Once in a while, I verify in and show objects which can be circulating in Wall Avenue circles and blogs.

-

Lengthy-term market and financial traits.

-

Extra particulars about what you suppose is undervalued or overvalued.

-

Hyperlinks to nice explainers of ideas.

**All info as of February 15, 2023.

As SPY and QQQ plummet to all-time highs, analysts and commentators are specializing in whether or not the inventory is getting into overvalued bubble territory, continues to be fairly valued, or is it nonetheless on its strongest since October of final 12 months? Regardless of the rally, the query stays whether or not the inventory nonetheless has room to rise as 2024 progresses. .

Like every little thing in life, it is dependent upon your perspective. Let’s dig a bit of deeper.

Truthfully, on an absolute foundation, it is arduous to discover a legitimate argument that the broad inventory index is undervalued in the intervening time. That is partly because of the rise we’ve got already seen, but in addition as a result of the underlying elements of the index are broadly divergent from one another by way of valuation.

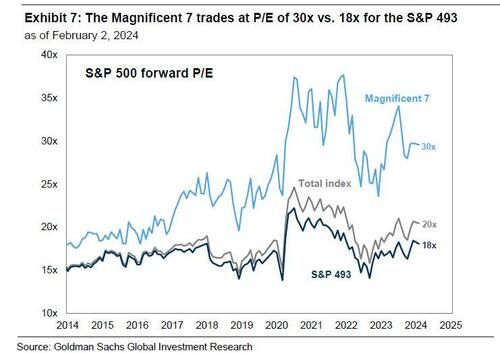

Many analysts now persistently handle the seven Magnificent corporations (MSFT, AMZN, NVDA, META, TSLA, GOOGL, AAPL) as their very own class, and the opposite 493 corporations as their very own class. Masu. That is due to how unrelated these corporations are to one another.

The very best argument I’ve ever heard for getting shares low-cost is definitely basket unfold buying and selling. Purchase a basket of different 493 shares, promote Magnificent 7, after which allow them to play. The intention is to return to a extra fairly balanced ratio between the teams, however the primary danger is that these Magnificent 7 proceed to dominate the market and bully the remainder of the market.

take a look at Traderdads.com — For patches, shirts, buying and selling desk equipment, and extra! New objects drop each month! Please check by clicking here.

The argument that the worth of the inventory is truthful is way more attention-grabbing and debatable. First, the P/E ratio exhibits that the present worth of the S&P 500 is just one customary deviation above its long-term common. Nothing excessive.

Moreover, as we noticed earlier, in case you extract the seven largest tech corporations, the remaining index elements are an affordable 18x.

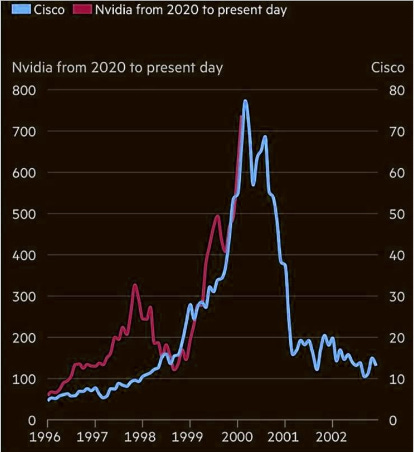

Taking a more in-depth take a look at Magnificent 7, NVDA (now the king of all) really has stable causes behind its rise. You possibly can see that whereas the inventory value has exploded, so have NVDA’s revenues. This means that the fast rise is predicated on precise beneficial properties quite than hypothesis or sentiment. So long as NVDA continues to satisfy expectations, its market cap and trajectory are inside purpose.

