(continued from 10 Merchants You Encounter in Prop)

Might thirtieth 2013. 11:11am japanese time.

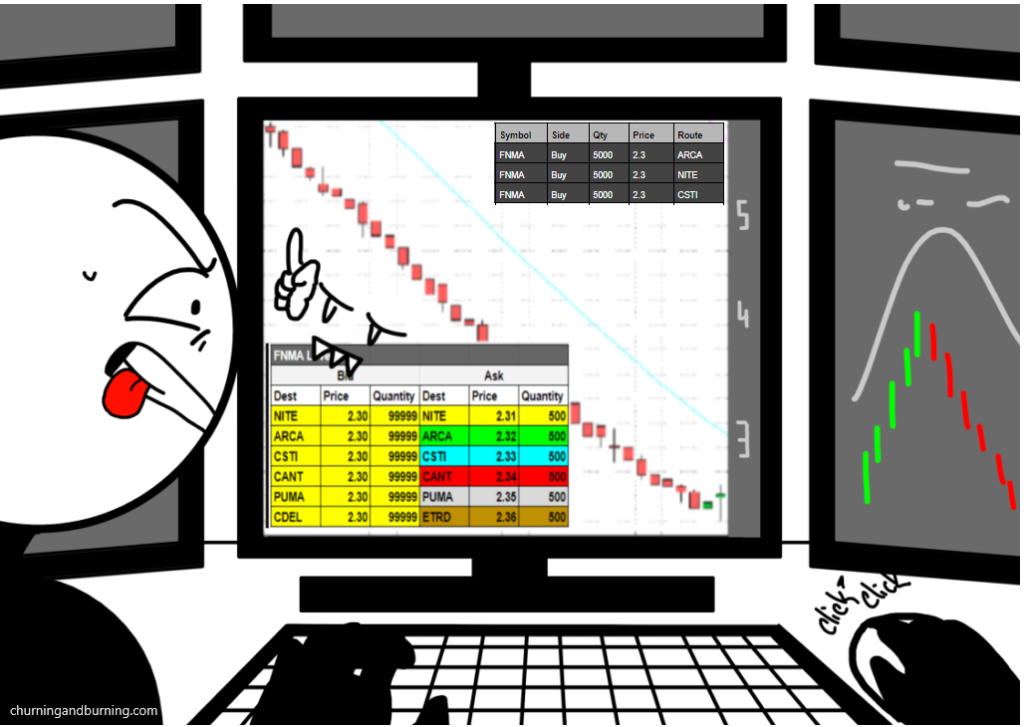

It’s occurring once more. They’re crushing the inventory value on Fannie Mae. Deja-Vu.

My fingers hover over the keyboard. My proper hand fidgets across the arrow keys, tapping the restrict value decrease in sync with the bid dropping. My left hand is able to triple faucet the purchase button for all of the shopping for energy in my account. It’s only a matter of ready for the sign.

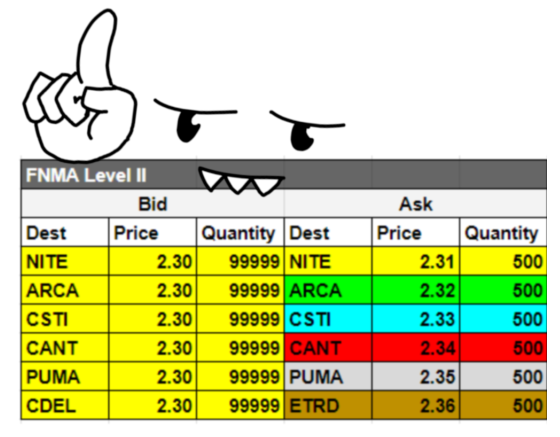

Whole account all-in on the actual backside. 5k to NITE. 5k to CSTI. 5k to ARCA. Don’t fuck it up.

