Candlestick patterns are among the many most mentioned matters in buying and selling circles…

…however why?

Nicely, as a result of they’re the important thing to understanding what story the market is attempting to inform you!

Do you want there was a candlestick sample that might provide perception into market reversals?

Or one that might point out when bears have gained management over bulls?

If the reply is sure – at the moment is your fortunate day!

It’s precisely what the Darkish Cloud Cowl Candlestick Sample might help you with.

On this article, you’ll:

- Uncover what the Darkish Cloud Cowl Candlestick Sample is and the completely different styles and sizes it may take.

- Discover the markets the place the Darkish Cloud Cowl Candlestick Sample may be discovered and learn to commerce it in numerous market situations.

- Study diffrerent startegies for actively buying and selling the markets with real-life examples.

- Perceive the constraints of the Darkish Cloud Cowl Candlestick Sample and conditions the place it’s finest to keep away from buying and selling it

Sound good?

Let’s dive in!

What’s the Darkish Cloud Cowl Candlestick Sample?

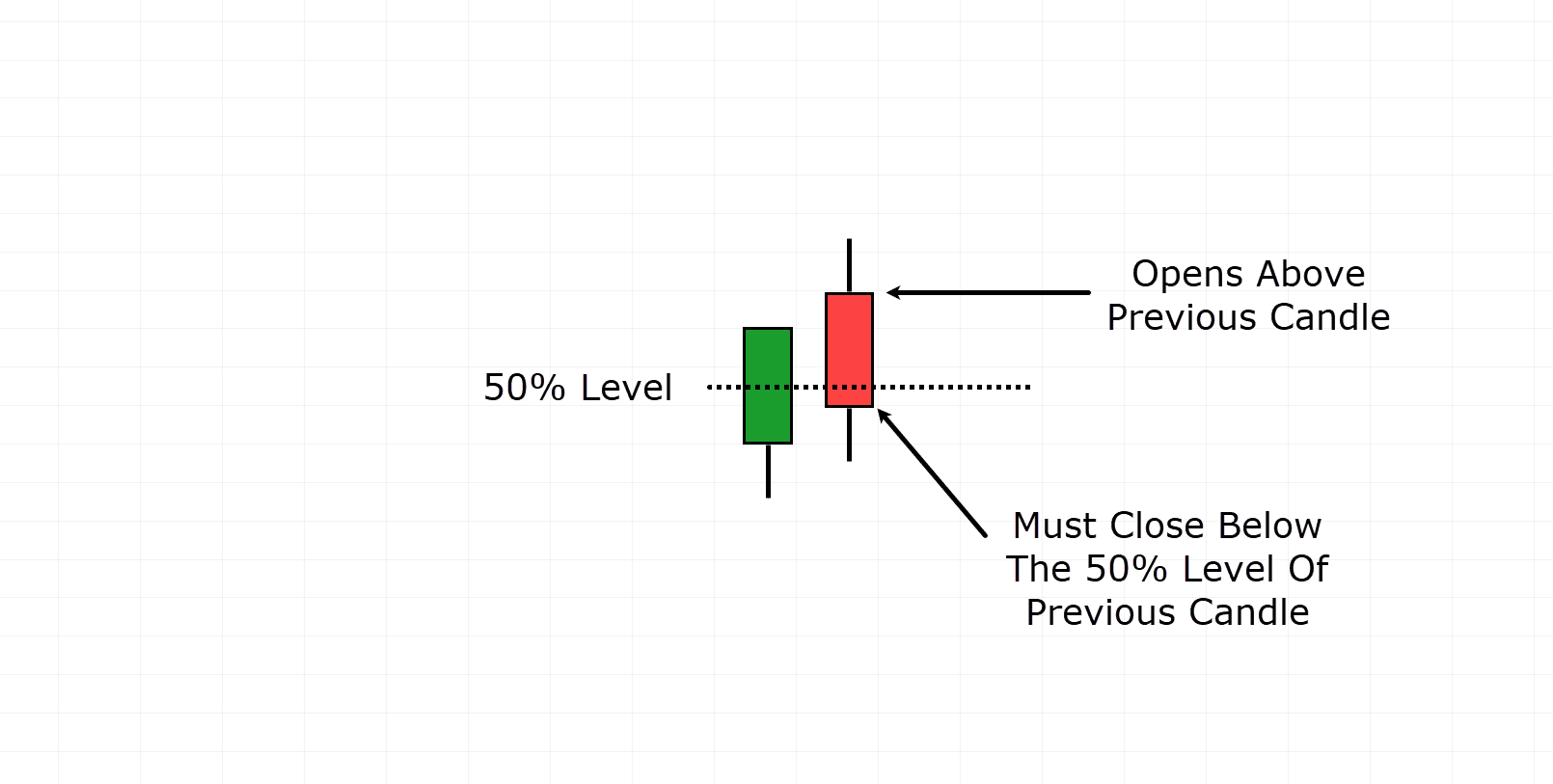

The darkish cloud cowl candlestick sample entails simply two candles and acts as the alternative of the piercing sample.

So, whereas the primary candle is bullish and might take numerous styles and sizes…

…it’s the second candle that issues most!

It wants the value to open greater than the day past’s shut after which drop greater than midway down the earlier candle.

Whereas this would possibly sound a bit tough, examples might help clear issues up.

Let’s take a look at just a few to make issues simpler to grasp…

Darkish Cloud Cowl Candlestick Sample Diagram:

On this instance, the value initially rises with bullish momentum, adopted by the subsequent candle gapping up.

Nevertheless, inside the identical candle, the value should then fall and shut beneath the 50% degree of the earlier candle.

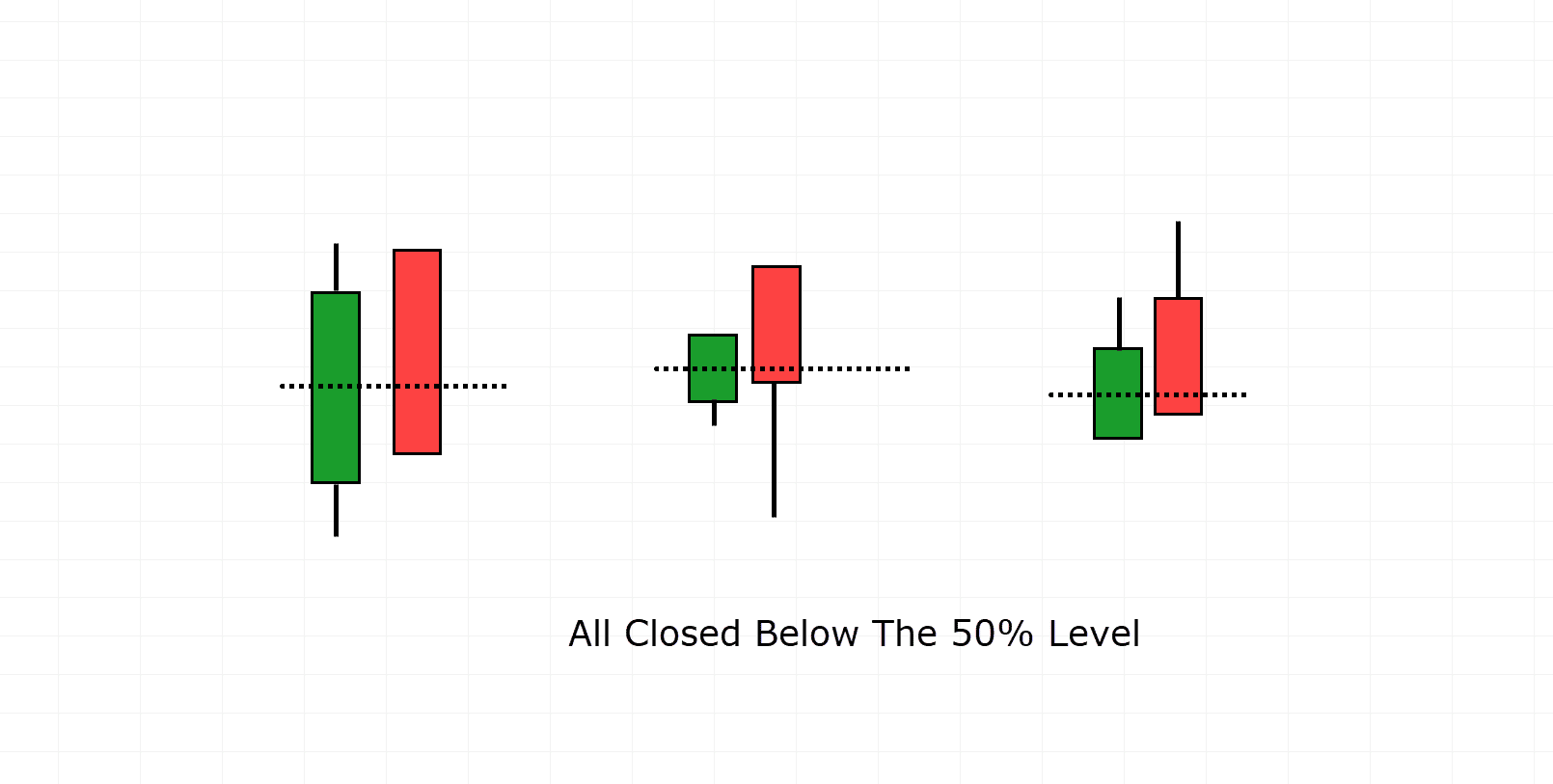

To point out the varied eventualities the place this would possibly occur, check out this diagram…

Darkish Cloud Cowl Candlestick Sample Examples:

The significance of this candlestick sample lies in how the market reacts to it.

Contemplate this: the primary candle indicators bullish energy, setting a constructive tone for the subsequent day.

The bullish momentum is so robust that the value opens greater than the earlier shut, making a worth hole—a transparent indicator of bullish dominance!

Nevertheless, as time progresses, the value progressively falls beneath the 50% degree of the bullish candle and closes…

This shift demonstrates that regardless of the preliminary bullish momentum, the bears managed to overpower the bulls, negating the day past’s positive aspects, even with the added increase from the hole up.

At this level, any bullish traders might begin to query their positions, as momentum swings again in favor of the bears…

…effectively, I do know I’d!

