If you wish to create an automatic buying and selling technique with Bollinger Bands, however do not know methods to code, then this tutorial will prevent a ton of time since you will not need to study a sophisticated and complicated programming language.

Watch the video above to see your complete course of in motion.

That is the simplest manner construct an automatic buying and selling technique that I’ve seen in my 15+ years of operating this web site.

Upon getting the fundamental framework setup, you are free to check completely different indicator setting, entry and exit concepts, very simply.

The textual content model is supplied beneath in case you’re at work and you don’t need your boss to listen to that you just’re doing buying and selling stuff 😉

What are Bollinger Bands?

The Bollinger Band is a technical buying and selling indicator invented by John Bollinger within the Nineties.

It consists of a shifting common, mixed with 2 complimentary traces, that are every sometimes 2 customary deviations above and beneath shifting common.

That is what it appears to be like like on a chart.

The setting of two customary deviations could be modified, as can the lookback interval of the shifting common.

A regular deviation is statistical measurement that exhibits how far a worth has moved away from the imply.

Subsequently, the Bollinger Band is usually used as a method to present an space of the chart that worth prone to keep inside. In different phrases, it is a regression to the imply indicator.

Since worth motion is probably going to stick with within the higher and decrease bands, there are a number of completely different buying and selling methods that may be created utilizing these reference factors.

This indicator is on the market on virtually all buying and selling and charting platforms.

How the Bollinger Band could be Utilized in a Buying and selling Technique

Like with some other indicator, there are a number of ways in which Bollinger Bands can be utilized to create a buying and selling technique.

I am going to provide you with a technique that it may be used, however after you learn this tutorial, you will have the information to invent your individual methods.

Begin testing your individual concepts since you by no means know…you would possibly simply provide you with a brand new worthwhile method to commerce with the Bollinger Band.

One of the crucial frequent ways in which the Bollinger Band is used to take a commerce is to purchase when worth touches the decrease band, and promote when worth touches the higher band.

Now there a number of alternative ways to deal with the exit. However one method to exit is to focus on the central shifting common.

This is what that appears like on a chart.

Now that you understand the final thought of the technique I will be exhibiting you, let’s take a fast take a look at why you would possibly wish to create an automatic technique with this indicator.

Why Automated Buying and selling Methods Rock

At this level, you’ll be able to most likely see that there are many completely different settings and guidelines that can be utilized to create a buying and selling technique with Bollinger Bands.

If you happen to needed to take a look at all of those concepts manually, it might take a looong ass time.

That is the place automation can velocity up the method…dramatically.

As an alternative of taking days to check one thought, an automatic backtest can provide you a end in only a few minutes.

Even in case you do not construct a completely automated buying and selling technique, partial automation may also help you rapidly take a look at completely different entry, exit and commerce administration concepts.

Now that you just perceive the fantastic thing about automation, this is methods to setup your first automated Bollinger Band backtest.

The Technique

The wonderful thing about constructing a buying and selling technique round Bollinger Bands is that there are well-defined methods to enter and exit trades.

I’ll be utilizing NakedMarkets to backtest this technique. It’s the best and quickest manner that I’ve discovered to backtest.

I prefer it higher than Foreign exchange Tester.

To enhance my odds of success, I feel that will probably be a good suggestion to enter a brief commerce when worth closes above the higher band, or a protracted commerce when worth closes beneath the decrease band.

Is that one of the best ways to do it? I do not know, however you will discover out with me.

That is why we backtest.

So this is my buying and selling technique:

- Go brief when worth closes above the higher Band and shut the commerce when worth closes beneath the middle shifting common.

- Go lengthy when worth closes beneath the decrease Band and shut the commerce when worth closes above the middle shifting common.

In concept, solely buying and selling a detailed above or beneath the outer bands ought to give me a greater entry and extra of an opportunity that worth will reject that stage.

However I might be unsuitable about that in order that’s why I would like to check the thought.

Begin with my instance, then take a look at your individual concepts.