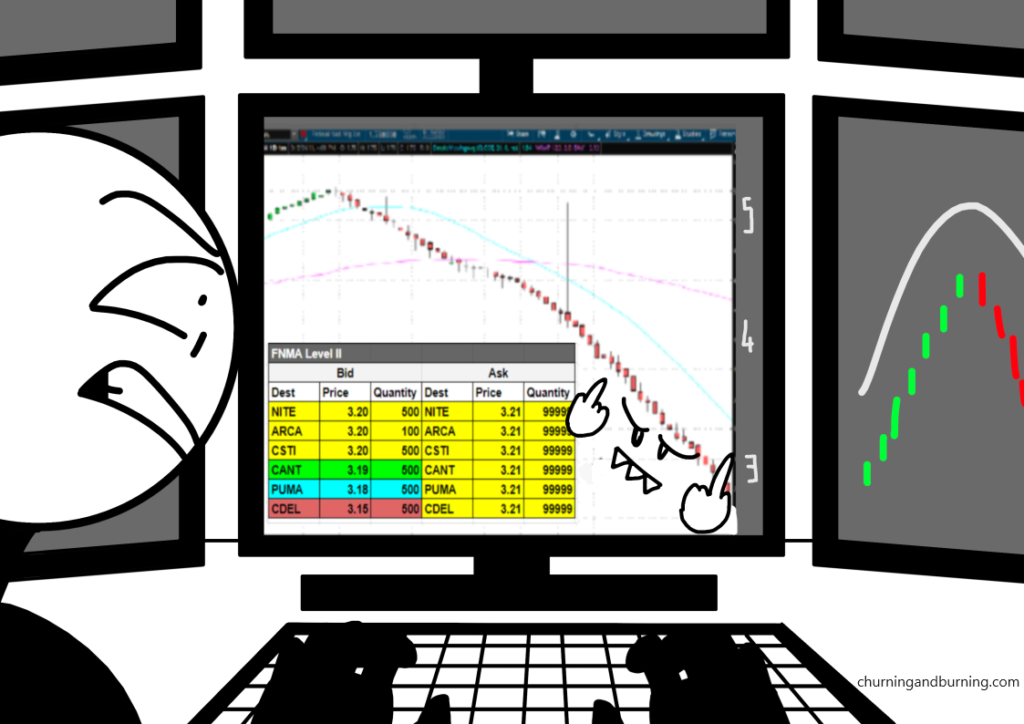

The inventory flushes $3 with out a hitch. The market makers print the minimal tick dimension after which cowardly again away fairly than present any liquidity. It appears like it’ll by no means cease falling however I do know there’s a backside value the place it’ll bounce 100% from the underside tick. It might be $2. It might be $1. It might even be $.01 for all I do know. I don’t wish to assume something and be early. I simply know the customer is there, someplace.

I wait. Fannie retains plummeting.

