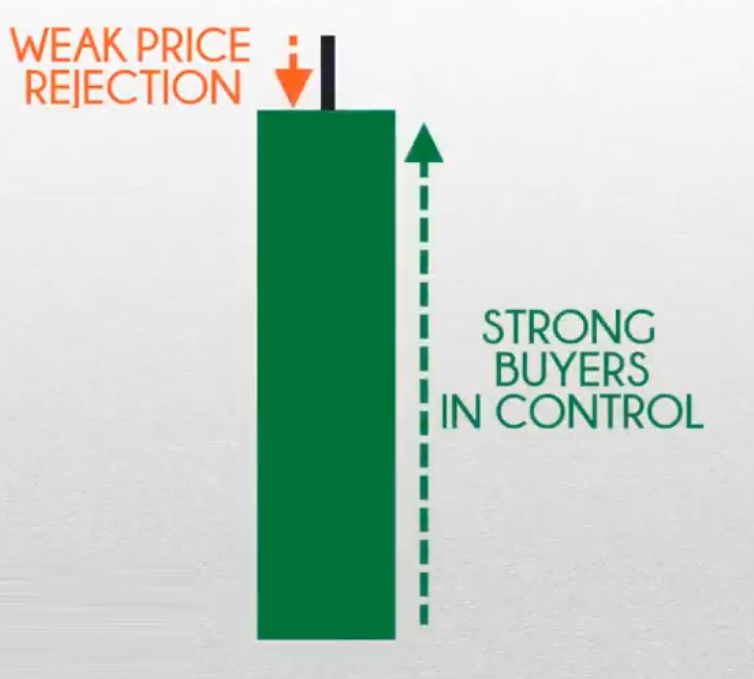

The physique tells you who’s in management, on this case, you’ll be able to see that the client is in management.

The patrons push the value up and shut on the excessive of the session.

Nevertheless, you’ll be able to neglect the shadow, as a result of what’s telling you is that there’s a worth rejection of upper costs.

As a result of if you concentrate on it, this was as soon as the very best of the session.

This merely signifies that at one level the sellers pushed the value from these highs down decrease till its worth closed over right here:

