For those who missed the primary mailbag, it’s right here. These are actual questions from actual merchants, fielded from my e-mail, twitter account, or remark part. You probably have any questions, simply ask away. Let’s get began.

1. How’s your buying and selling stepping into 2024?

Eh. I believe it’s time for me to take a hiatus from lively buying and selling I discover myself directionless and with none love or ardour for the sport. I typically really feel riddled with anxiousness and every kind of fucked up ideas swirling in my head. I assumed I might combat by it however I’ve reached my breaking level.

For a lot of 2023, buying and selling was only a part-time gig for me. I targeted most of my time on taking good care of my new child and my recovering spouse. No matter spare time I had was then spent on writing. It felt liberating to simply say “I don’t need to commerce immediately as a result of I don’t really feel prefer it”. I traded about 50% of all buying and selling days in 2023 (lots of these days have been only one commerce and completed by 10am kind days too)–by far the bottom variety of buying and selling days in any yr I’ve had.

Then in December, I began ramping it up a bit and hastily discovered myself again into full-time buying and selling, maybe for the incorrect causes. My child was going to start out daycare and my spouse’s maternity depart had ended. In order that left me at dwelling considering I needed to occupy myself and be the breadwinner once more. I didn’t need to simply watch TV and eat junk meals and really feel responsible like I had in the course of the early components of 2023 after I took a protracted break from buying and selling. So I pressured myself to commerce each day. At first it appeared okay and I ended 2023 on a constructive notice by getting inexperienced on the yr. I assumed I might carry that momentum into 2024 and simply hope for the very best. I didn’t even overview the yr or overview my worst losses like I normally do. I didn’t set any targets. I had this nagging feeling that I hadn’t actually dedicated to creating some much-needed modifications, I simply needed to show the web page instantly and never give it some thought.

Along with all that, I picked up some good vibes from all of the individuals who had reached out to me whereas I used to be writing Prop Dealer Collection–rookie merchants, marginal merchants, constantly worthwhile merchants, and even some masters of the sport–all to say that they’ve been the place I’ve been, felt what I felt, did the dumb shit I did, and noticed components of their lives and careers mirrored in my journey. I felt extra linked to the buying and selling group and that’s good for somebody like me who can typically really feel remoted and alone. I additionally felt humbled, like perhaps my mind was lastly in the appropriate place to be taught new issues once more. I assumed these good vibes would assist however they didn’t carry over into any significant motion.

In January, I felt like I used to be repeating how I began the earlier yr. Risky outcomes. Tons of adverse feelings. My thoughts simply feeling it’s now 100% consumed by buying and selling and unable to search out any steadiness. Doing the identical shit I vowed to not do, like a loopy one that can’t hearken to himself. Feeling super-conflicted about my inventory choice and methods, torn between having made cash up to now on sure dangerous performs and wanting to maneuver away from these strategies in order to evolve in the direction of a extra Platonic dealer perfect. Continuously questioning why I’m even on the display screen. Utterly bereft of any creativity and unable to put in writing. January truly completed OK PnL-wise however PnL can masks plenty of underlying points. I keep in mind this thought echo-ing in my head… “this (the cash) isn’t even price it.” It’s not price how horrible I really feel each day, primarily a results of how I deal with myself. That harsh inner-critic that lots of you picked up from studying Prop Dealer Collection, could be very a lot an actual a part of me. Spending an excessive amount of time in that state typically has me drifting into full-blown nihilism mindset the place I simply begin lighting cash on fireplace. That’s precisely what occurred final yr–a January the place first rate outcomes masked poor course of after which in February, the lease lastly got here due. I don’t need to go down that path once more.

Anyway, I’ve determined sufficient is sufficient. It’s time to push myself to an uncomfortable brink. Both I re-invent myself as a dealer and resolve some long-term points or I transfer on completely from buying and selling. It doesn’t make sense to maintain doing one thing that makes me essentially sad. I query if I even have the juice to do it at this level in my life. It may be the toughest factor I’ve ever tasked myself with at a time when my thoughts isn’t precisely assured it might tackle a terrific problem. I can’t simply preserve doing the identical factor time and again and finish the day desirous to to bash my brains in.

I don’t know what’s going to occur, I’m not right here to swear to you that I’m going to return out of this as a greater dealer than ever. It’s potential you simply gained’t hear from me in a yr as a result of I’ve moved on with my life. I took a day without work to put in writing all this and actually, I already really feel nice. I really feel relieved. I went for a stroll and ate a pizza and I truly savored the style relatively than simply scarfing all of it right down to fill some bottomless void. Music looks like a wealthy sensory expertise relatively than simply injected stimuli neccesary to jolt my lifeless husk of a self at 9am. I really feel like a model new individual when I’m able to simply utterly let go of the market.

