Every so often, I examine in and show gadgets which can be circulating in Wall Road circles and blogs.

-

Lengthy-term market and financial tendencies.

-

Further particulars about what you assume is undervalued or overvalued.

-

Hyperlinks to nice explainers of ideas.

**All info as of March 8, 2023.

I despatched it out Ideas in the marketplace #012 On January 16, we pointed to a wierd arbitrage alternative for banks that emerged in November 2023.

Rate of interest arbitrage – Eager about the market #012

Nicely, somebody on the Federal Reserve has to subscribe (they do not, you are most likely studying the identical editorial as me). As a result of only a few days later, change of judgment It was introduced that the Fed would get rid of this arbitrage by forcefully decreasing the lending and borrowing charges supplied. do not need cross one another.

The humorous factor is, when you give it slightly time, the system will work more often than not.

It additionally predicted that the Financial institution Time period Funding Program (BTFP) would halt new lending to banks, and formally ended on March 11 as scheduled.

anyway –

Gold and Bitcoin have been on a wild rise for the reason that starting of the 12 months. The flip aspect is that it’s truly only a resumption of a long-term bullish development for each.

So the plain query is why?

Some articles and specialists declare that the current rise in gold and Bitcoin is because of a return to inflation in the USA. Some level to imminent technical occasions for Bitcoin ( next half-life) However I do not actually purchase both trigger.

Beneath are all of the gold mined in historical past stacked into 400 ounces. Place the bar relative to different objects to regulate the size. The 166,500 tones are divided into 4 classes: Jewellery (50.5% of all gold), Non-public Funding (18.7%), World Authorities (17.4%), and Business (13.4%). All of the gold on the planet might slot in one home.

I feel gold and Bitcoin are rising for the next causes different Nations concern that their currencies will quickly depreciate in worth. Demand for gold will come from international locations akin to Russia, which must pay for the battle in Ukraine, and China, which is attempting to stability a powerful foreign money with actual property in opposition to an financial downturn and the necessity to get rid of giant money owed. Appears to be like prefer it’s coming.

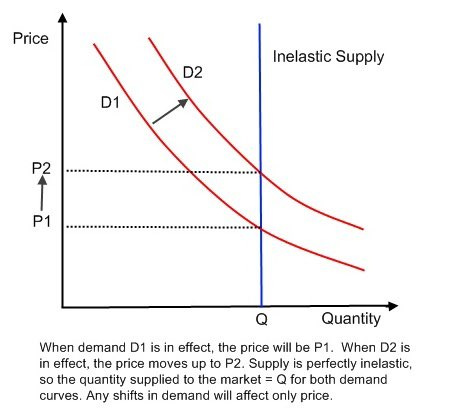

The entire mechanism by which international locations purchase gold and Bitcoin is to maintain the relative power of their currencies aggressive. Gold and Bitcoin each have finite provides, so the worth of every will increase as cash and credit score develop. The quantity of gold on the planet is fastened, however extra (international) money is required to purchase a few of it, inflicting the worth to rise.

Gold and Bitcoin could proceed to rise within the coming months, however I favor to proceed to deal with international purchases and coverage selections moderately than any actions the Fed takes relating to worth components.

Involved in showing on the Dealer Dads Podcast in 2024? Ship us an e-mail!We wish our subscribers to affix the dialogue

What are your ideas? Have a query? Remark?

Attain out!Possibly I am going to do a full publish on this subject or publish it as a Q&A

traderdads@substack.com