Step 1: Create the Core Guidelines

Since there can be completely different guidelines for longs and shorts, I am going to need to create 2 completely different units of guidelines.

The very first thing I’ll do is open Rule Supervisor in NakedMarkets.

Then I’ll create a brand new Rule by clicking the New Rule button within the decrease left nook of the display screen. This additionally the place the Save Rule button is, you will want that later.

Now I am prompted to create a brand new Rule. On this case, I’ll create a Core Rule.

Everytime you create a brand new Rule, it’s best to at all times title it on this format:

[Trading System Name] [Rule Type] [Long or Short]

- Itemizing the buying and selling system title first will group the entire Guidelines for a similar system collectively.

- Since you can’t have Guidelines with the identical title, together with the Rule sort will stop that from taking place.

- Lastly, you wish to have lengthy/brief on the finish so it is easy to alter after you clone a Rule. Extra on that in a minute.

So for this backtest, I’ll title my first Core Rule: BB Stretch Core Lengthy.

This Rule will search for the case the place worth closes beneath the decrease Band.

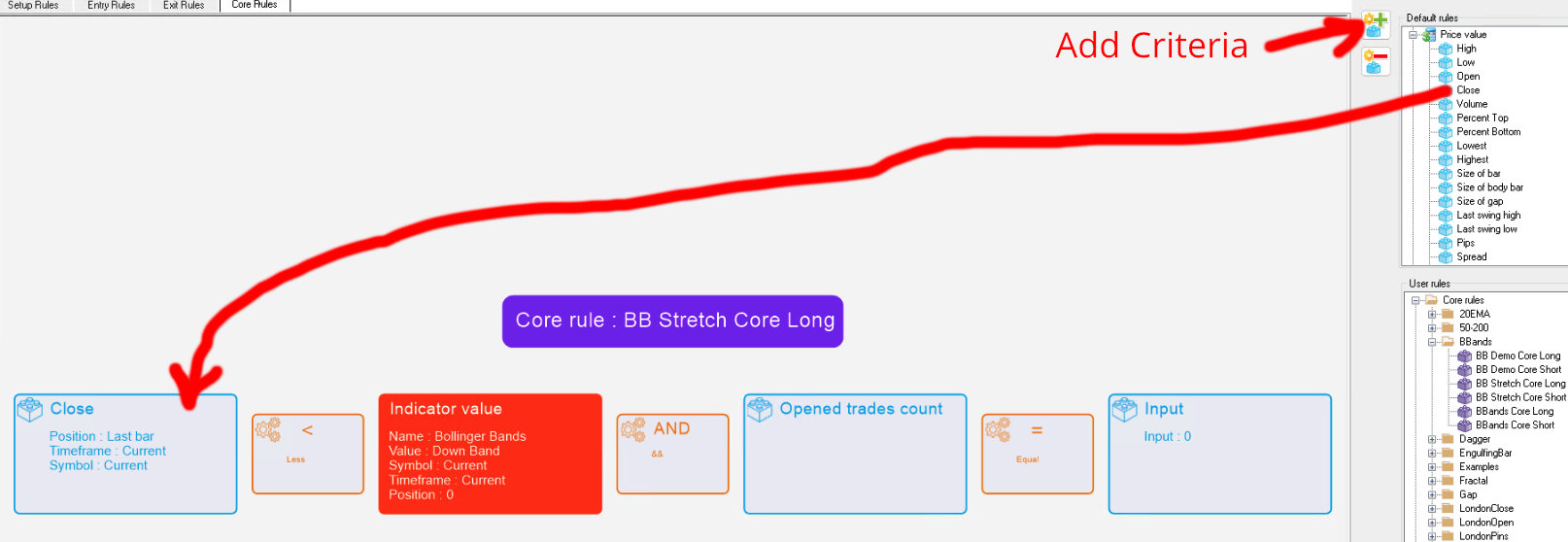

This is what this Core Rule appears to be like like.