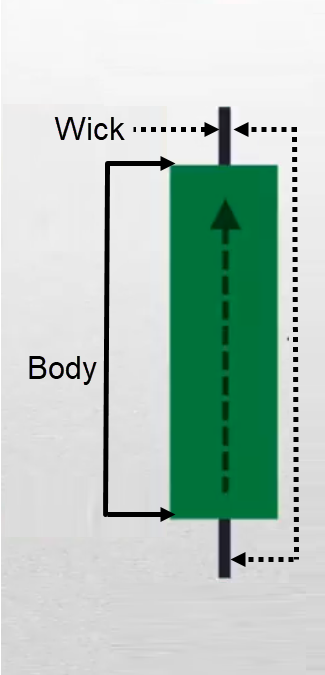

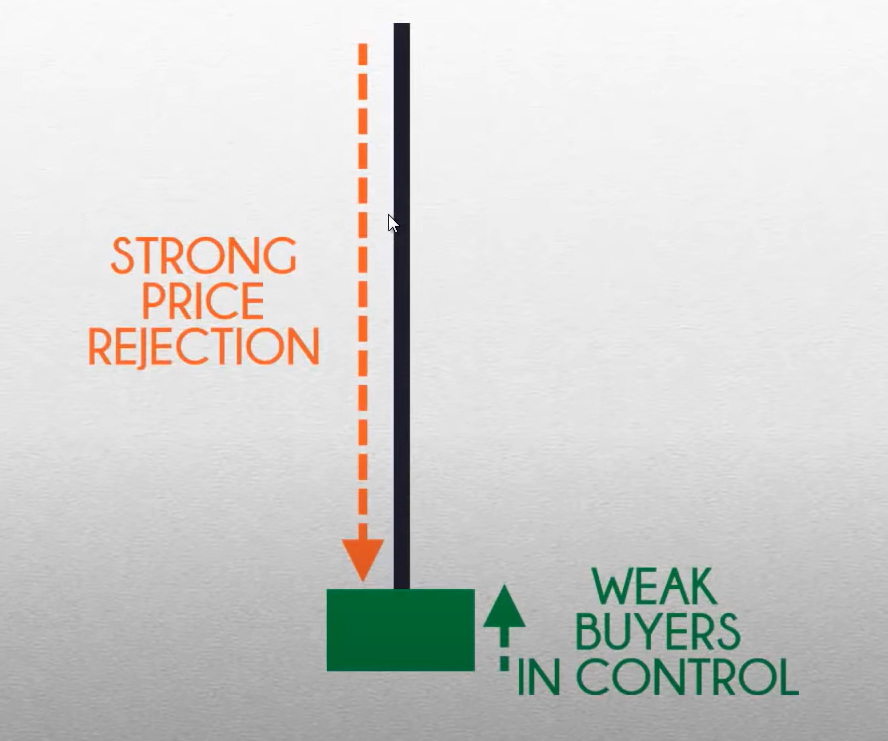

The third factor that I need you to know is that, take a look at this candlestick.

What’s the dimension of the physique relative to the wick?

As you’ll be able to see, you’ve got a wick and physique, however this time the message is totally completely different. When you take a look at this candlestick sample,

It reveals that sure, the value did shut greater. However for those who take a look at the wick, you’ll discover that the value rejection at one level is the very best of the session.

The worth got here all the best way down from the excessive of the session and closed at that stage.

What does this inform you?

It tells you that the patrons did push the value up barely greater for the session. Nevertheless, there was an immense quantity of promoting stress and a robust worth rejection that pushed the value decrease through the session.

This isn’t a really bullish sample.

It’s fairly bearish. Because it reveals immense promoting stress by the sellers. You additionally need to take note of these three issues.

- The physique

- The wick

- The physique relative to the wick.

Often, if the wick is for much longer than the physique, it’s an indication of worth rejection.

That is the way you learn candlestick patterns.

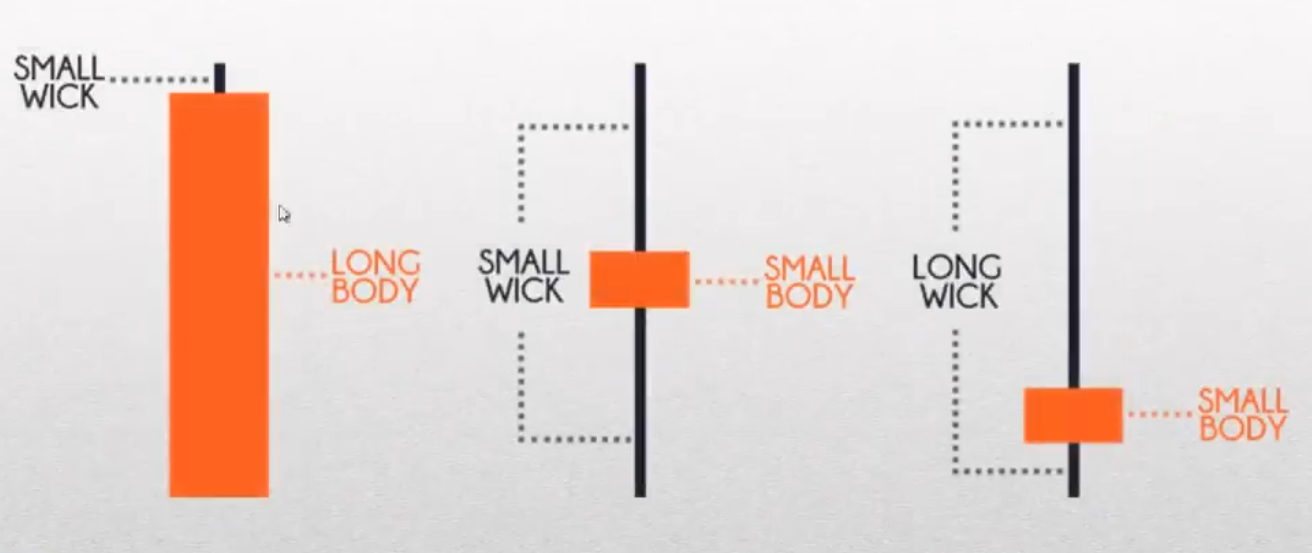

Variations To Candlestick Patterns

The primary one I feel is one thing that you’re in all probability conversant in.