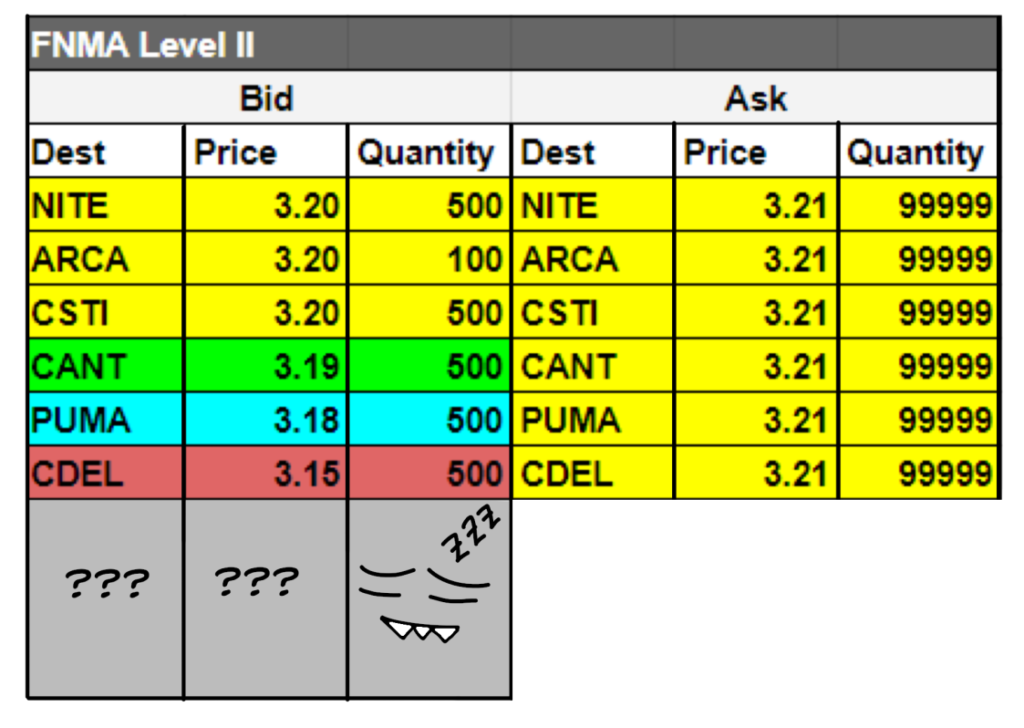

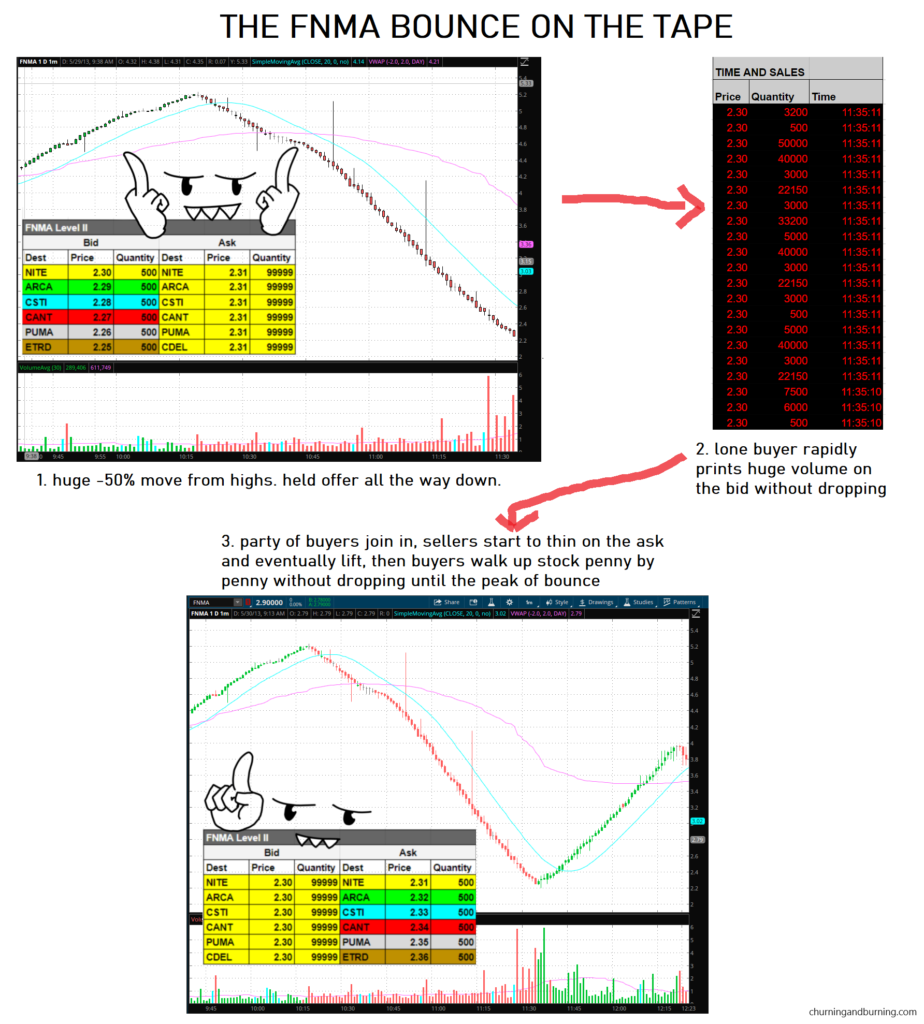

At 11:35, it reaches $2.30. Sellers are nonetheless encroaching. There are market orders ticking by way of the very best bid at 2.25. However the final remaining 2.30 bid on NITE doesn’t drop. There’s a pause.