That’s my 2024 to date, hope yours is faring lots higher and that you just’re richer than your wildest creativeness. I nonetheless have plenty of self-work to do, both attempting to repair no matter is damaged to commerce once more or doing soul-searching to determine what’s subsequent.

2. Does tape studying nonetheless work?

One of many themes I attempted to the touch upon in Prop Dealer Collection was MBC’s tried inside re-focus from tape scalping in the direction of intraday place buying and selling. We tried to deal with a number of contexts–earnings breakouts, junk inventory parabolic corrections, tech inventory catalysts, distressed conditions, and different distinctive tales. Primarily, you let the story of the inventory play out for an even bigger transfer, so long as the value motion is in your aspect. In fact, many people struggled with that originally as a result of we received caught up in attempting to compete with the algo’s on the tape. However with expertise and elevated confidence, you be taught to correctly weigh these intangible components relatively than being super-reactive on a regular basis.

I as soon as requested Victor, what was it like buying and selling in 2008? This was, on the time, MBC’s finest yr as documented in Two Good Positions and tape studying was an enormous a part of it. His response was one thing like: “You didn’t want any concepts to start out a day. You simply discover a monetary with plenty of quantity, play momentum, be within the cash instantly, get out when it slows. The higher merchants would even flip place.” You simply observe the circulation. It’s extremely short-term reward-focused, which requires much less analytical considering and fewer persistence.

My opinion on the present state of tape studying NYSE/NSDQ in 2024? It’s an indicator, not a method. SOES-era Nineties buying and selling and 2008 Nice Monetary Disaster, the tape might be the technique by itself. FNMA in 2013-2014, that tape was the technique. Now it’s simply an indicator and one in all many items of the puzzle. Good tape studying offers you higher micro timing and higher entry/exit costs. It gained’t make you hundreds of thousands of {dollars}.

3. How a lot do you assume a dealer like Jimmy was compromised by focusing completely on micro value motion and ignoring information?

It wasn’t simply the truth that he solely traded micro value motion and ignored any context (though it’s extra apt to say he’d choose and select once we’d weigh context into equation, relying on his must commerce his PnL). To get actually over the hump as a dealer and print in good markets and dangerous, you could deal with all the pieces significantly. Sample recognition is only one facet of buying and selling. You might have research little issues like exit technique, the way you analyze value, the way you place orders, what performs aren’t following by and why, larger image market construction and the way it modifications, and a lot extra. You must have your finest setups on psychological lockdown–comprehend it just like the again of your hand what to anticipate and learn how to execute. I believe Jimmy had simply sufficient ability to print throughout an excellent market or in the course of the SOES period however not throughout common markets and sadly, he began proper after the 2008-09 bear market ended. He was too streaky and that in the end saved him caught in that “marginal dealer” stage.

4. Did anybody of you go to work on the buying and selling desks of the massive Wall Avenue names?

I keep in mind a pair guys from my day–one went to Point72 Ventures and one other went to Bridgewater. They have been two desk favorites identified for his or her exhausting work after which featured in Victor’s e book. They left MBC earlier than their third yr. Perhaps they might have been good merchants if that they had caught round lengthy sufficient.

Two prime merchants from 08-era MBC opened their very own hedge funds. Tuco and Rowboat began Inexperienced Ivory Fund in 2013.

Two guys who interned throughout my first and second yr (however by no means turned MBC trainees) began and bought off profitable crypto buying and selling companies–one began an choices market making agency and one other began an choices analytics hub. Previous to their crypto companies, they each had Chicago prop backgrounds at Akuna and DRW. Neither of them knew each other till assembly up 10 years later.

5. How do I get on a prop desk?

That is the commonest query I get–how do I commerce at MBC or another equities agency? I hate to be the bearer of dangerous information, however you must perceive that the “keyboard equities buying and selling” subset of prop buying and selling has shrank considerably up to now 15 years. There aren’t practically as many seats as there was. For those who don’t fall into 2 distinct classes–younger expertise and veteran expertise–you could have a slim likelihood of getting by the door.

Younger expertise: Faculty graduate who has already been buying and selling for 3-4 years. Ten years in the past, this wasn’t as frequent so I used to be shoe-in candidate. Then day buying and selling discovered its approach into the mainstream with the Covid-market growth, crypto, meme shares, Robin Hood and the rise of zero-commission buying and selling, the rise of sensible cellphone buying and selling, Dave Portnoy, Wolf of Wall Avenue, discord teams, and lots of different components. Now there’s a 1000 guys like me yearly. There’s going to be an 22 yr outdated prodigy who has studied markets since age 15, has made $100k already and he’s going to be taking one of many only a few out there seats left.

Veteran expertise: Confirmed dealer with not less than a ten yr monitor file and likewise buying and selling severe dimension to maneuver the needle for a prop agency’s PnL. Most of those guys are already at a prop agency or they don’t want one.

So yeah, it will likely be tough for you.