Nevertheless, it’s additionally price noting that the upper the value gaps up after which returns beneath the 50% degree, the stronger the sign turns into.

Consider it as the value having further bullish momentum that will get worn out inside the identical session, successfully swinging the momentum in favor of the bears!

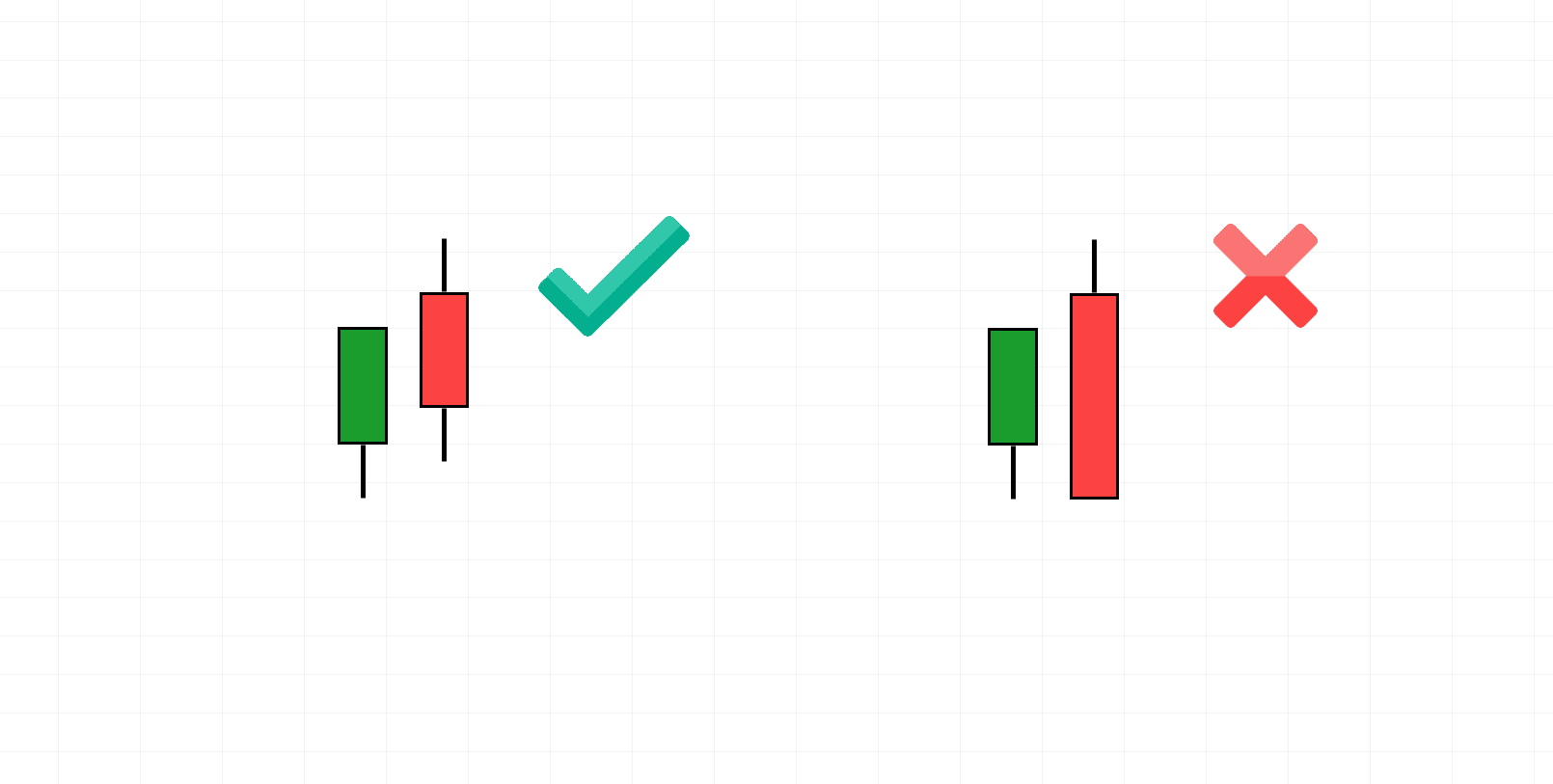

Distinguishing Between Engulfing and Darkish Cloud Cowl Patterns

It’s necessary to grasp that if the second candle fully engulfs everything of the previous bullish candle, it’s not a darkish cloud cowl sample however quite a bearish engulfing sample.

Take a look at these examples…

Darkish Cloud Cowl Vs Bearish Engulfing:

On the left aspect is an illustration of the Darkish Cloud Cowl candlestick sample, whereas on the correct aspect, you may see the bearish engulfing sample.

The bearish engulfing sample represents a stronger bearish sign, however in contrast to the Darkish Cloud Cowl sample, it doesn’t require a gap-up and follows its personal algorithm and techniques.

What markets can the darkish cloud cowl be utilized in?

The darkish cloud cowl candlestick sample can be utilized throughout all markets, however it’s most steadily seen in shares.

The reason being that shares are inclined to exhibit extra worth gaps from at some point to the subsequent – as a consequence of their each day open and shut.

In distinction, foreign exchange markets usually expertise gaps solely on very low timeframes or over weekends.

Personally, I usually use the Darkish Cloud Cowl sample in shares, because it happens extra steadily on this market – so there’s much less looking out to do.

Ranging Markets

Usually, the Darkish cloud cowl candlestick sample is related to pattern reversal, and though true, I prefer to view the sample as an indication of rejection.

It may be utilized to all market situations, together with trending and ranging eventualities.

For instance, when the value revisits a spread excessive, discovering a Darkish Cloud Cowl sample is usually a worthwhile indicator of potential worth motion.

This means that, regardless of bullish momentum, worth failed to interrupt above the vary excessive.

On condition that the vary excessive space represents an space of worth and the Darkish Cloud Cowl sample emerges, it’s affordable to imagine that worth would possibly expertise a quick retracement, presenting a beneficial buying and selling alternative…

…and that’s what we’re on the lookout for, proper?

Trending markets

In trending markets, the darkish cloud cowl sample affords numerous buying and selling alternatives.

The obvious can be its position as a reversal sample at excessive highs.

This typically occurs when worth encounters a big resistance degree on a excessive timeframe, following a protracted uptrend.

Much like the ranging instance, if worth demonstrates rejection at a serious resistance degree, it’s affordable to imagine some promoting stress goes to return with it.

One other state of affairs in trending markets occurs when worth is already in a big downtrend and experiences a quick pullback.

Using the darkish cloud cowl sample right here might help you time your entry to seize a commerce alternative that may have been missed earlier.

As well as, the darkish cloud cowl sample may even be utilized in counter-trend trades.

Whereas this method does take apply, it may nonetheless be helpful for locating minor reversals inside developments, serving to you time your exits or begin quick positions in sure property.

Information on easy methods to commerce the sample

Alright then! So how do you truly commerce this sample?

Nicely, there are just a few necessary issues to consider earlier than you start.

Firstly, you should at all times commerce the darkish cloud cowl sample within the context of the general market.

You shouldn’t blindly take each darkish cloud cowl sample with out a robust understanding of what the market is doing and its total place within the greater image, that’s for positive!

As a substitute, it is best to ask your self:

- Is worth approaching a resistance degree?

- Is it trending and reaching a serious space of worth?

- Is there a pullback in a downtrend?

All of those questions needs to be considered when deciding easy methods to use the darkish cloud cowl sample in your buying and selling technique.

Understanding the market context helps you make extra knowledgeable selections and will increase the prospect you’ll make a profitable commerce.

Utilizing different Technicals

As at all times, the darkish cloud cowl candlestick sample shouldn’t be utilized in isolation; it should be mixed with different triggers and technical evaluation instruments.

This might embody a transferring common crossover or figuring out a key resistance degree.

For example, you would possibly observe a darkish cloud cowl sample at a Fibonacci retracement degree.

Whatever the particular technical indicator or set off you employ, it’s very important to not rely solely on the sample in isolation!

By utilizing it with different technical evaluation instruments, you achieve a significantly better overview of what the market is doing, making your buying and selling selections more practical.