The worth opened, after which it closed. That is the highs and the lows of the session.

By way of the that means…

You may see it’s fairly simple the value opened close to the lows it tried to come back down decrease however was rejected then lastly closed close to the highs.

It’s an indication of bullish energy.

Subsequent…

The worth opened and closed.

When the market simply opened presumably what occurred is that the value got here down decrease.

The sellers had been in management then the patrons took cost and pushed the value all the best way greater again in the direction of the highs.

Then lastly the sellers got here again in and the market closed at this worth stage.

The that means behind that is that there’s indecision within the markets the place each patrons and sellers are current.

When you ask me typically, that is what we name an indecision sample.

Subsequent…

When you take a look at this final candlestick sample, the value opened right here:

The market got here down decrease, sellers had been in management then the patrons took cost and reversed again lastly closing close to the highs.

The that means of this sample is rejection of decrease costs, the patrons are clearly in management.

Transferring on…

That is the alternative of what we have now simply shared earlier. That is the promoting model of it.

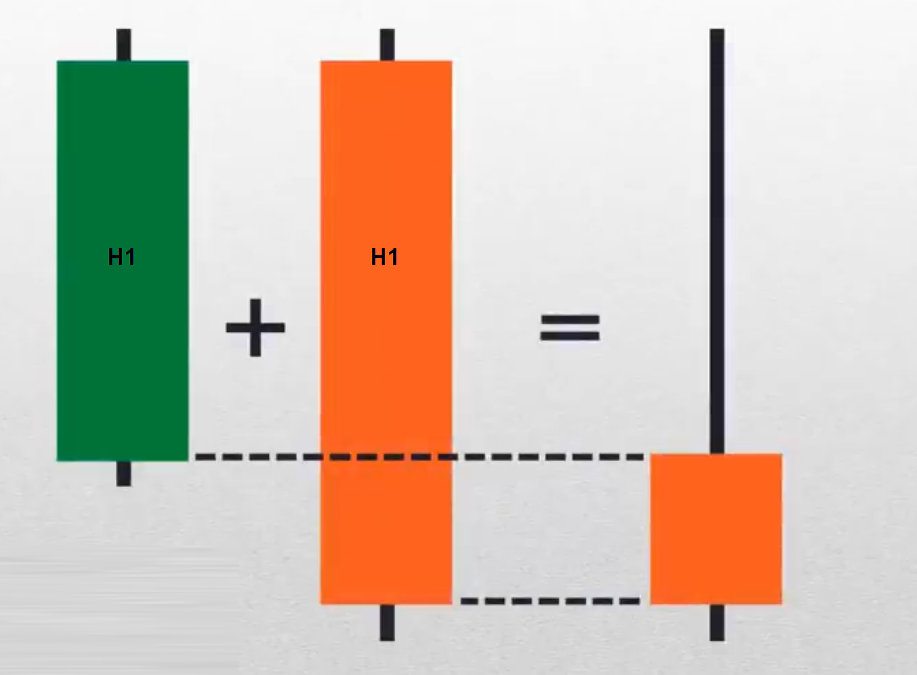

Candlestick on Completely different Timeframes

When you recall, I mentioned that candlestick charts can seem in several time frames.

On a 60-minute timeframe, a candlestick is one hour. For each hour a bar could be painted.

The identical applies to the day by day timeframe. For each 24 hours, a bar could be painted.

That is how candlestick patterns can kind on the completely different timeframes.