Let’s say you’re a 28 yr outdated engineer with 4 years of buying and selling expertise and you’ve got inconsistently worthwhile outcomes. You’re the textbook marginal dealer who doesn’t fall into both the younger or veteran expertise bucket. One of the simplest ways to make your self fascinating is to produce other abilities–in the event you’re a giant asset in coding or information monitoring, attempt to leverage {that a} bit. Be keen to assist the senior merchants along with your abilities. The most effective of the very best quants don’t go to the keyboard equities subset of prop, they go to Jane Avenue or Goldman Sachs. So the old-fashioned companies like MBC are all the time in want of quants. The second finest approach is to simply know somebody deeply embedded in prop who can vouch for you by some means. They want to have the ability to comfortably look the hiring supervisor within the eye and say “this man is the toughest employee I do know“.

For those who assume you match into one of many two perfect molds however perhaps on the perimeter, then being likeable goes a good distance. That is extra a life precept than the rest–if individuals such as you, they need you on their group. For those who’re an asshole, you higher make some huge cash or they gained’t take you. For those who’re a weirdo who everyone seems to be not sure about, they might take the likeable man over you. Learn Two Nice Positions and also you’ll see that Victor and Avery rent guys who match the tradition and are enjoyable to shoot the shit with about markets and sports activities. Being on a buying and selling desk is meant to be a enjoyable expertise in comparison with buying and selling at dwelling.

Take note, that is now the post-covid working setting. Lots of the prime merchants have gone absolutely distant and also you gained’t be capable of sit proper subsequent to them to be taught all their tips like a sponge. One dealer relayed to me his expertise in coming again to work at WTG’s Austin desk someday in 2021: “Lots of the prime guys stayed dwelling. It was wild man individuals have been within the workplace testing constructive for COVID and never giving a shit. The 20 one thing’s all of us simply known as them [head trader]’s minions. I felt like there have been toddlers operating round. Everybody paid for various chat companies to name out their pumps. There have been guys in there in 250k holes (drawdown) who hadn’t been fired simply chucking shares at something.” For sure, he left shortly after that. It may not be the expertise you dreamed about.

You must ask your self: Is it actually price it? Do I extremely worth a group setting? Do I extremely worth direct mentorship and do I do know the dealer who will mentor me is the man who’s the appropriate match? Do I like being subsequent to merchants and vibing with them? Do I care extra about growth, help, and shopping for energy than I do about revenue cut up? If you wish to be a terrific dealer, work on buying and selling. If you wish to encompass your self with good individuals, be very social on-line and discover the genuine merchants who can earn money and brazenly share their trades (they’re on the market). You don’t need to do prop.

One fast story I’ll share: a few years in the past, a man contacted me on-line to choose my mind on the in’s and out’s of prop buying and selling. This man later utilized for Trillium, having meticulously researched each out there element about them on-line. He compiled this info right into a PowerPoint presentation and had a ready script to clarify why he was the right candidate. He blew away the hiring supervisor to such an extent that the supervisor made positive he would sit subsequent to the agency’s prime dealer for mentorship. For those who actually need to be on the prime prop companies, you’re going to need to go the additional mile in your individual approach. Don’t inform me why you must get a seat, present me.

6. On condition that MBC shouldn’t be your typical 6 fig gross sales and buying and selling job you get out of school, are you able to communicate to what kind of popularity you assume MBC has on the road? Did you ever meet individuals who work in gross sales and buying and selling at a giant financial institution for instance and also you inform/informed them you’re a prop dealer?

I actually don’t even know if Wall Avenue has any consciousness of keyboard equities prop in 2023. Again in 2010 the subsector was a lot larger. Now I don’t assume anybody cares anymore. There aren’t that many respected companies left on the market and most of them don’t actually promote their presence–MBC being the most important exception to the rule. For those who spoke to some TradFi go well with and informed them you’re a prop dealer and to guess which agency, they may undergo all of the quant companies, banks, and multi-strat hedge funds (Jane, FNYS, Millenium, Schonfeld) earlier than they only cease guessing completely. Day buying and selling continues to be seen as largely a retail factor–image a man at dwelling in his underwear, chit-chatting on the web about the very best shares to purchase.

For probably the most half, I inform individuals I’m a dealer after they ask as a result of I’m uncomfortable being dodgy about it. However I don’t need to speak about all of it that a lot as a result of too typically I run into these two frequent reactions, neither of which I take pleasure in:

A. Individual has pre-conceived notion that day buying and selling is a rip-off and could be very skeptical and opinionated on environment friendly market idea

B. Individual is completely 100% into market hypothesis and begins asking for warm inventory suggestions

I’ve a canned response to each. To individual A) “Yeah you’re proper. Market can’t be beat in the long term, I 100% agree.”To Individual B) “I’m a nasty dealer, you don’t need to hearken to a bum like me.”