Affirmation

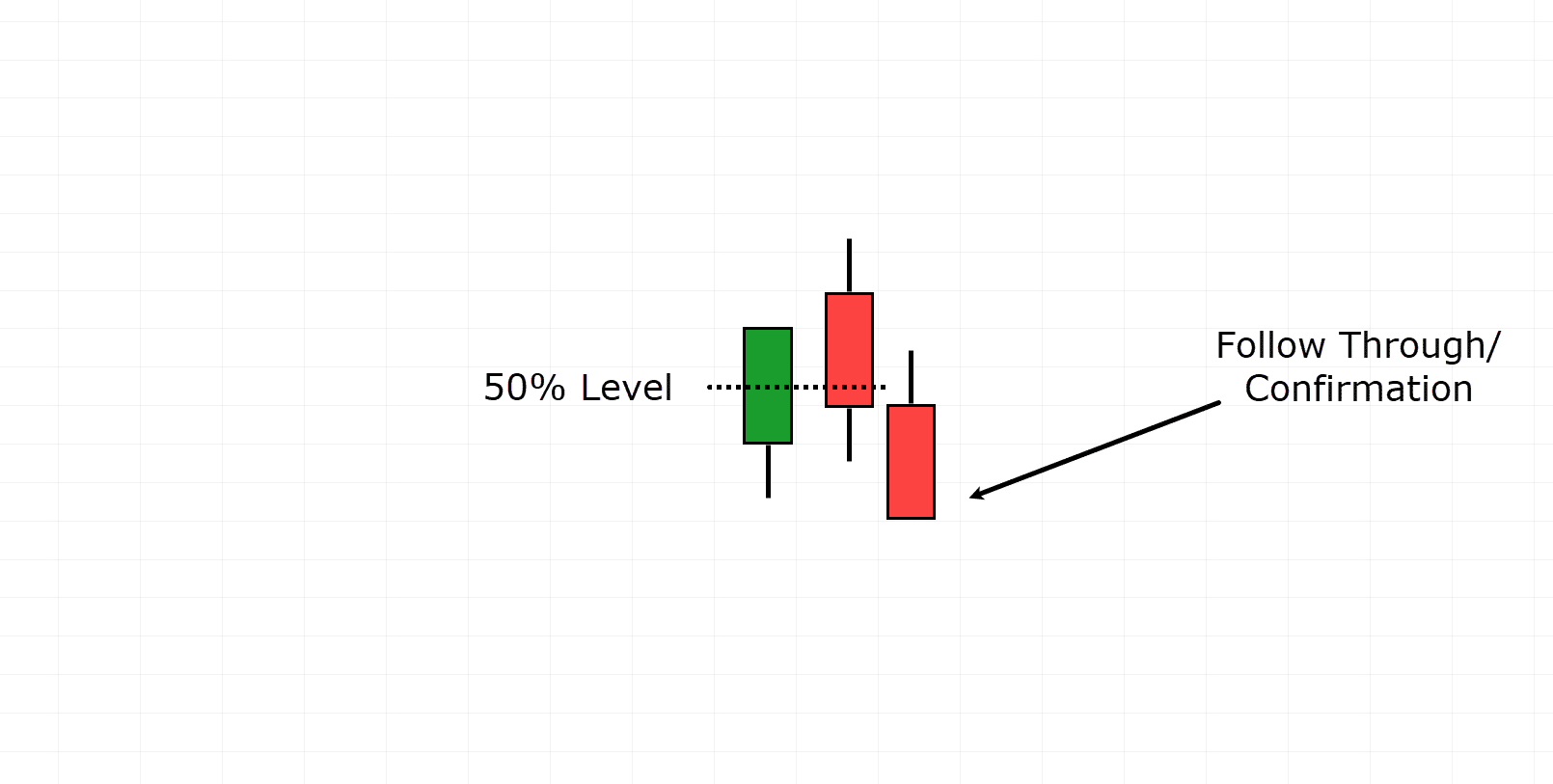

One other essential idea to think about is ready for further affirmation.

Now, this might be as easy as observing the subsequent candle after the sample kinds…

Affirmation Candlestick Instance:

For instance, if the next candle reveals bearish follow-through, the value will doubtless proceed to say no additional.

Whereas ready for affirmation might imply lacking out on coming into the commerce instantly after the sample happens, it may present further peace of thoughts – rising confidence in your buying and selling selections.

This technique helps make sure that you enter trades with better conviction and reduces the chance of coming into prematurely.

Quantity Affirmation

Lastly, including some quantity affirmation brings one other dimension to buying and selling the darkish cloud cowl sample.

Elevated quantity on each the bullish and bearish candlesticks on this sample strengthens the probability of a profitable reversal.

Larger quantity means heightened exercise, indicating that bulls and bears are combating for management in that space of the market!

Whereas not a requirement for buying and selling the sample, the heightened quantity offers further affirmation of the reversal sign.

It provides one other layer of confidence and strengthens the validity of the buying and selling setup.

Alright, now that you understand how to establish the sample, let’s delve into some actual examples that can assist you efficiently commerce it out there!

Buying and selling Technique For Ranges

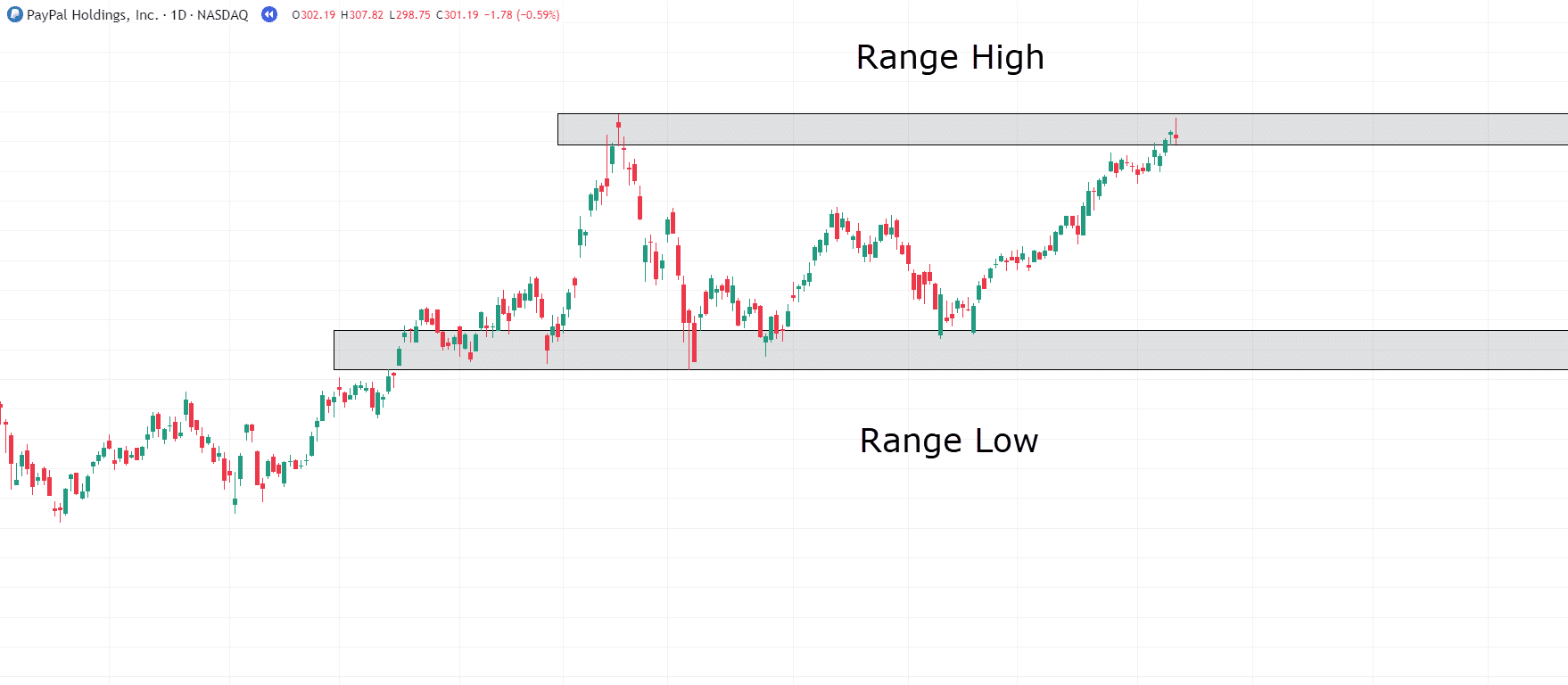

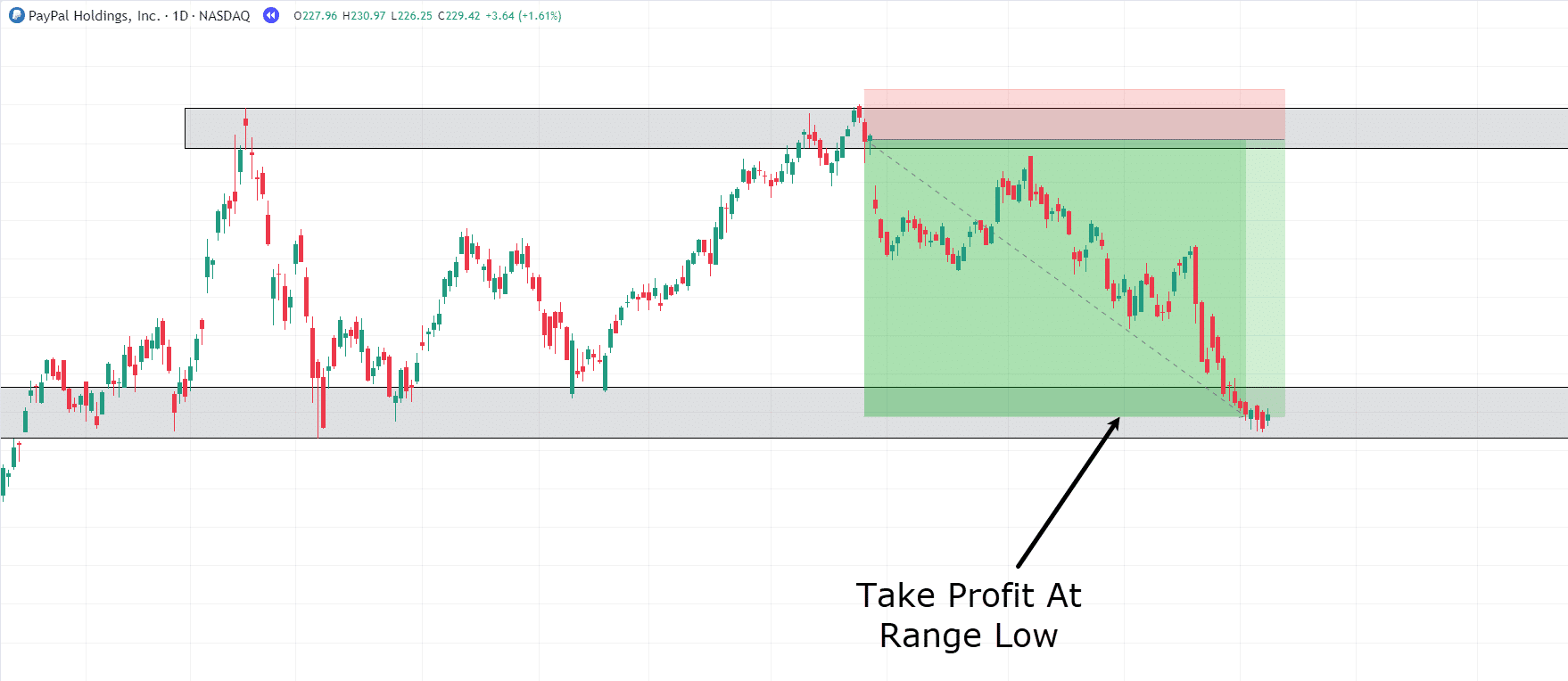

Every day PayPal Holdings Chart Vary:

On this Every day PayPal Holdings chart, PayPal reveals a spread after a substantial uptrend.

Value has established a distinctly greater degree earlier than retracing to the identical degree a number of instances.

As the value returns to this vary excessive, it means that this space of worth might probably act as a resistance degree.