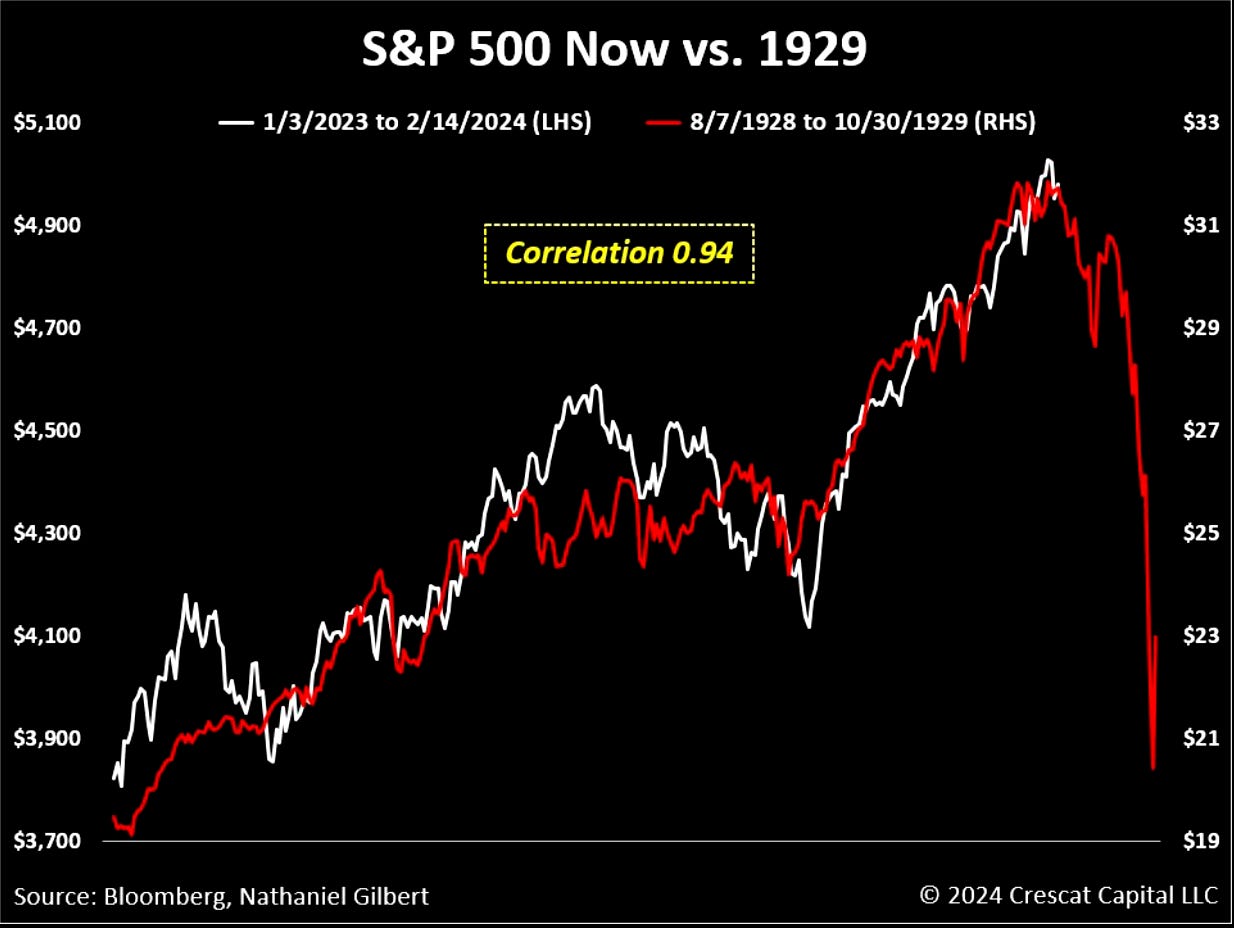

Not like discovering the reason why inventory costs are low, Rooster Little is filled with chart crimes that recommend an impending crash is on the horizon. You may make something comparable by adjusting the axis scale and place to begin of the graph sufficient.

Listed below are two of my favourite criminals. See in case you can guess why the reviews of the market’s demise are so exaggerated.

Total, it looks as if there are few issues which can be low-cost in the intervening time, however the S&P 493 is comparatively low-cost in comparison with the remainder of the Magnificent 7. Nevertheless, simply because one thing is pricey does not imply it is going to keep costly for the foreseeable future.

Fascinated with showing on the Dealer Dads Podcast in 2024? Ship us an e mail!We would like our subscribers to affix the dialogue

What are your ideas? Have a query? Remark?

Attain out!Perhaps I will do a full submit on this matter or submit it as a Q&A

traderdads@substack.com