7. What was the tough success/dropout charge of trainees at MBC whenever you have been there?

1 out of 10 in any coaching class would go onto turn out to be a CPT on the agency. Perhaps 25-33% of the category would linger for years as marginal merchants who might make a small sum of money however would battle in the event that they pushed tougher. In the event that they don’t breakthrough after a pair years at that stage, they transfer on from the desk and would perhaps choose up buying and selling on their very own sooner or later, hopefully turn out to be a retail CPT. The remainder don’t even make it previous a yr to turn out to be Junior Dealer. There could be a number of merchants who match into uncommon classes, they weren’t CPTs however would fluke their approach right into a windfall throughout some uncommon volatility-driven occasion. I keep in mind being informed one rookie dealer made $1 million throughout 2015 volatility and by no means did something noteworthy after that.

8. How do you’re feeling about how buying and selling is portrayed within the media?

It is a good time for me to share my takes on all trading-related cultural media. For one, I nonetheless don’t assume there was a compelling and correct portrayal of the fashionable buying and selling expertise in our media. I believe Buying and selling Locations was a enjoyable film in regards to the outdated approach of buying and selling within the pits however since then, virtually the entire high quality stuff has been in regards to the institutional hedge funds–which is commonly a master-of-the-universe kind in his workplace, sitting in his boss chair both rigging the machine or making godlike calls to beat the market. This was perfected in Wall Avenue after which re-mixed in a technique or one other in Billions, Margin Name, and The Massive Quick. I don’t know if there can ever be compelling media a couple of prop agency of merchants or one man buying and selling in his own residence. The place would the drama come from? It must be an excellent area of interest comedy, perhaps an inexpensive net sequence at finest.

Anyway, some takes.

Billions: Seasons 1-2: good schlock, largely pushed by Giamatti and Lewis performances, however nonetheless overrated and never worthy of prestige-TV label. Season 3 and on: Sizzling rubbish. The additional away the story deviated from normal hedge fund stuff, the more serious it received. Everyone seems to be a grasp of the universe kind taking part in 3D chess and they’re going to clarify their each transfer and motivation to an underling with an exasperating pop-culture reference. I keep in mind Bryan Connerty, one of many key US Legal professional characters, asking one other character “Did you ever watch the film PI?” to which that character truly mentioned oh sure, I completely did and know the precise level you’re attempting to make. Come on, man. Pi made $3.2 million on the field workplace, no person watched that shit. So hacky.

Black Monday: Attention-grabbing idea however I checked out after about 5 episodes as a result of It’s a comedy that didn’t make me snort. I didn’t really feel invested within the inventory market plot both.

Wall Street: Nonetheless holds up as nice in any case these years. Let’s not speak in regards to the sequel.

Margin Call: Glorious grounded and dialogue-driven film. I simply don’t know if the Sam Rogers character is definitely rooted in actuality–what did he need the financial institution to do precisely? Maintain the bag? His altruistic motivations don’t really feel actual. Some nice memes from this film.

Overheard: I’m going to guess not a single one in all you has seen this one. It is a Hong Kong film about some cops who get a scorching inventory tip through police surveillance. It’s not precisely about buying and selling, it’s extra like against the law thriller that makes use of inventory pump as a plot system. However it’s a enjoyable film and I’ll all the time keep in mind the scene the place the down-on-their-luck bucket store losers are all cheering on the pumped inventory.

Dumb Money: I’m by no means, ever watching this. I lived by it in actual time, why do I must see it once more?

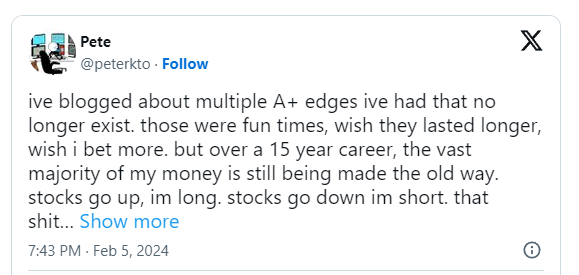

9. How do you’re feeling in regards to the matter of edge erosion recently? Ought to us merchants be extra cautious of showing info?

The final week or so, there was a discourse within the small cap subsect of FinTwit about edge erosion. And actually, I discover myself chuckling in any respect the people who find themselves wringing their arms about it and begging others to not “leak a lot edge”. I chuckle as a result of I image them studying a submitting about some Junk Inventory and observing that the chart exhibits the inventory went up lots after which all the best way again down, so now they assume they’ve found the final inefficient frontier in the complete market. I don’t imply to be overly dismissive as a result of it may be a nuanced dialog as a result of right here’s a easy reality: shares that go up lots after which return down have been part of the marketplace for over 100 years. There are lots of methods to investigate it and some ways to commerce it lengthy and quick. Lots of these strategies are mentioned out within the open by 7-figure (or extra) Grasp Merchants, in the event you look exhausting sufficient.