The bid begins to print rather more quickly. 2.30. 2.30. 2.30.

Thousands and thousands of shares altering fingers at 2.30–the biggest quantity candle of the day. That’s him, that’s our purchaser. He’s awake!

Can’t hesitate. Ship within the purchase orders.

I get stuffed my complete 15000 shares. I exhaust what little I’ve on my retail buying and selling account. My coronary heart’s pumping at 200 mph. I’m residing by way of a life-changing second. Inside seconds, the route of liquidity fully modifications. They’re now quickly printing the ask for the primary time. Then the bid begins to thicken as all of the market makers be part of the highest market and type an enormous wall. On the ask, the final remaining sellers lastly again off. The NITE bid steps as much as 2.31 whereas market orders begin to pile in over the ask.

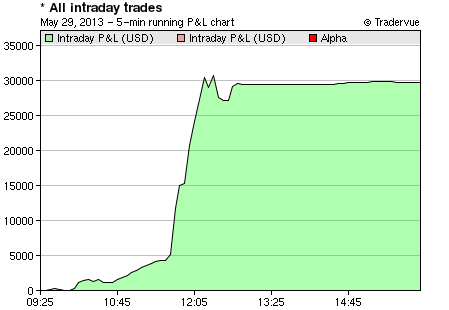

The primary 5-minute inexperienced candle closes at 11:40, preceded by what in actual time had felt like ten thousand crimson candles raining from above. There are actually no sellers in sight and all of the late consumers begin to chase as the worth springs increased. FNMA trades to 2.60 inside 10 minutes. I’ve an unrealized revenue of $4500. There’s no purpose to promote.

In one other 10 minutes, FNMA finds the entire at $3. I’m up $9000, double what I used to be up 10 minutes in the past. 2.30 to $3, that’s a fairly good commerce with no drawdown. There hasn’t been a single downtick or dropped bid for the reason that $2.30 backside. There’s no purpose to promote.

quarter-hour later. 3.60. Near $20,000 unrealized. The consumers are marching up the inventory penny by penny, simply as easily as when it went down. Nonetheless no purpose to promote however my adrenaline is off the charts. I take a couple of breaths and direct my complete focus in the direction of watching the tape for any indicators of momentum slowing down. I’m simply attempting to do the suitable factor and anticipate my promote sign. It’s the identical because the purchase sign besides the inverse. He’ll inform me when he’s performed.