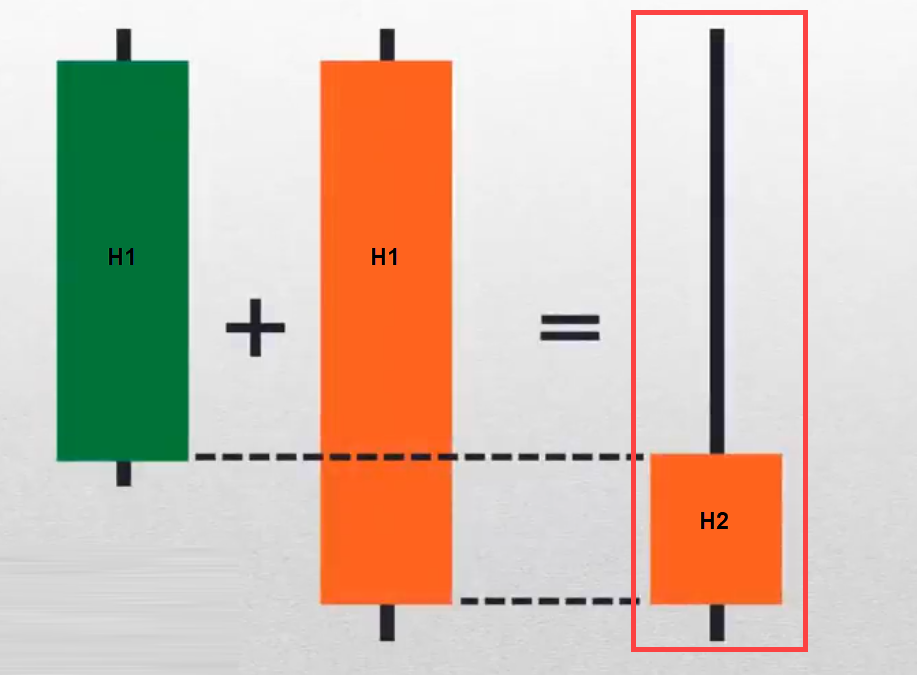

Combining Candlestick Patterns

Candlestick patterns simply present you the value of the completely different classes.

Take a look at this…

Let’s say this can be a one-hour candle for the inexperienced and the purple candlestick respectively.

Whenever you mix these two candlestick patterns, what timeframe is that this going to be?

It will be the H2 timeframe.

How did this candle come about?

A H2 candlestick merely means, figuring out the excessive and the low during the last two hours, the opening worth of the primary and second candles.

Does it make sense?

I hope you’ll be able to perceive how candlestick patterns may be mixed.

That is very helpful if you’re a worth chart.