Let’s take a more in-depth look…

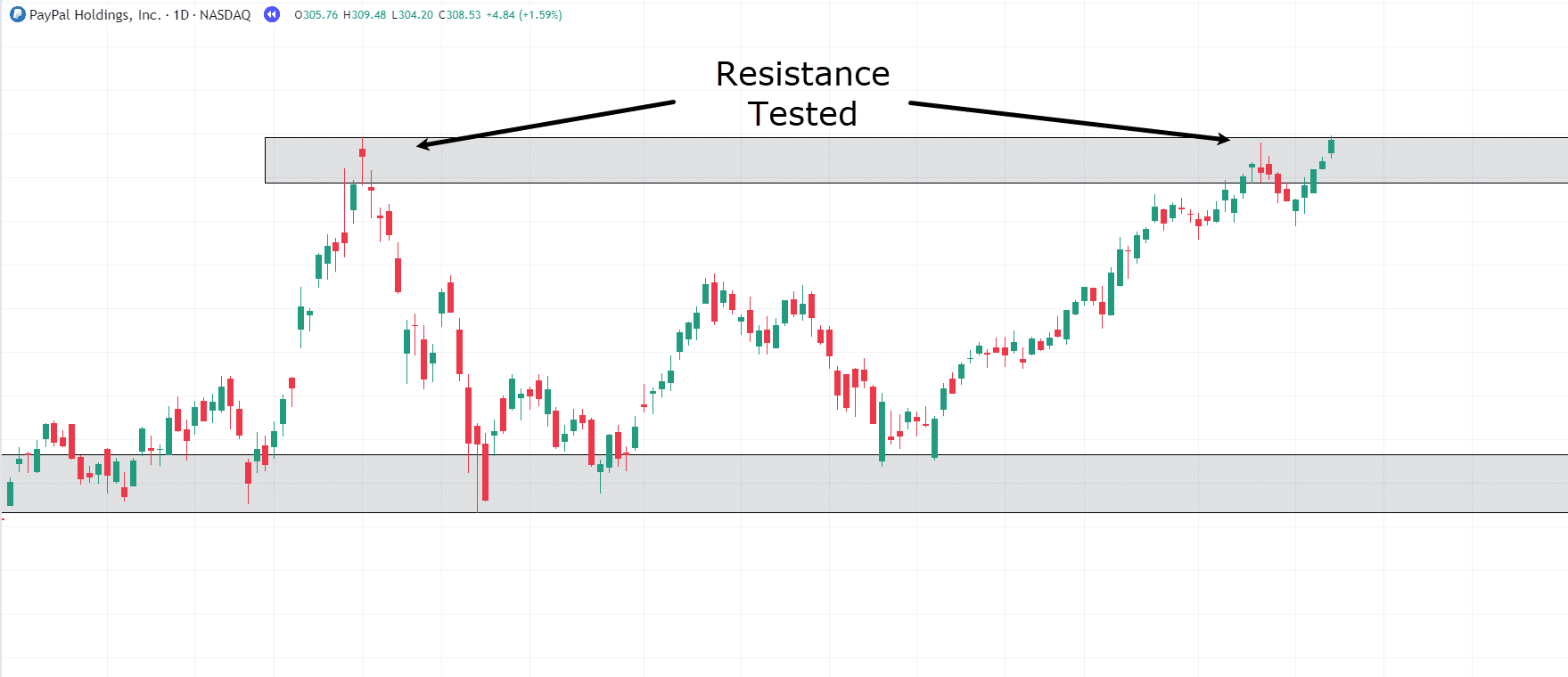

Every day PayPal Holdings Chart Resistance Take a look at:

On the resistance degree, the value kinds an inverted Hammer, indicating some rejection. Nevertheless, the value subsequently returns to the zone once more.

At this level, it’s difficult to find out whether or not the bulls or bears have management!

Subsequently, it’s finest to attend a bit longer to see if the market offers extra data…

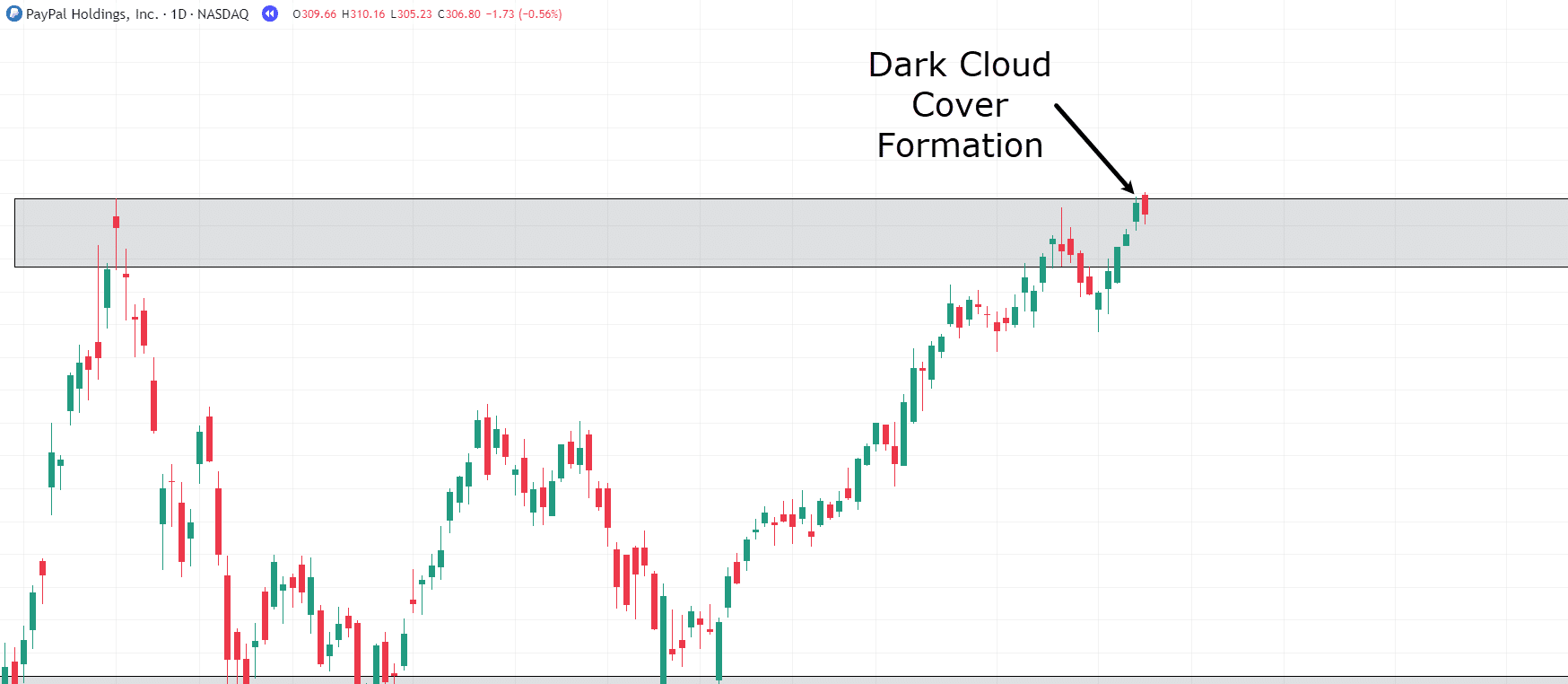

Every day PayPal Holdings Chart Darkish Cloud Cowl Formation:

So the subsequent day, the value gapped up however closed across the 50% degree of the earlier candle.

This occurred at resistance, which has witnessed a few rejections already…

So…. what am I ready for, proper?

“…Let’s pull the set off, Rayner!”

“…Take the commerce!”

After all, it might sound very tempting to leap proper in…

…Nevertheless, it’s essential to recollect the significance of affirmation!

Value has swiftly returned to this degree, and it could be a good suggestion to attend for extra affirmation displaying that this degree will stay a robust resistance degree.

Let’s take a more in-depth take a look at what unfolds subsequent…

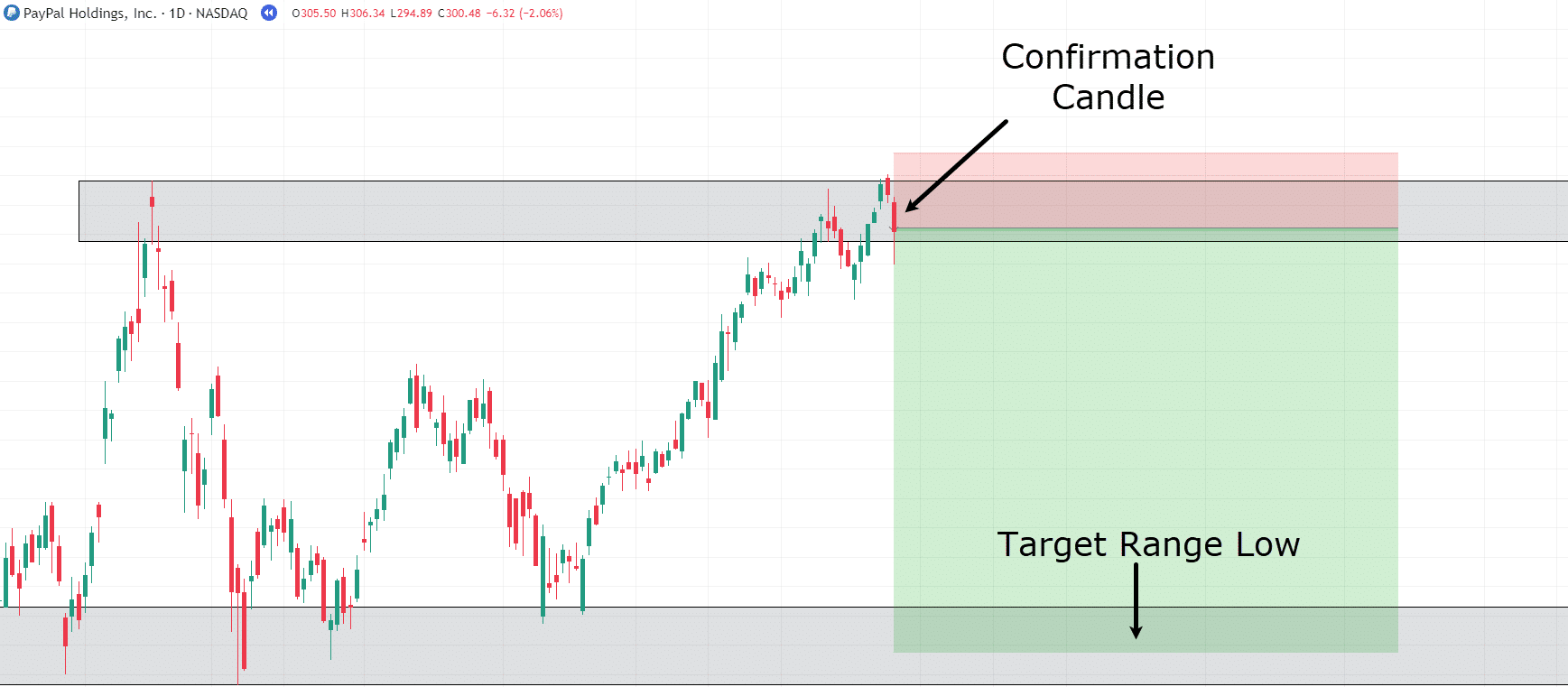

Every day PayPal Holdings Chart Darkish Cloud Cowl Affirmation:

OK, with the robust bearish affirmation candle now in place, there’s extra confidence that this resistance degree will doubtless maintain, proper?