I keep in mind somebody on twitter citing the so-called “China liquidation plays” for example of edge erosion. The purpose was mainly this–“they have been so good and straightforward to quick all-in till everybody talked about them, then they turned dangerous and blew up”. Zoom out and you’ll understand that these shares are a super-niche play they usually have been all the time going to return and go, similar to the 2009-2011 period OTC pump and dumps that additionally went down 90% in a day. They’d their day after which they have been gone. As a private apart, I actually don’t care anymore to commerce hyper-controlled shares and take a look at to determine the manipulation. You don’t make a profession out of that and one ZJYL occasion can finish you. Commerce an excessive amount of of that stuff and your mind would possibly simply rot and begin considering all the pieces is faux manipulation.

In order that prompted me to tweet this:

Shares transfer how they transfer and if in case you have perceive fundamental rules to benefit from human-driven phenomenons like tendencies, breakouts, vary, and imply reversion, then you can be simply high quality. Some market cycles reward sure actions greater than others. In good markets, you’ll crush. In dry markets, you’ll survive. That’s how it’s and all the time might be. For those who’re one of many fortunate .001% to search out one thing actually wild that ought to not final, then go forward: wager huge and keep silent. That’s simply frequent sense.

10. Recommendation for quadrant 3 merchants to maximise their strengths and minimise their weaknesses?

Ever watch Rounders? Keep in mind the character Joey Knish? Q3 guys are mainly the embodiment of Joey Knish. An actual grinder’s grinder. Don’t roll up and take a shot for the massive Vegas pipeline like a Mike McD (clearly a Q2 man). Play inside your means, don’t overextend your self, and pay for lease, alimony, and baby help. Put meals on the desk.

Anyway, my recommendation is sort of totally different relying on what stage of dealer you’re at.

Rookie Dealer: You don’t have any thought what you even are but, go discover a method and provides your self a yr.

Marginal Dealer: That is the exhausting one since you’re attempting so exhausting to desperately make it and you’re feeling such as you’re shut. Perhaps you grind inexperienced 4/5 days however then you definately get carried away and wipe all the pieces out in a day on tilt. Work in your psychology and double down on self-discipline and restraint. Create guidelines that preserve your self in examine. In a totally distinction case, perhaps you grind with self-discipline however with inconsistent outcomes as a result of it looks like each play has questionable and random followthrough (similiar to our consolidation performs again in 2012). You must be single minded and diligently take notes in your technique, drill down on what works and what doesn’t. Give attention to context and what strikes shares verus what’s random or frequent.

CPT: This one is attention-grabbing. You’re already making an excellent dwelling however you need to push your consolation zone a bit of bit and make that career-high, life-changing cash don’t you? However you pike round an excessive amount of, you weak-hand what ought to have been year-making winners, and also you simply examine your self approach an excessive amount of relatively than letting it rip. I get it, I’ve been there.

I had the privledge to sit down subsequent to an excessive Q3 dealer who didn’t need to take any ache at one level however later developed into an 8-figure dealer a decade later. So I requested him straight:

Clockwork: “Make 1k/day for five years. Get 300-500k in financial institution financial savings (or no matter quantity has you feeling financially snug for five years). Then simply go YOLO for an opportunity to be a millionaire. Take a leap of religion in your finest trades to do it.”

11. How do you’re feeling about (no matter buying and selling chatroom insert right here)

I received plenty of questions on: what’s up with this [insert paid chatroom here]? Is it legit? Is it useful? I can’t reply all of them as a result of I don’t subscribe to each single one in all them.

Paid chatrooms are sort of a charged matter to speak about within the present buying and selling discourse. You both love them otherwise you hate them. I’m going to attempt to preserve this skilled the place anytime you ask me a couple of chatroom, I’m going to judge it purely as a dealer product and attempt to take away emotion out of it.

So one chatroom I used to be part of from 2011 to 2015 was the Investors Underground chatroom. Throughout this time, I realized lots about OTC buying and selling and the way penny shares moved. That alone made it well worth the cash and it’s what gave me the leg up on buying and selling these shares whereas I used to be at MBC. Right here’s the caveat: no person broke it down step-by-step the best way I did speaking about held bids within the Fannie Mae chapter. It was extra such as you’d observe a number of feedback akin to “seeking to play FNMA bounce“… after which the play unfolded after which quickly after, everybody celebrated and known as out the place they’d promote. So it was plenty of saying one thing with out explaining all of it. Then whenever you’d ask extra questions, you’d get responses like “in the event you see it, you see it, in the event you don’t see it, don’t commerce it” This was annoying however I type of perceive the place it comes from. Not everybody is a good communicator–some good merchants see the sample however they’ll’t break it down into nuts and bolts for the layman. After which I perceive not desirous to really feel answerable for a brand new dealer getting himself caught by saying something too concrete like “simply purchase it after I purchase it.” Nonetheless, this turned a recurring sample–you’re feeling such as you’d be onto one thing actual however not sufficient to make it extra systematic or repeatable.