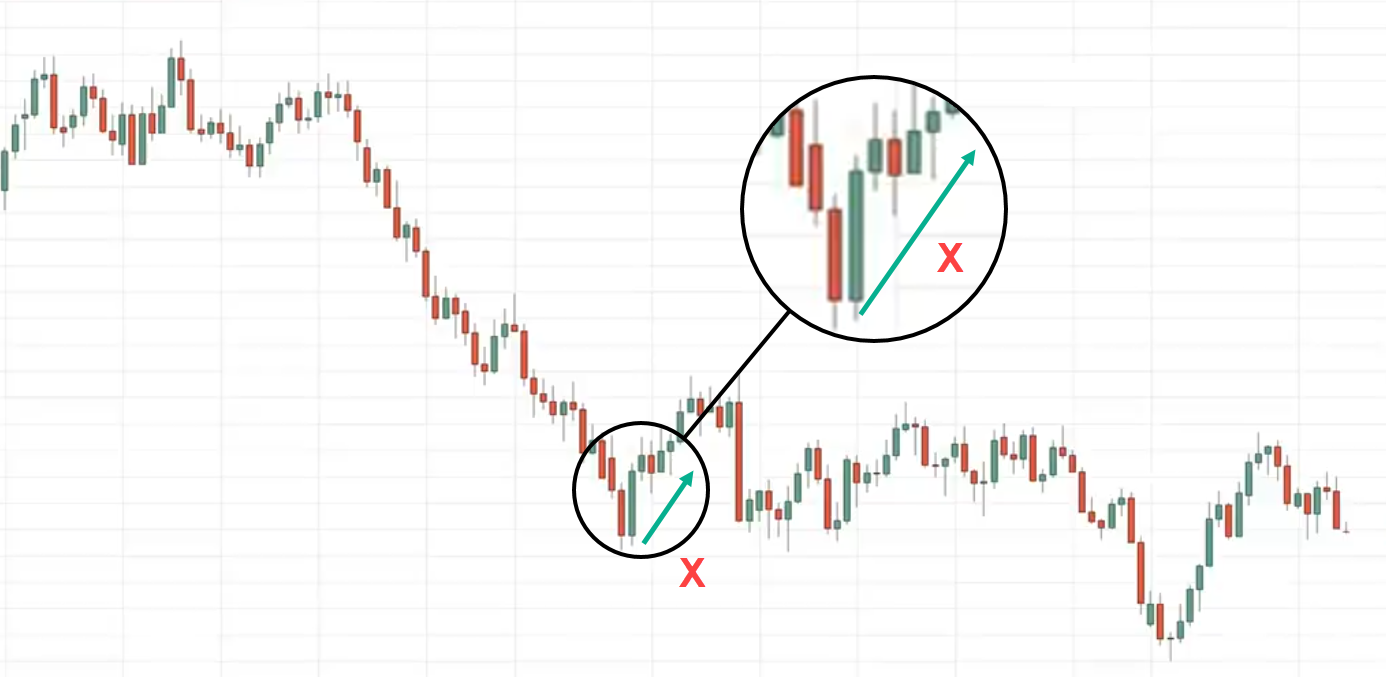

How NOT to Commerce Candlestick Patterns

You understand how to learn and mix the candlestick patterns.

How do you not commerce candlestick patterns?

This can be a mistake many new merchants make as a result of as I’ve mentioned earlier, for those who recall, for those who see a inexperienced candle, it means bullish, If the candle is purple, it means bearish.

What merchants would do is that they take a look at a chart and so they discover a sequence of inexperienced candles and so they go lengthy.

They are saying…

“The candle is bullish let me purchase it”

Bam!!!

The market reverses.

Equally…They see purple candles…

“It’s so bearish!!!”

Rayner’s mentioned…

“Vendor is in management I ought to go brief”

Bam!!!

The market reverses.

What’s occurring? Why is that?

I’ll clarify…

“You don’t need to commerce candlestick patterns in isolation”

What’s isolation?

It means you don’t need to commerce candlestick patterns by itself. Simply because that candlestick is inexperienced or purple doesn’t imply you go lengthy or brief respectively.

Don’t commerce candlestick patterns on this method.

How To Commerce Candlestick Sample

I wish to introduce to you one thing that I name the “TAE Framework”

T – Development

A – Space of Worth

E – Entry Set off

Whenever you need to commerce candlestick patterns, keep in mind these three issues.

Earlier than I can dive into this technique, I want to elucidate to you what an entry set off is.

Entry Set off

I’d say candlestick patterns are very helpful and highly effective entry triggers right into a commerce.

Earlier than we are able to go into this framework, let me share with you 5 highly effective candlestick patterns that may function an entry set off.

Engulfing Sample:

The inexperienced candle is what we name the bullish engulfing sample. Why is that?

When you take a look at the physique of the inexperienced candle, it has engulfed the physique of the earlier candle.

The earlier candle is the purple candle.

The sellers had been in management and on the second candle the patrons had been someway on steroids. It opened close to the lows and eventually pushed the value up.

This can be a signal of energy.

It reveals that the patrons have reversed all of the promoting stress and extra.

This is the reason it’s known as a Bullish Engulfing Sample.

Bearish Engulfing Sample

That is simply the alternative.

Consumers had been in management, however the sellers took cost and pushed the value decrease.

This can be a bearish engulfing sample telling you what sellers are in management.

Hammer and Taking pictures Star

That is one thing that you simply could be conversant in.

That is displaying you worth rejection out there. Rejection of decrease costs.

At one level, the sellers had been in management to push the value decrease close to the lows of this session after which the patrons got here in and pushed the value greater.

This can be a signal of energy.

Rejection of decrease costs.

Taking pictures Stars

That is displaying you rejection of upper costs.

The patrons took cost, took the value greater, after which the sellers out of the blue got here in and pushed the value down.

This can be a rejection of upper costs

This sample would allow you to determine market reversals.

Dragonfly and Headstone Doji

This sounds handful.

However dependent.

That is similar to the hammer and capturing star.

This can be a signal of worth rejection

Morning and Night Star

This can be a morning star:

That is considerably just like the Engulfing sample however with a slight variation to it.

Within the first candle, the sellers had been in management, and within the second candle, there was indecision out there.

Then lastly, the third candle opened and pushed the value up and shutting close to the highs.

It’s a bullish reversal sample.

The night begin is simply the alternative of the primary candle.

Consumers are in management and the second candle is an indecision candle. Then the third candle the bears got here in and pushed the value decrease closing close to the lows.

Tweezer Backside

This can be a highly effective sample.