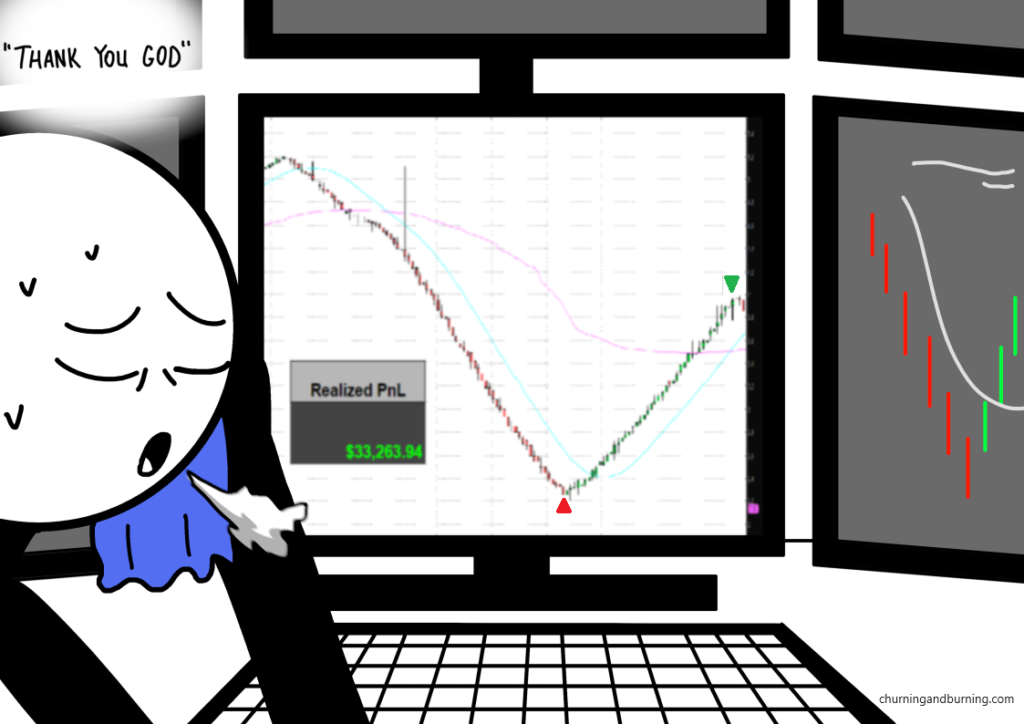

As FNMA trades near $4 once more, our purchaser begins to wobble. The identical fast printing that occured on the two.30 bid is now occuring on the three.95 ask. Sellers are soaking for the primary time for the reason that upswing transfer began and forming a wall. The customer drops. Thanks, whoever you’re. His work is finished and so is my commerce. I promote all of it within the 3.90s. $24,000 acquire. Add it to some scalps made previous to the large transfer and I’m now up over $30,000 on the day, shattering my prior greatest $6000 day on the March FNMA commerce. I simply doubled my retail account in a day. Time to take a deep breath.

All I can really feel is aid as the stress fades. You didn’t fuck it up. You secured the bag.

Me: Hey. Verify this out.

Clockwork: What’s occurring?

Me: I’m up $30,000 buying and selling Fannie Mae.

Clockwork: Holy shit. HOLY SHIT. $30,000?

Tuco, who now sits behind me, picks up on the dialog.

Tuco: Nice job P-To. I noticed twitter chirping FNMA, glad you crushed it.

Phrase begins to unfold that I made $33k in a day. Abruptly I’m the man–the man who confirmed the remainder of the desk that yeah, you’ll be able to really make severe fucking cash on this daytrading racket.

Everybody needed to know the key sauce. How did OTC-Bandit Pete pull it off? As a lot as I needed to prop up this picture of myself as an excellent tremendous dealer who picked the underside by way of sheer guts and instinct, the reality is you possibly can educate a toddler find out how to spot the underside on FNMA. They held the bid at 2.30–it’s that straightforward. It ought to by no means be that simple to purchase the underside tick in a so-called “environment friendly market” however generally the Gods provide you with a present and all you are able to do is graciously settle for it.

The Might twenty ninth, 2013 FNMA & FMCC bounce commerce lives on as a watershed second for a lot of underground small-cap merchants–an enormous bankroll builder for smaller accounts and a profession day for skilled veteran merchants. There was a lot extra liquidity on today relative to the identical transfer in March when FNMA traded within the $1 vary. There’s a very good likelihood that your favourite retail dealer, in the event that they had been buying and selling penny shares in 2013, made an outsized revenue on today. Simply off the highest of my head, I can identify 3 merchants from the ChatWithTraders podcast, not together with myself, who performed it.

Max aka Madaz, CWT episode 124, made $38,000.

Tim Grittani aka Kroyrunner89, CWT episode 10 made over $80,000.

Bao Nguyen aka ModernRock, CWT episode 100: made $1.4 million.

I even discovered an obscure FNMA dealer from Copenhagen, Denmark whereas studying a guide referred to as “Merchants of the New Period”–a dealer named Flemming Kozok. He made $800,000.