I felt this particularly extra true when it got here to studying learn how to commerce NSDQ/NYSE shares, the place I couldn’t lean on the crutch of fresh tape patterns the best way I did on FNMA and the pot shares. There have been too many imprecise feedback. Watch this stage, watch that stage. Properly, what am I supposed to observe for? A lot of dealer slang like “gearing, perking, stuffing” There’s plenty of chaos and generally you don’t know the place sure merchants are coming from. You can’t contextualize the one commerce they’re making inside a larger technique. It’s all condensed into a brief remark–“Quick TSLA right here at 190.” “Lengthy NVDA there at 502.” Why is he selecting to commerce this inventory? Why at this stage? One man exits inside seconds. One other man exits and also you surprise when he even posted his entry. Then one other 5 random merchants make their very own 5 callouts, some even going lengthy the inventory on the stage somebody is brief. It turned its personal ability to need to course of all this info and switch it into actionable buying and selling.

It was good for information alerts and good for extra eyes on shares at a time when real-time scanners weren’t as ubuiqtious as they’re now. That is worthwhile for the CPT who is aware of learn how to earn money already however most individuals aren’t CPTs, they’ll’t extract worth from alerts but. They want instruction and the instruction type of the room was simply not my cup of tea. You’d get basic ideas however it wasn’t dialed sufficient into particulars.

There have been positively good merchants within the chat however you needed to actually dig into them through DM to choose their mind. Me being cussed as a mule, I normally needed to go my very own approach and never need to be all buddy-buddy with everybody to get all of the solutions. I didn’t need to really feel just like the one centesimal man to ask the identical query.

Generally you simply don’t vibe with a room anymore and that’s okay. There have been dangerous days–inevitable in buying and selling, perhaps I received stopped out lots and overtraded and I’m pink–and my thoughts is so strained by the very finish of it. Then I’d peek on the chat at shut and that is what I’d see:

Moderator: “Nice job all people! We banked immediately!”

20 totally different newbs: “OMG thanks! Made cash immediately bc of your calls!”

It jogged my memory of my prop expertise with the MBC blotter the place I felt like shit to be adverse when everybody else was inexperienced. That feeling of “everybody else made cash immediately cept’ me huh?” That shit could make you jaded. Generally I’d discover myself being attentive to some newb taking a questionable aspect of a commerce. Then when he posts his cease loss, I’d assume to myself “HA, I knew that fool didn’t know shit.” This was an entire waste of mind energy and a focus span.

Now, it couldn’t be true that *everybody* made cash in a big room like that however clearly there’s a survivorship bias at play: individuals who struggled typically cope with it quietly whereas the newbs who made $100 for the primary time get excited and the individuals who run the enterprise need to preserve it constructive–I get that. I simply didn’t need that on my display screen anymore until I used to be getting large worth elsewhere, which I wasn’t as soon as I had my OTC setups on lockdown. I’ll concede that that is largely a “me”-problem, besides, that’s my sincere expertise.

Anyway, that’s my overview of a chatroom expertise from virtually a decade in the past. I don’t know what it’s prefer to be in there now, perhaps they modified plenty of issues for the higher (or worse). What you must take away from it isn’t whether or not I’m endorsing or bashing this sure room, however how I’m evaluating it. What am I getting out of it for myself? Is it this one thing I need as part of my every day buying and selling expertise? Don’t get too slowed down into wasteful and gossipy conversations like how a lot does dealer X on this chatroom make or lose. Transparency is necessary however that’s a can of worms I don’t need to get into but. The subsequent chatroom I subscribed to ended up having the exact opposite issues as IU did (however it was nonetheless additionally helpful and well worth the cash)–perhaps I’ll write about that one other time.

I’ll add one last item: in immediately’s buying and selling setting with the 1000’s of telegrams and discord channels all over the place… in case you are a hard-working, likeable and social individual keen so as to add worth and share info–you may work your approach into personal chatrooms with superior merchants with out having to pay something. It’s known as having mates and it removes the issue of getting to contextualize what & how each random stranger is buying and selling and commenting on since you’ll have a greater grasp of how your mates commerce. I at present don’t pay for any chatrooms, I’m solely in personal channels with individuals who I vibe with.

12. How do you assume buying and selling has impacted your sense of empathy/sympathy? We cope with a lot bullshit and so many head in arms moments, it makes it exhausting to hearken to different peoples issues and prolong a way of sympathy, not less than for me. Have you ever skilled the identical factor and do you assume that’s typical of most merchants?