It reveals you rejections of decrease costs two instances.

First and second rejection.

This can be a signal of sturdy rejection of decrease costs.

Tweezer High

At one level, it was on the excessive of this session earlier than the sellers pushed the value fairly a bit and eventually closed close to the center of the vary of the candle.

Then the following candle, the value opens and the patrons took cost and received rejected on the identical stage earlier than the sellers pushed the value decrease closing close to the low.

Two instances the value rejection of upper costs, this can be a bearish reversal sample.

The TAE Framework

Now that you simply perceive the 5 highly effective candlestick patterns, how does this match into the TAE framework?

We now have settled the entry triggers portion due to the reversal patterns that you simply noticed earlier, these are the entry triggers that you need to use to enter the commerce.

However earlier than you commerce it, keep in mind we mentioned don’t commerce it in isolation, which means that we have now to make use of different components or different market circumstances to search for.

Earlier than we watch for our entry set off, the circumstances that we search for are the TAE framework.

What we’re in search of is that if the value is above the 200MA, we could have a protracted bias.

Which means we need to be a purchaser on this market situation.

If the value is beneath the 200 MA, we’ll have a brief bias. which means that we’ll solely be seeking to brief.

Development

- If the value is above the 200MA, have a protracted bias

- If the value is beneath the 200MA, have a brief bias

Perceive that after I outline the development, it doesn’t imply that simply because the value is above the 200-period shifting common you go lengthy instantly…

That is simply to offer you a bias that now it’s time to be shopping for. It’s time to be in search of shopping for alternatives.

Space of Worth

- Help and Resistance

- Transferring Common

- Trendline

- Channel

Entry Set off

- Engulfing sample

- Tweezer Tops and Backside and many others.

Utilizing this framework, we are able to then formulate buying and selling methods to revenue in bull and bear markets.

Bear in mind the very first thing we’re in search of is the development

If it’s an uptrend, we glance to purchase and we’ll purchase it at an space of help, shifting common, after which we search for an entry set off.

The entry set off could be a bullish reversal sample like a hammer, a bullish engulfing sample, dragonfly doji, and many others.

Does it make sense?

Instance:

Let’s convey all of the ideas collectively

I don’t have the 200MA on the chart however for sure, the development is down as a result of you’ll be able to see that the market is shifting from as much as down.

The worth got here into this space of resistance. The worth was rejected thrice.

You’ve received this entry set off (Taking pictures Star)

Now you’re buying and selling candlestick patterns within the context of the market that means you’re buying and selling candlestick patterns primarily based on market construction.

Primarily based on the development this elevated the likelihood of your commerce understanding.

The capturing star occurred on the resistance in a downtrend and the market did proceed barely decrease.

One factor to level out is that the examples I confirmed you might be all successful trades however in actuality, you gained’t get all successful trades.

You’ll in all probability meet losers.

The explanation why I share successful trades is that it’s simpler as an instance the idea however once more these charts or somewhat the possibility you might be seeing now are cherry-picked.

Instance:

What’s the development?

Downtrend.

The place is the realm of worth?

This time across the space of worth is a shifting common and it acts as a dynamic resistance.

What’s your entry set off?

We now have a bearish engulfing sample.

We now have three issues

The development, space of worth, and entry set off.

We are able to go brief and have our stops someplace concerning the highs.

Conclusion

Candlestick patterns are positively one of the crucial well-liked topics in relation to technical evaluation.

Nevertheless, it’s at all times used the improper manner.

This is the reason in right this moment’s information I’ve shared with you that:

- A candlestick consists of an open, excessive, low, and shut

- The distinction between a bearish and bullish candlestick sample is the colour of the physique, and the size of its wick

- Candlestick patterns has a whole lot of variations from giant physique and small physique, to lengthy wicks and brief wicks

- Completely different candlestick patterns can equate to completely different patterns on the upper timeframe

- The improper solution to commerce candlestick patterns is to enter the commerce with out wanting on the market construction

- One of the best ways to make use of candlestick patterns is to make use of it as an entry set off

- You need to use the T.A.E. framework to commerce candlestick patterns

How about you…

Do you agree with the ideas I’ve shared with you right this moment?

If that’s the case, which one stands out essentially the most to you?

Let me know within the feedback beneath!