Now could be the time to enter the commerce and goal the vary low for our take revenue!…

Every day PayPal Holdings Take Revenue:

…and Congratulations!

You simply efficiently traded the Darkish Cloud Cowl in a spread!

Nevertheless, let’s face it, markets don’t at all times vary like this, do they?

So let’s focus on the way you would possibly use this in a pattern buying and selling scenario!

Pattern Buying and selling Instance

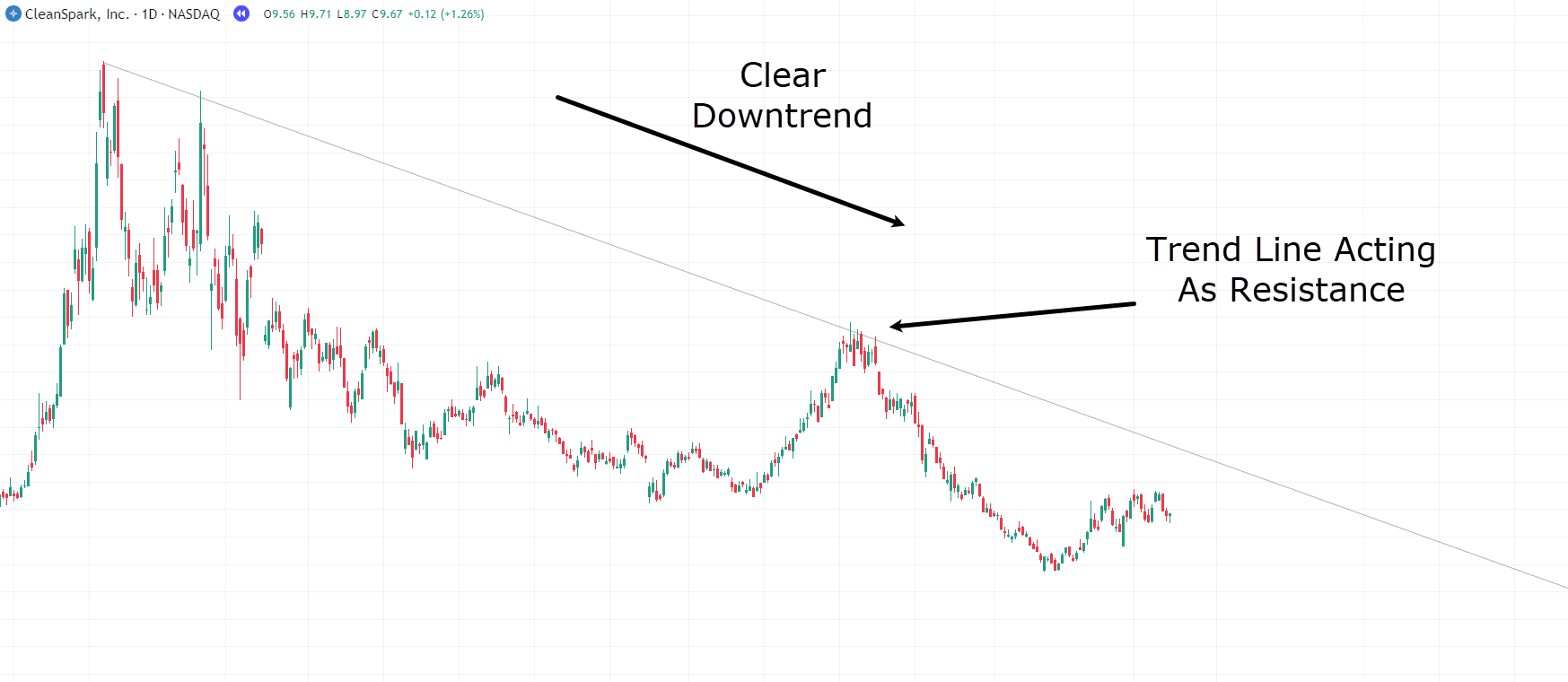

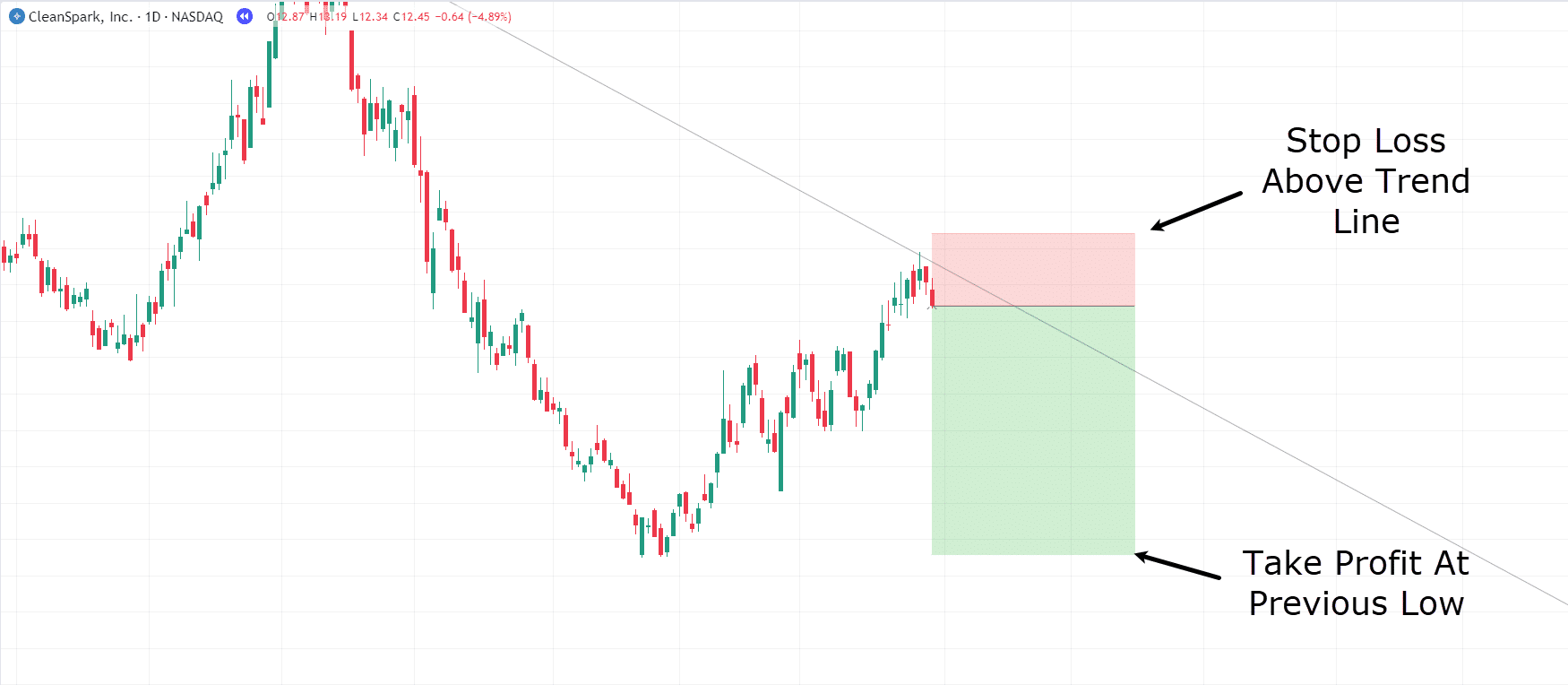

Every day CleanSpark Downtrend Chart:

On the each day timeframe, CleanSpark Inc. is clearly in a robust downtrend.

The trendline serves as a information to the place worth would possibly encounter resistance sooner or later.

