On occasion, I verify in and show objects which can be circulating in Wall Avenue circles and blogs.

-

Lengthy-term market and financial traits.

-

Further particulars about what you assume is undervalued or overvalued.

-

Hyperlinks to nice explainers of ideas.

**All data as of January 8, 2023.

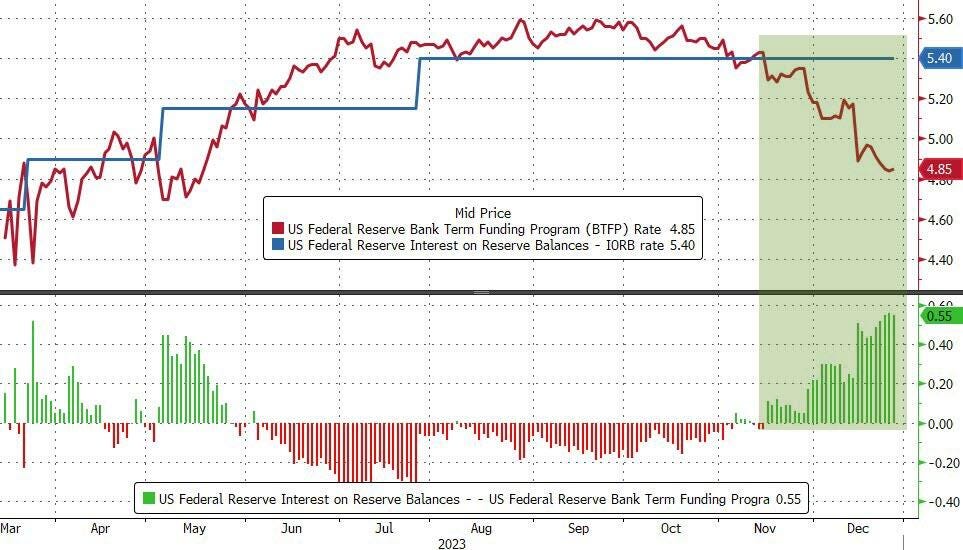

Unusual issues began in November 2023. Cash market merchants and different funding desks have realized that arbitrage exists throughout the Federal Reserve’s numerous applications.

-

The brand new Financial institution Time period Funding Program (BTFP) permits banking establishments to pledge their Treasury securities as collateral at face worth (no haircuts), and the Fed offers money loans for as much as one 12 months at a 4.85% rate of interest. I’ll present a.charge

-

Banking establishments can even deposit money with the Federal Reserve and accumulate 5.40% curiosity. This rate of interest is named the reserve steadiness curiosity. (IORB)

In consequence, Free 0.55% revenue For any establishment succesful and keen to function commerce.

Following the failure of Silicon Valley Financial institution (SVB) in March 2023, the Federal Reserve introduced the creation of a brand new non permanent financial institution. Bank Term Funding Program (BTFP). BTFP provides loans for as much as one 12 months at low rates of interest. floating Fee — OIS swap rate + 10bps —- to banks, financial savings associations, credit score unions, and different eligible depository establishments.

This system was meant to offer money to banks that have been shedding deposits as clients moved the money into high-yield cash market funds. The lover a part of this program comes from the next clause: Debt devices will likely be valued at 100 (par worth), whatever the valuation of the general public debt market.

However, because the Nice Monetary Disaster, banks have been in a position to earn curiosity on their deposits with the Federal Reserve.Costs Repaired and set by the Federal Reserve. It exists to set limits on rates of interest. Even within the worst-case state of affairs, banks can at all times deposit their extra funds with the Fed and accumulate the IORB charge as an alternative of flooding the open market with money to lend out and decreasing rates of interest.

November 2023

As quickly as October’s inflation report recommended that inflation had lastly fallen sufficiently, market expectations shortly adjusted to anticipate a reduce within the federal funds charge. Authorities bond charges and different cash market rates of interest fell quickly, pushing down swap charges on benchmark indexes.Used to seek out variable BTFP charge — You possibly can even fall.

IORB, however, by no means modifications and won’t change till explicitly adjusted by the Federal Reserve. Because of this arbitrage will live on till the Fed lowers the IORB charge or the market pushes again on cash market charges.

However, kudos to the buying and selling desk. Bankers and merchants are totally, legally, and correctly profiting from arbitrage alternatives the way in which they have been taught of their first-year analyst trainee courses. I wish to do the identical if potential.

Jimmy Stewart, however, It is a great life– is not it.

Shifting money round on a steadiness sheet is totally completely different from the spirit of the sport, which is allocating capital for financial productiveness. I additionally nonetheless do not perceive why establishments utilizing one program are allowed to make use of others on the similar time. However we’re right here, so all we will do now’s wait and see the way it ends.

Fascinated with showing on the Dealer Dads Podcast in 2024? Ship us an e-mail!We would like our subscribers to affix the dialogue

What are your ideas? Have a query? Remark?

Attain out!Possibly I will do a full put up on this matter or put up it as a Q&A

traderdads@substack.com