Only a guess–I believe there’s most likely 50 different merchants who made 5-6 figures flipping FNMA today. Perhaps a handful made 7. I felt extraordinarily lucky that I used to be capable of commerce this extremely simple, slam-dunk commerce setup. I believe my colleagues knew that they missed a giant second. Any first rate MBC dealer who took the coaching program on tape studying might perceive the setup. Tuco, Eagle, Clockwork, Jimmy–any of them. If I might go all-in and double my account when had I struggled to danger even $1000 on my MBC account, it should have been the best play ever. The opposite merchants, they know Pete isn’t the kind of man who bets massive on a falling knife except he completely is aware of it’ll work. They’d’ve crushed it too, I’ve zero doubt.

So then Victor involves congratulate me on my breakthrough commerce. He tells me he’s all the time believed that I might make this stage of cash. He’s beaming like a proud coach. After which Tuco interjects.

Tuco: Vic, what are we doing not gaining access to OTC shares? P-To only made $33,000 on it in at some point. You and Mr. West have to take a seat down and determine find out how to get us an OTC platform ASAP.

That will be that. MBC Securities was going to commerce OTCBB penny shares for the primary time ever.

Fannie Mae: A Commerce breakdown

The next Friday, Victor assembled a small room of our high junior merchants, those who would first get OTC entry. I’d go over the Fannie Mae commerce and clarify how the OTC market works. A commerce evaluation is meant to have 3 key elements, based on MBC protocol.

- Intraday Fundamentals — the information and story of the inventory

- Technical Evaluation — value motion, quantity, indicators

- Studying the Tape — the extent II and the time & gross sales

The primary two elements aren’t as very important however they supply significant context.

Intraday Fundamentals or ‘The Story’: Again in 2008, the GSEs assured too many poisonous dwelling loans they usually stood precipitously on the sting of insolvency. The federal government needed to take management of them to stabilize the market. FNMA and FMCC had been taken into conservatorship–this meant dividends had been suspended indefinitely and future earnings went straight to the Treasury. FNMA declined right into a 20c penny inventory–mainly chapter ranges. However finally, the financial system improved and earnings rebounded to pre-08 ranges. Because the years glided by, hypothesis fueled within the GSE’s on the premise that conservatorship would finish and the inventory would recapture its personal earnings. In Might 2013, FNMA paid a whopping $59 billion dividend to the U.S. Treasury. Buyers, like hedge fund manager Bruce Berkowitz, argued that sufficient was sufficient. They paid their money owed, why not let the shareholder eat once more?

What information got here out that drove FNMA down a lot that day? Nothing. Completely nothing.

The Chart: There’s no want for any superior chart evaluation. Simply ask your self: are there 30 consecutive crimson candles and an enormous -50% collapse occuring? Sure? Then the bounce play might be on. The explanation you’ll be able to’t commerce the reversal on the chart alone is as a result of it’s a lagging indicator and it’ll have you ever lead-footed in your executions (extra element under).

The Tape: It’s ALL concerning the tape on the FNMA bounce play. I really feel like I’ve to clarify 3 completely different semi-complicated issues right here, so please attempt to stick with me.

OTC-market mechanics:

The very first thing to grasp is that OTC shares commerce completely different than “listed” shares on the NYSE or NASDAQ. The listed market is run on ECNs–you level and click on on the liquidity you see and it’ll fill immediately. The OTC is market maker pushed. There may be one ECN (ARCAEDGE) however most quotes are posted and stuffed by market makers like Knight, Citadel, E-Commerce, and smaller broker-dealers. There’s no NYSE matchmaking or NASDAQ Tremendous Montage to facilitate superior value execution. There aren’t any darkish swimming pools or HFT. You simply commerce instantly with the market maker. Liquidity is opaque as market makers will usually solely show the minimal tick dimension. Executions have a lag time–you hit a market maker’s open order he may fill you or he may not. There’s no obligation to honor a quote. Quotes are sometimes late to replace–you’ll suppose you hit an order however somebody already took it 10 seconds in the past. Orders will get held up throughout volatility and they don’t seem to be assured to be stuffed–feel-based timing and execution are very important. Ready too lengthy for value affirmation may go away you unable to get stuffed till a lot later. Whereas your orders are held, you’ll be able to attempt to cancel them however there is no such thing as a assure of that both. It’s very simple to get caught in a big place with no method out apart from to soak up monster slippage. The OTC is an archaic market nonetheless caught in 1991 and it sounds horrible however all these inefficiencies really contribute to why tape studying and correct execution is a such enormous edge. You get to commerce towards shitty infrastructure and gradual, unsavvy traders.