Let’s check out what unfolds subsequent!…

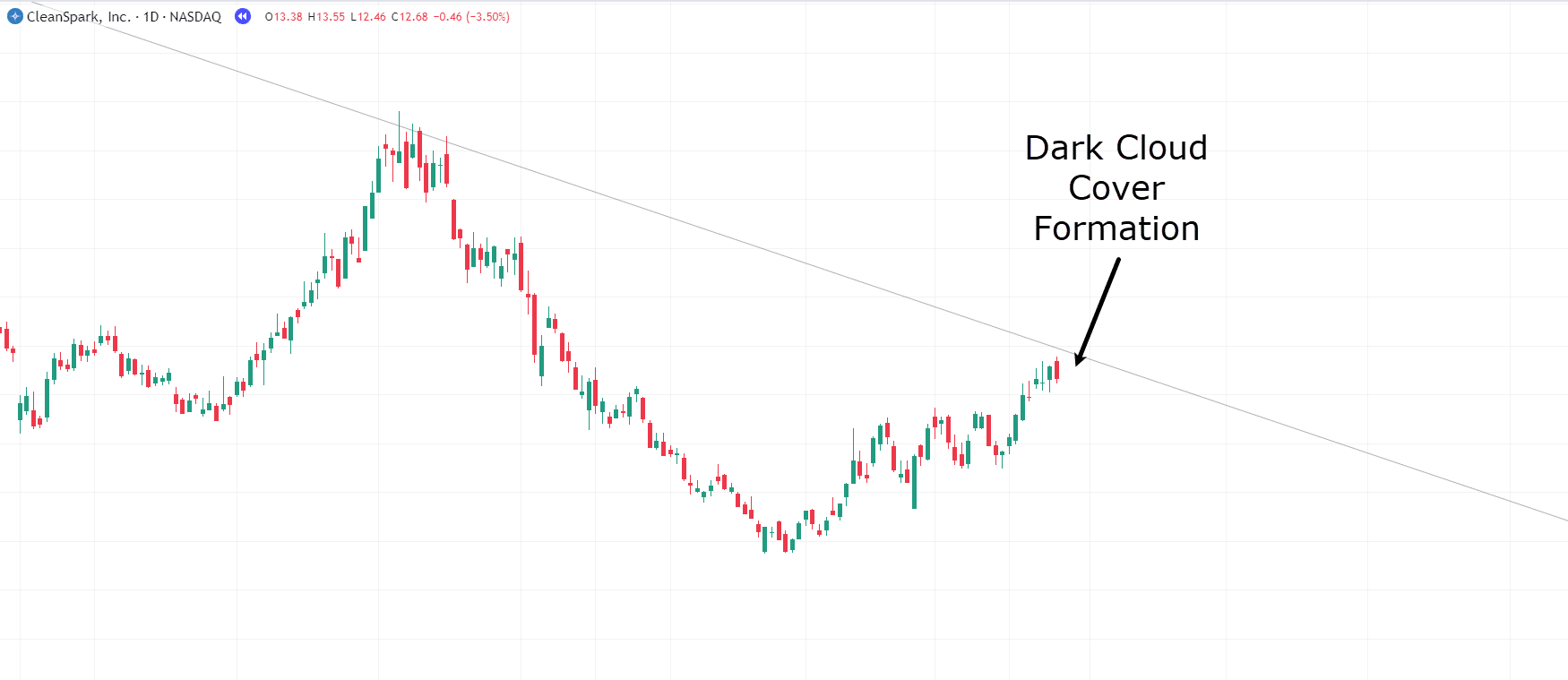

Every day CleanSpark Darkish Cloud Cowl Formation:

As soon as once more, worth has gapped up however didn’t maintain greater ranges, closing beneath the 50% mark of the earlier candle.

Much like the earlier occasion, let’s train persistence and look forward to additional affirmation…

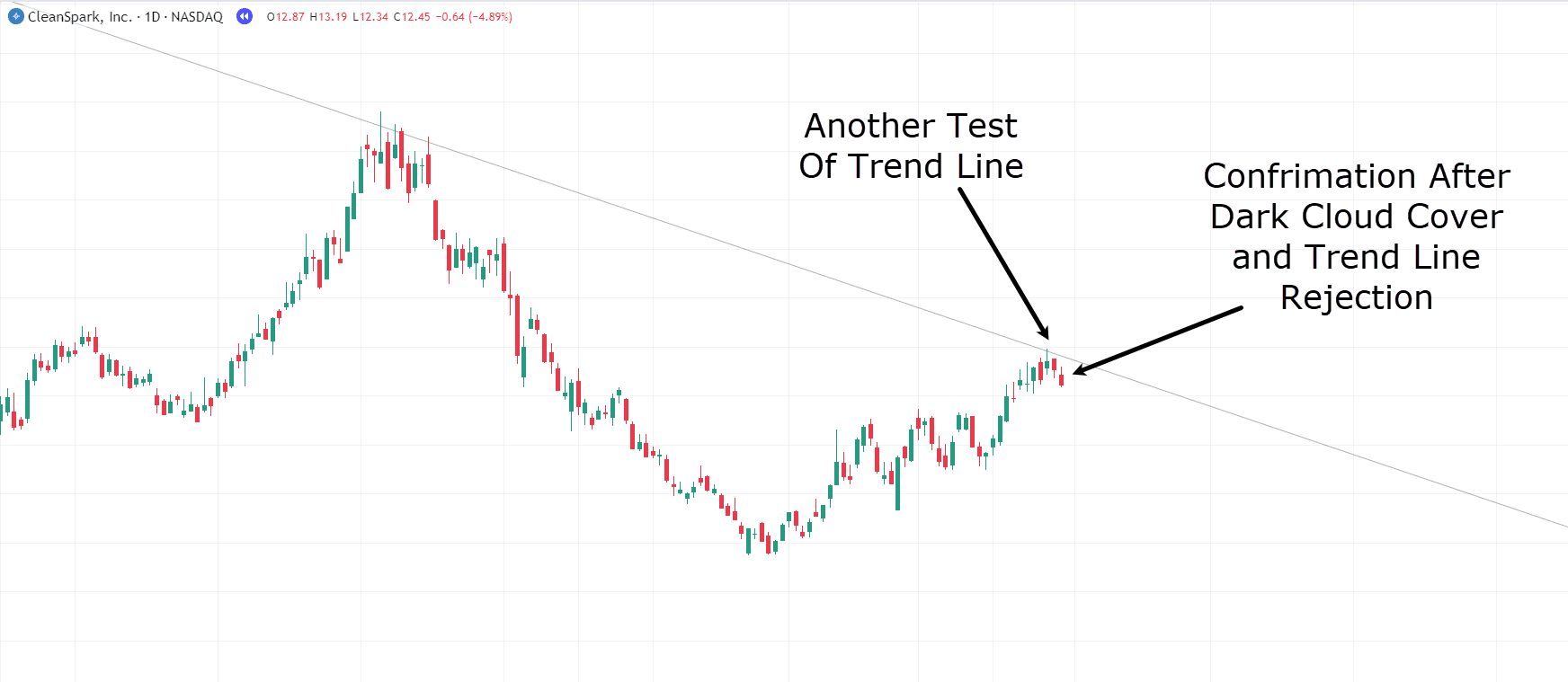

Every day CleanSpark Darkish Cloud Cowl Affirmation:

Whereas worth didn’t affirm the reversal instantly and as an alternative retested the trendline, it did ultimately fall beneath the sample.

Now at this level, you might have a number of elements in your favor:

- Value is rejecting the robust each day trendline

- Value has shaped the Darkish Cloud Cowl Rejection sample at this degree.

- Value has begun to fall away from the trendline.

- Downtrend momentum is in your aspect!

So let’s get to it and take this commerce!…

Every day CleanSpark Darkish Cloud Cowl Entry:

For the cease loss, inserting it simply above the pattern line permits room in case worth continues to check the trendline.

That approach, if worth breaks above the trendline, the commerce is now not legitimate, and exiting can be prudent.

As for take income, I feel taking them on the earlier low appears logical.

Make sense?

Good!

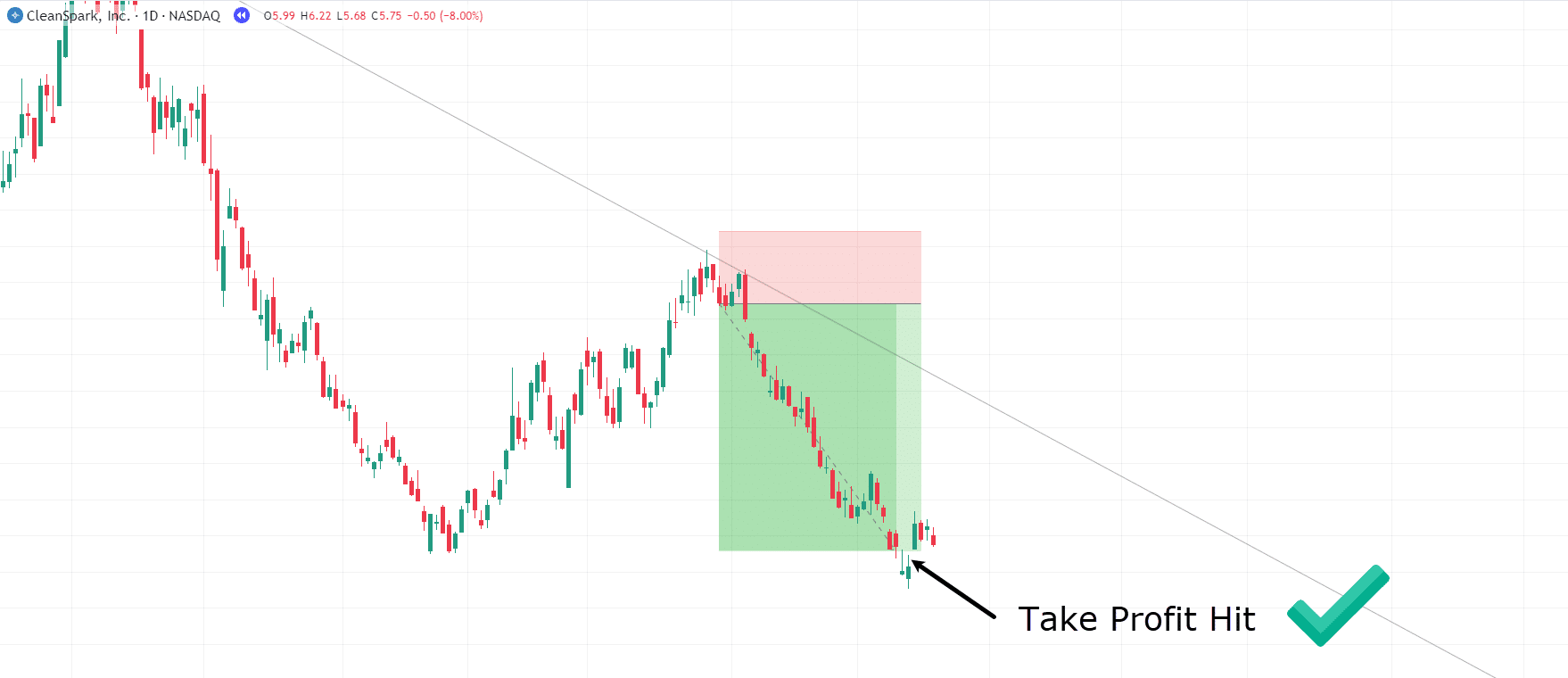

Let’s see what occurs subsequent…

Every day CleanSpark Darkish Cloud Cowl Entry:

Wow! Congratulations on one other profitable commerce!