I believe I’m going the opposite approach… I don’t even give myself any slack for my very own points. Merchants are simply parasites. That’s all we’re. We should not have actual issues and all the pieces is self-imposed. No matter you’re upset about, mad about–simply keep in mind–it’s all the time your fault and your fault alone.

I’ve to remind myself each single day. I should not have the worst issues on the earth–not even shut. Individuals are on the market at warfare, or they’re ravenous, or they’re unsafe of their setting. There’s all sort of horrible issues occurring to the silent and unseen lots.

For the reason that inception of this weblog, I’ve often had the urge simply to let all of it out in a single lengthy, incoherent “fuck the market and fuck me!” kind of rant. I’ve had every kind of dumb, trivial buying and selling occasions which have triggered me right into a close to psychotic break–huge losses, small win/losses the place I really feel I piked out proper earlier than a big transfer, medium wins the place I really feel I didn’t dimension sufficient and I had the misfortune to pay attention to somebody who did, orders that missed me by fractional pennies, or simply some jackass spouting nonsense on twitter getting too many likes. Simply something that set me off–I needed to set it on fireplace. Additional than that, I needed to dispell any notion that buying and selling was in any respect fulfilling like all the opposite content material means that it’s. It’s ThE mOsT cHaLlEnGiNg GaMe In ThE uNiVeRsE aNd YoU gEt To Be YoUr OwN bOsS–oh shut the fuck up, will you? Rattling, there I’m going once more–simply fascinated about it places me within the temper.

Then I remind myself: who desires to learn this? Okay it’s most likely humorous the primary time. And there’s positively a darkish allurement to it–like watching a automobile wreck–if I used to be truly blowing up cash left and proper. However I’m only a regular-ass constant dealer who’s up in his emotions. I’ve an excellent life. It’s unbecoming to lack gratitude when blessed with an excellent life. I neither need anybody to really feel sorry for me nor do I need any such content material to signify me.

So if I’m up in my emotions, I write down every kind of horrible shit in a draft… after which I erase it. Simply flush it down. No “Fuck the Market, Fuck Everybody!” publish immediately, though you may see it leak out right here and there on some posts I’m positive.

13. What do you consider Public sale Market Idea?

I learn Steidlmayer’s e book a very long time in the past–he’s the man who popularized Market Profile, which was a preferred charting approach for futures merchants from approach again within the day and supposedly based mostly off Public sale Market Idea. I don’t keep in mind lots about it however I believe it made sense. I don’t actually apply it to my buying and selling however I do know individuals who do and have been profitable.

Simply understanding market construction by one explicit evaluation mode–whether or not or not it’s AMT or Wyckoff or Dow Idea or market breadth–and sticking with it for a very long time (I imply many years, though you may velocity up the training curve by historic charting) might be very highly effective in shaping how your potential to see huge image strikes unfold in actual time.

Keep in mind Paul Tudor Jones within the documentary Trader? It documented his fund being place quick on the 1987 Black Monday crash, having forecasted the transfer through Elliot Wave Idea–a preferred market cycle indicator invented by Robert Prechter. Prechter has since been uncovered as nothing greater than a hacky permabear and I don’t know a single dealer efficiently utilizing Elliot Wave to earn money. I extremely doubt PTJ himself makes use of it anymore to information his resolution making. My level is that this: the very best merchants see the massive image modifications, they usually do it by learning markets over time by no matter methodology it’s that is smart to them. The strategy itself doesn’t matter. They’re simply good at buying and selling, that’s the important thing.

14. What do you prefer to cook dinner within the morning?

My present breakfast rotation, the place I both make it at 8:45am if I’m not busy pre or 11am if I’ve time:

- Eggs over simple + Dealer Joes frozen roasted potatoes (mainly dwelling fries) + including cooked bacon/sausage (I like chorizo recently)

- Eggs over simple over a flour tortilla with salsa (mainly a fast huevos rancheros)

- Egg scramble with peppers, onions, cheese, bacon bits and plenty of scorching sauce

If missing time: microwave a burrito or eat yogurt with some granola and fruit jam blended in it.

15. Do you wager extra on A+ setups in comparison with a B? Or your bets typically are equal?

I’ve all the time been extra of a “wager larger on A-setups” discretionary man versus a “all bets equal” programs man. I do know stable merchants exist on either side of this debate however that’s simply how we have been taught to do it within the prop buying and selling world. A dealer would possibly grind a inventory for $5000 every day after which when the market has an insane transfer, he bets all his BP (an 8-figure quantity) and places his profession on the road. That’s an excessive that I don’t help clearly however it may be completed thoughtfully with measured threat controls.

To borrow an American soccer time period, I refer to those larger bets (after they work) as “chunk good points”. More often than not you could transfer the chains along with your 3-5 yard runs and a few fast passes (e book a inexperienced week throughout a gradual market), however generally you gotta be grasping and chuck it deep. Go get that huge chunk achieve in your PnL curve.