On this Core Rule, I am on the lookout for worth to shut beneath the decrease Bollinger Band and I solely wish to take one commerce at a time. This may stop overloading on trades when there are a number of indicators in a row.

To arrange the above, do the next:

- Click on the Add Standards (+) button twice so as to add 2 extra standards. It is best to now have 4 major packing containers and three operator packing containers. Click on the Take away Standards (-) button to take away standards.

- Within the first field, click on and drag Worth Worth > Shut into the field.

- Subsequent, drag Operators > Much less Than into the field.

- Then drag Indicators > Bollinger Bands into the third field. Maintain the entire default settings, however choose Down Band beneath Chosen Worth.

- Drag Operators > And into the 4th field.

- Nearly accomplished…then drag Account Data > Open Trades Depend into field quantity 5.

- Drag Operators > Equal into the sixth field.

- Drag Worth Worth > Enter into the final field. Set the quantity to zero.

- Lastly, click on the Save button within the decrease left nook of the window.

Subsequent, duplicate the Rule to create the brief Rule. Proper-click on the Rule and choose Clone Rule.

This makes it very easy to create a Rule for the alternative facet of the commerce.

Then right-click the brand new Rule and choose Rename Rule.

Rename the rule to BB Stretch Core Quick.

Double click on on the brand new Rule to edit it.

Change the settings to the next:

- Change the primary operator to Better Than.

- Double click on the Indicator Worth and alter the Down Band to Up Band beneath Chosen Worth.

- Click on the Save button within the decrease left nook of the window.

This is what it would appear like.

That is it.

Now you may have 2 Guidelines that may verify for the entry standards.

Let’s transfer on to the Exit Guidelines.

Step 2: Outline Exit Guidelines

Subsequent, it’s important to outline how the technique will exit trades.

On this instance, I’ll shut a commerce when it closes on the alternative facet of the central shifting common.

My preliminary reasoning for doing that is that I really feel that worth may be very prone to cross the shifting common simply and thus shut at a fast revenue.

Exiting the commerce on a detailed would additionally theoretically present extra revenue in comparison with exiting the commerce on a contact of the shifting common.

Once more, you’ll be able to simply change this exit to check out completely different concepts that you’ve.

So comply with the directions above to create a brand new Rule, however this time create an Exit Rule.

This is what the Rule appears to be like like.

Title it: BB Stretch Exit Lengthy.

To create this Rule do the next:

- Add a standards within the Exit Situation part by clicking the Add Standards (+) button within the higher proper nook of the display screen.

- Within the first field, click on and drag Worth Worth > Shut into the field.

- Subsequent, drag Operators > Better Than into the second field.

- Then drag Indicators > Bollinger Bands into the third field. Maintain the entire default settings, however choose MA beneath Chosen Worth. Ensure that the remainder of your Bollinger Band settings are the identical throughout all of your Guidelines.

- Beneath Actions, drop Actions > Shut Order within the field.

Then clone the Rule and rename it to: BB Stretch Exit Quick.

The one factor it’s important to change within the cloned Rule is Better Than to Much less Than.

Step 3: Create the Entry Guidelines

Alright, now you are going to create an Entry Rule that may make the most of the Exit Rule you simply created.

Make a brand new Entry Rule and title it: BB Stretch Entry Lengthy.

This is the way you set this up:

- Within the prime field, double click on the field and alter the order sort to Prompt Purchase.

- Within the left field, drag and drop Worth Worth > Final Swing Low into the field.

- Change the Lot Dimension to 1 static lot. It’s also possible to select to make use of a p.c danger lot sizing.

- Drag and drop the BB Stretch Exit Lengthy Rule into the Exit Rule field.

- Click on the Save button.

Then clone and rename this Rule to create the brief.

Simply change the next:

- Order sort Promote.

- Cease loss to Worth Worth > Final Swing Excessive.

- Exit Rule to BB Stretch Exit Quick.

- Click on the Save button and also you’re accomplished!