You possibly can see how this method may be an efficient technique for leveraging the downtrend momentum of upper timeframes to seize income in shorting eventualities.

OK – let’s discover one final instance…

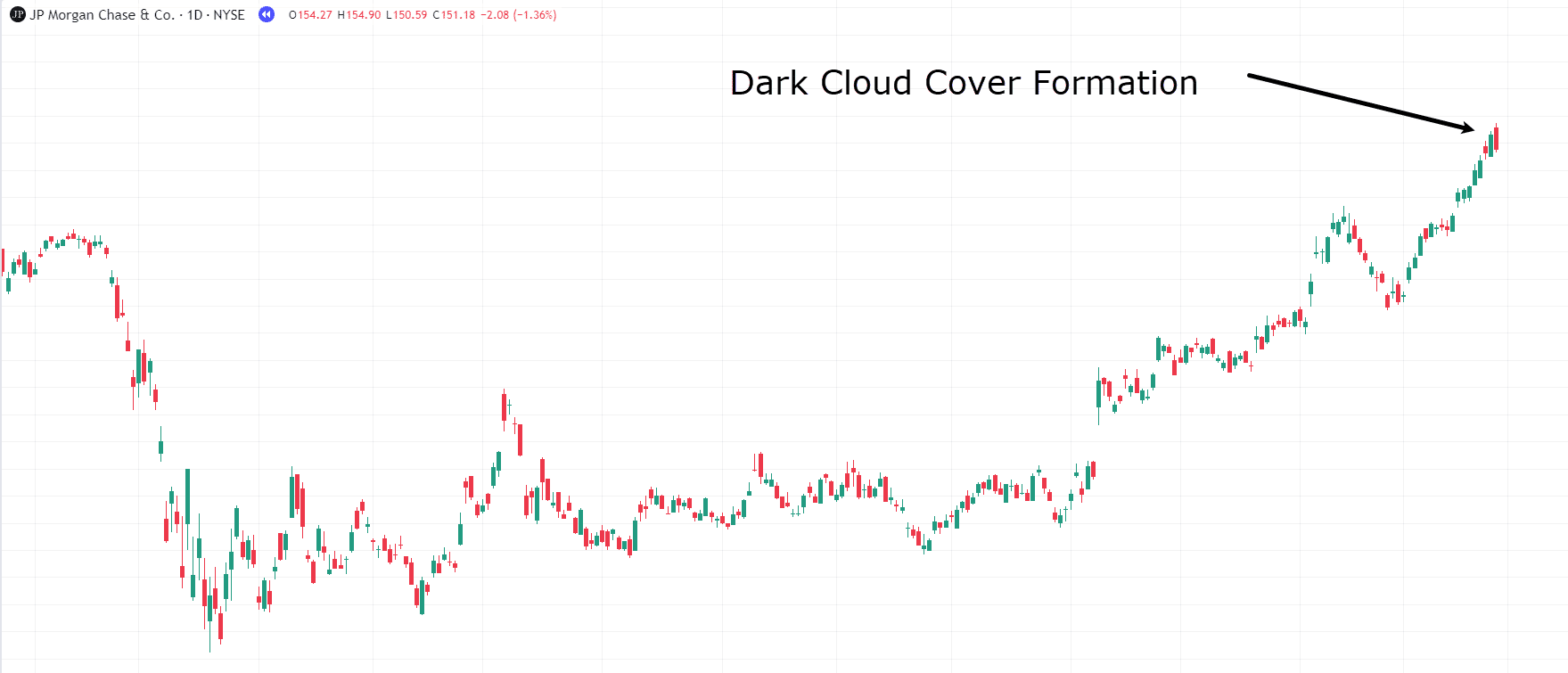

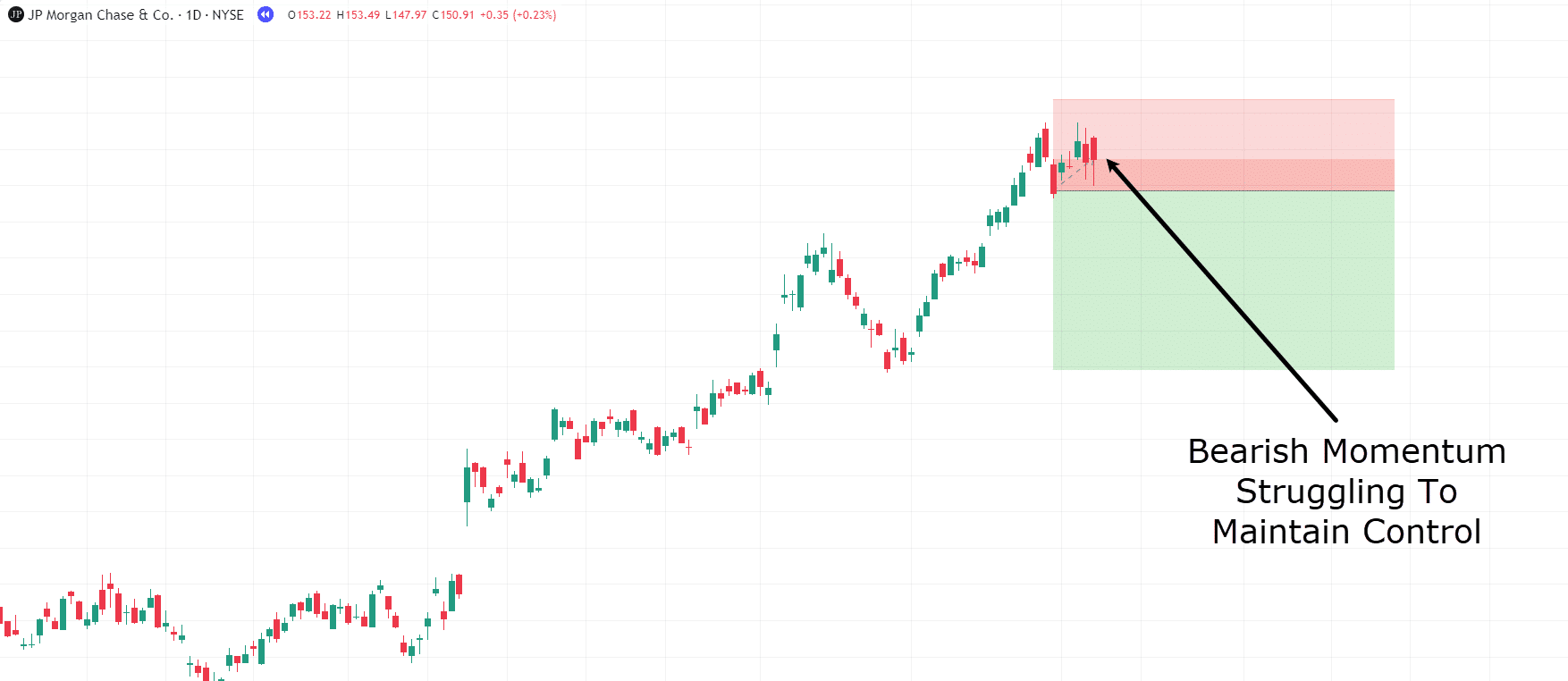

Every day JP Morgan Chase & Co. Chart:

As soon as once more, the Darkish Cloud Cowl formation is noticed.

As ordinary, it’s advisable to attend for one further candle of affirmation earlier than contemplating this commerce…

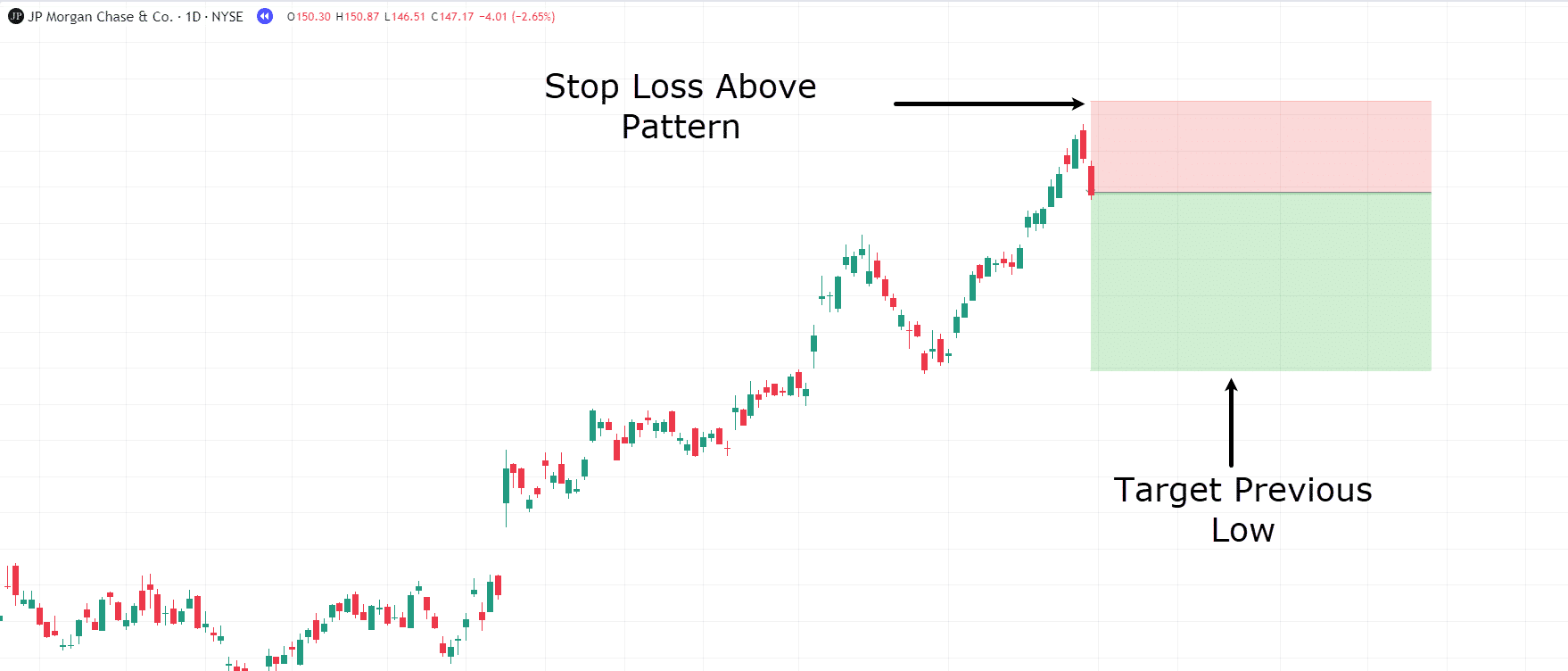

Every day JP Morgan Chase & Co. Entry:

With the affirmation now in place, it’s time to take the commerce.