Catching a Falling Knife

The FNMA commerce, broadly talking, falls into the class of Catching Falling Knives–that’s, attempting to purchase shares that drop 30% or extra in a single day. It isn’t simple and normally reserved for superior and deep-pocketed merchants. Most shares are normally down that a lot for a very good purpose. I’ve seen two approaches a dealer can take: 1) The Take Ache strategy and a couple of) The Papercut strategy.

The Take-Ache strategy is that this: you purchase whenever you suppose it’s “down an excessive amount of” and also you simply maintain it. And if it doesn’t work out… you lose so much. Consider Mr. West’s VRX commerce within the final chapter. The take-pain technique is unpalatable for quad-3 merchants like myself, it requires an incredible quantity of ache tolerance and conviction.

Then there’s the Papercut strategy, the place you utilize “value motion” as a framework to measure a backside after which use affordable cease. There’s much less danger to this strategy however you may miss out on the commerce for those who’re too delicate and wonderful concerning the entry. It’s additionally simple to get shaken out and nicely, take quite a lot of papercuts losses. You’ll by no means purchase the useless low with out 5-6 tries first. Some monster bounces can happen with out an apparent intraday exhaustion sample, like by way of intraday halts or in a single day gaps.

Then there’s FNMA commerce. You generally is a whole donkey and simply purchase the useless backside on one attempt. It’s an anomaly, a unicorn. It’s the one commerce setup that even a piker like me might really feel assured sufficient to dimension in on.

MBC Securities Tape Studying Program:

It’s humorous. For the reason that finish of 2009, MBC went by way of all this inside hand wringing over how HFT has destroyed scalping and tape studying as an edge. Merchants would undergo the coaching, search for tape performs on the demo, after which after they go dwell, you hear the excited HELD BID at $33.10 on ___! HELD OFFER at $25 on ____! on day 1. Then they slowly study it’s not what it’s cracked as much as be.

Let’s outline a held bid for many who don’t know: It’s when a purchaser holds the precise value on the bid for an uncommon quantity of quantity. Instance, there’s 5000 shares purchased at different ranges however at $10, a purchaser is absorbing for 80,000 shares with out dropping. It represents demand at a value. The inverse idea is the held supply (ask), which is similar factor however somebody promoting the inventory.

95% of all held bids we noticed would simply finally drop and cease out anybody attempting to play a decent cease towards it. It’s simply noise and it could don’t have any impression on the place the inventory would finally go by the closing bell. Perhaps it was extra significant 5 years in the past however not after the rise of HFT available in the market. The algo’s bought too good at posting held bids, shaking out frontrunners with tight stops, after which ripping increased on low liquidity. Tuco would rhetorically ask why are we even buying and selling like this nonetheless? We must always revamp this system.

Then comes this inventory FNMA, which nobody at MBC may even commerce but, and it’s the useless excellent inventory for a skilled tape reader. The sample is so easy.

It began to daybreak on me that I used to be grossly underutilitzing this enormous edge. I’m solely buying and selling this one setup, the large bounce play, with dimension. I might be utilizing this complete idea as a extra expansive strategic basis. Why am I not crushing the brief facet, which is simply as clear? Why am I not scalping the smaller turning factors that swing off of held bids/affords? Why am I not taking part in the pullback performs and the opening drive performs? Why don’t I attempt to search for tape edges on different in-play OTC names? It’s the right type for a dealer like me who can’t tolerate extreme drawdown. I dropped every thing I used to be engaged on–attempting to determine imbalances, attempting to backtest for automated methods, attempting to commerce help and resistance on massive cap shares, that’s all on the backburner now. Now I’ve to be the Penny Inventory Dealer. I’ve to discover a method to return to the nicely.

(to be continued in Persistently Worthwhile Dealer)