Step 4: Create the Setup Guidelines

Now I am going tie the entire Guidelines collectively by placing them right into a Setup Rule.

That is the Rule that I’ll add to the chart. It’s going to verify the chart on each candle and see if the factors for the Entry and Exit Guidelines are met and execute trades accordingly.

Create a brand new Setup Rule and title it: BB Stretch Setup Lengthy.

Then add the next:

- BB Stretch Core Lengthy Rule within the prime field.

- BB Stretch Entry Lengthy Rule within the backside field.

Click on Save on this Rule.

Then clone and rename the Rule and add the suitable brief Guidelines.

Step 5: Check Your Rule

Now you are able to see this all in motion!

Open a brand new backtest and drag and drop each the Lengthy and Quick Setup Guidelines onto the chart.

After you are accomplished, you will see the connected Guidelines are within the higher left nook of the chart.

The clicking Play in your chart and the backtest will transfer ahead and execute trades.

Test Your Stats

On the finish of a backtest, save the backtest by going to File > Save Backtest.

Then go to Statistics > Stat Heart within the menu.

In Stat Heart, go to: Supply > Import From Backtest.

Open the backtest file you simply saved and you’ll see a whole evaluation of your backtesting session.

The outcomes of this take a look at on the Weekly chart was first rate, nevertheless it must be examined on extra markets and timeframes.

Even in case you get a damaging end result, do not stop simply but. The technique would possibly work significantly better in one other market or timeframe.

Additionally strive new indicator settings, exits and entries to optimize the buying and selling technique.

Velocity Up Testing by Utilizing Quick Backtest

As soon as your Guidelines are working as you anticipated, you’ll be able to hit the “turbo enhance button” by utilizing Quick Backtest.

It is a absolutely automated course of that runs with no chart show.

Go to Instruments > Quick Backtest within the menu.

On the primary display screen, verify the markets that you just wish to backtest and hit the Subsequent button.

If you have not downloaded historic knowledge for all of the markets, be sure you exit Quick Backtest and obtain the info in Instruments > Information Heart.

Choose the timeframe(s) that you just wish to take a look at and click on the Subsequent button.

In order for you do a really fast take a look at for the primary time, choose the Weekly (W1) timeframe.

Then choose the two Setup Guidelines you created for this tutorial and click on Subsequent.

The ultimate display screen will present you which of them markets, timeframes and Setup Guidelines can be examined.

Click on the Launch button to begin the backtest.

As soon as the backtest finishes, you will see the fundamental stats on this display screen.

To see detailed statistics in your backtest, click on the [Load Stat] hyperlink.

Quick Backtest will permit you to backtest a number of markets and timeframes on the identical time.

Setup the backtest then go get some dinner.

Whenever you get again, it ought to be completed.

Troubleshooting

There could be occasions while you make a mistake when establishing your Guidelines, particularly while you clone Guidelines.

I’ve accomplished it many occasions and it is nothing to fret about.

The best method to troubleshoot your Guidelines is to check them individually.

You are able to do this by creating a brand new Setup Rule.

Then drag and drop the Rule you wish to take a look at into the factors field. It would not need to be a Core Rule, it may be an Exit Rule or Setup Rule additionally.

Set the Motion to Actions > Pause Backtest.

Save the Rule, then drag it onto your chart earlier than your backtest.

Hit the Play button and the chart will pause each time the factors is met in your chart.

This may permit you to see what every particular person Rule is doing and diagnose errors.

When you see what the problem is, return into Rule Supervisor and alter the settings.

Conclusion

Now you understand how to create a completely automated Bollinger Bands buying and selling technique that you need to use to check completely different concepts and settings.

It does take a little bit of time to setup the Guidelines.

However after getting them setup, you’ll be able to take a look at completely different concepts in a short time, so it is effectively well worth the time to create them.

I am positive you will agree that is a lot quicker than studying a programming language.

It is a instrument that I want was accessible after I first began again in 2007.

If you wish to get a reduction on NakedMarkets, go right here.