“No threat it, no biscuit.” — Bruce Arians, Tremendous Bowl-winning head coach identified for his vertical passing offenses

16. What’s the key to not bleeding away income for in a tricky market cycle?

Having a deep playbook the place you may make cash in all markets. How to try this precisely most likely requires a for much longer reply than I’m ready to provide. The extra area of interest your buying and selling is, the extra weak you’ll be to robust cycles (perhaps that is the sting erosion boogeyman coming for you, exhausting to say). For those who lack structural market understanding e.g. being a sloppy dealer who buys with out nice threat mgmt in bull cycles, you’ll even be extraordinarily weak to robust market cycles.

17. Do you commerce any alt cash?

The huge, overwhelming majority of my crypto income have been in bitcoin. Like 90%. I’m not the man to speak to about altcoins or ICOs. I believe I simply belief issues that final and have plenty of different individuals additionally trusting it. One other issue is I don’t assume I’ve the psychological bandwidth to be monitoring so many positions on 24-7 crypto markets. Letting go and managing a place by solely a chart’s closing value is a ability I must work on to have my swing buying and selling recreation attain the following stage. I positively really feel like I’ve missed some superb alternatives over the previous couple of years.

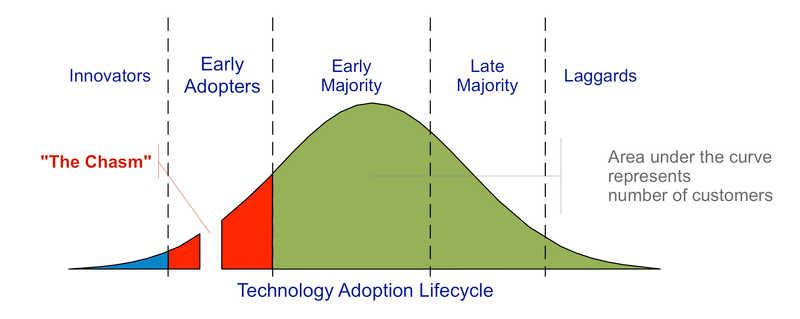

I look again at my begin in crypto in 2013 and I can’t however assume that looking back, I used to be to date forward of most individuals in conventional finance with my begin however I don’t assume I actually maximized it. It’s tough (not not possible) to know that in actual time although. I’m not even speaking about futures costs due to course we will’t know that however I’m speaking about “the second”–simply realizing that you just’re tremendous early in one thing that may develop exponentially bigger. For those who can simply sense it and consider… you may go a good distance. This pertains to the earlier reply I had about larger footage cycles–the tech adoption cycle is its personal factor to know.

18. How do you cope with tilt?

You must resolve what’s inflicting it.

There’s all the time little hacks on the market that will help you out. Guess smaller. Wiring out cash to scale back account dimension. Getting up for a cigarette break. Taking a deep breath. Ending your day at your PnL benchmark by midday relatively than giving again any cash. Watching humorous youtube movies to have amusing. Consuming your approach right into a lunch coma with a greasy double cheeseburger. These are little simple hacks to quickly scale back the stress of the second or to scale back your real-time anger and frustration however they aren’t everlasting resolutions. If you’re an individual like me, attempting to push your self on a regular basis and get probably the most out of your self and tackle probably the most intense conditions, there might be intervals the place the little hacks simply aren’t sufficient.

What’s decision? Let’s take a easy instance by poker–if getting “unfortunate” on the river tilts you, it’s a must to resolve that within the long-run that by rewiring your considering. You must settle for that dangerous luck and low likelihood eventualities will inevitably occur and they’re a part of the sport. Then in the long term, the magic occurs when nothing occurs. The outdated set off that causes you to snap occurs after which BOOM… you don’t really feel something.

Do I understand how to do that? To resolve and re-wire? No, not but. I believe beforehand, I had accepted the truth that I’m only a very flawed, tilty and emotional dealer who simply occurs to be ok to energy by it more often than not. I had my little hacks to get it out of my system. I went by remedy periods to scale back the influence of buying and selling tilt on my total well-being in life. However I by no means actually resolved the reason for it. I don’t even know if that’s potential however I believe sooner or later, I gave up on even the concept it might be achieved. I believe that led to a psychological backslide that I name buying and selling nihilism–a way of thinking the place I simply discover myself unable to consider in something apart from make $ = good and lose $ = dangerous. And now I’m the place I’m–I’m in a psychological place the place buying and selling very actively makes me essentially sad. I’ve to query this core perception that “I can’t resolve tilt” and perhaps I can’t resolve it instantly however not less than believing I can and attempting might be half the battle not less than. We’ll see I suppose.

Anyway, we will finish it there. Due to all my readers! Once more, be happy to ship inquiries to churning.burning.weblog@gmail.com and I’ll save them for the following one.