The goal stays the earlier lows, as seen in our different examples, and the cease loss needs to be set simply above the sample…

Every day JP Morgan Chase & Co. Commerce Administration:

However do you discover one thing fascinating occurring right here?

Value isn’t behaving as anticipated following the Darkish Cloud Cowl sample…

With bearish momentum struggling to keep up management, this can be trigger for concern.

Nonetheless, to observe issues by means of, let’s keep on with the commerce and see what develops…

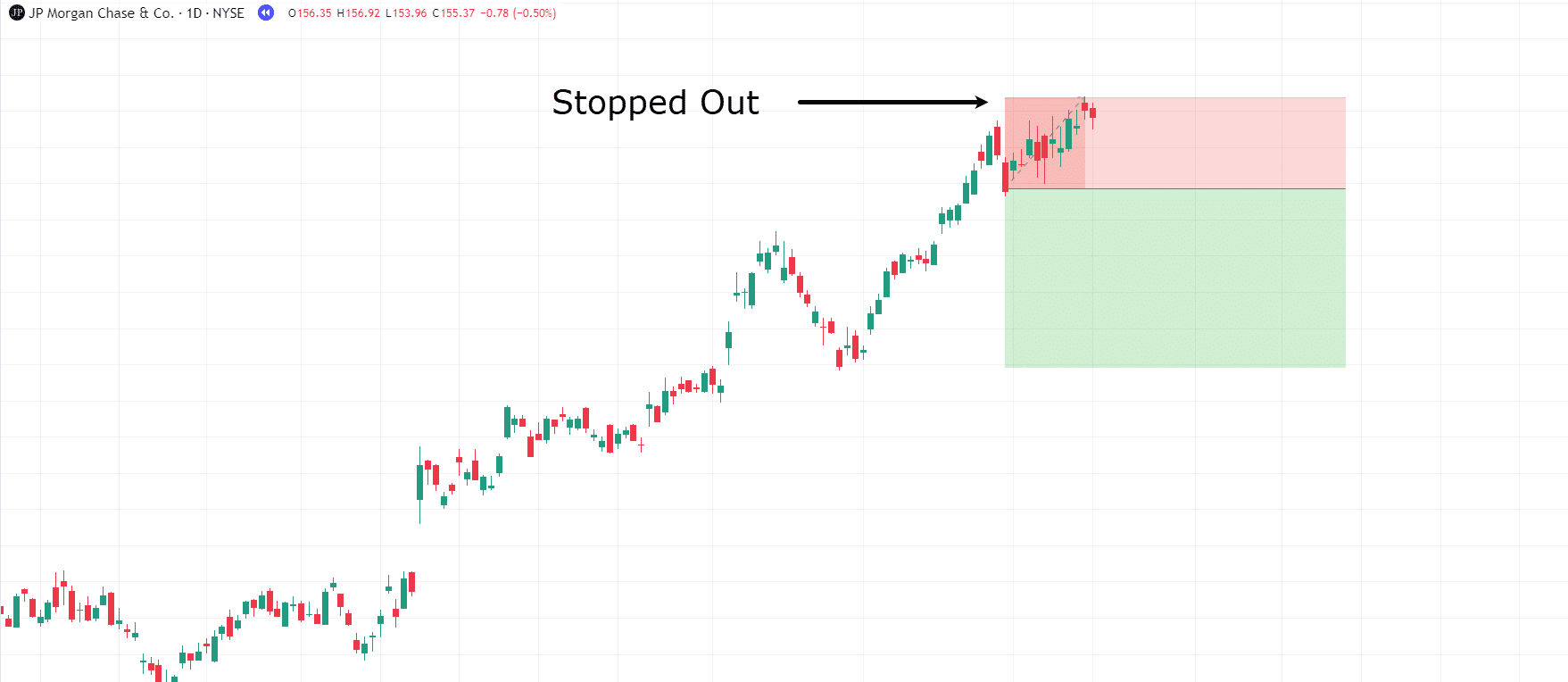

Every day JP Morgan Chase & Co. Commerce Cease Out:

Oh no!

You bought stopped out!

However it’s not all unhealthy information, as there’s a worthwhile lesson to be discovered right here.

You might need already realized, however let’s analyse whether or not this was really an excellent commerce to take…

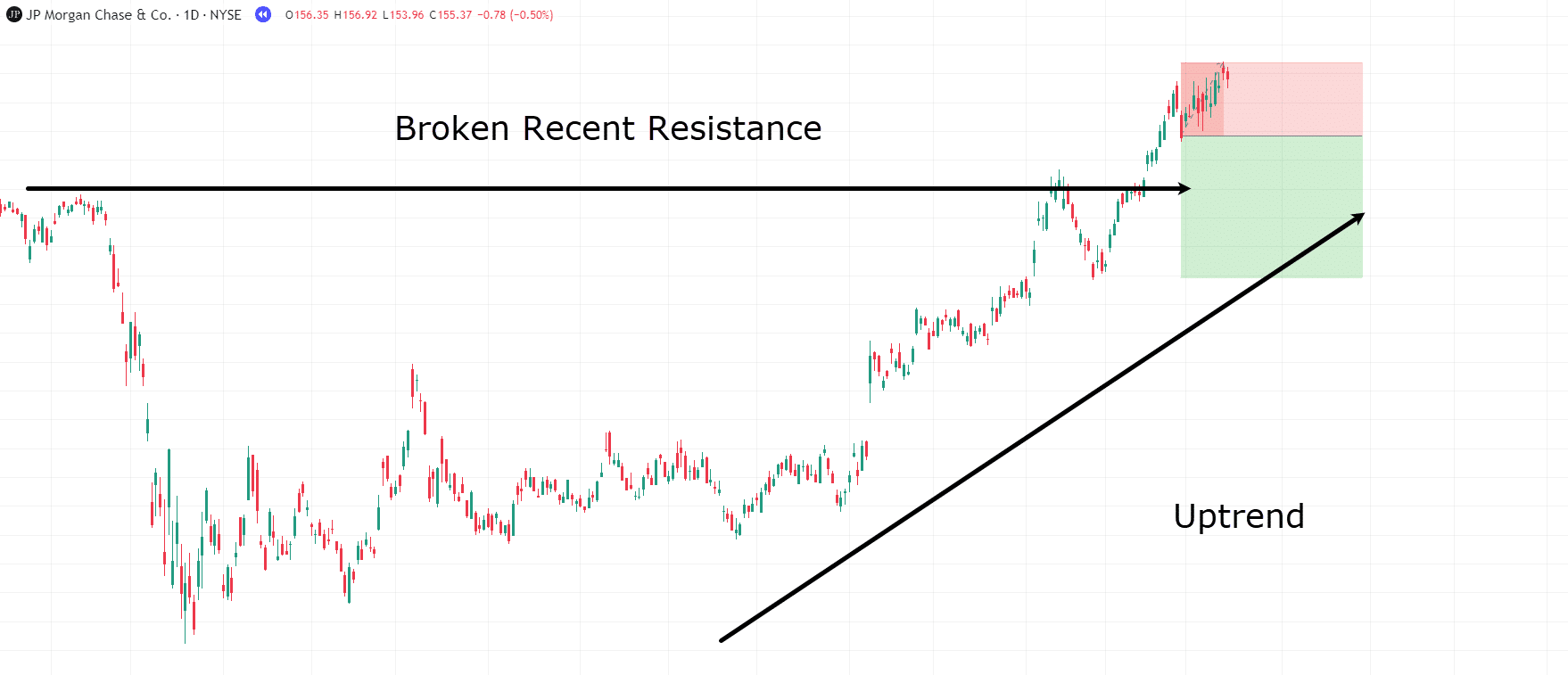

Every day JP Morgan Chase & Co. Commerce Evaluation:

After some reflection, there have been a number of necessary factors which wanted to be checked out extra rigorously earlier than coming into the commerce…

Firstly, all through this text, you’ve discovered which you can’t merely commerce the Darkish Cloud Cowl Sample at any time when it seems in your chart.

You want different technical indicators to help you in making that commerce.

Nevertheless, there are much more obvious the explanation why this commerce didn’t work out.

For one, the robust resistance degree was just lately damaged, and the sample didn’t happen on the resistance degree…

…it occurred effectively after bullish momentum had pushed by means of it.

This means that the bulls have appreciable management, as proven by their capacity to interrupt the resistance degree with vital follow-through.

Moreover, if you analyze the larger image of the market, it appears safer to categorise this chart as being in an uptrend quite than a downtrend.

In different phrases, extra elements had been working towards the commerce than for it.

It’s necessary to take a look at the larger image.

On this case, the Darkish Cloud Cowl sample alone couldn’t outweigh the momentum of different key elements out there.

At all times hold this in thoughts when recognizing the Darkish Cloud Cowl sample and deciding whether or not or to not execute the commerce!

Limitations

Can not Be Used In Isolation

As talked about beforehand, the darkish cloud cowl candlestick sample can’t be utilized in isolation.

Buying and selling this formation each time it happens on the chart would yield little or no success.

When used along with different indicators and technical evaluation, it turns into far more dependable!

Sample Location

The place the sample happens is necessary.

Context of the general market and its conduct is essential when contemplating whether or not or to not take a commerce.

Sturdy Understanding Of Technical Evaluation

The Darkish Cloud Cowl Sample requires a deeper understanding of indicators that may help it.

As a result of it is a sample that requires context and different technicals, one limitation is that you just want some information of different indicators and technical instruments to successfully commerce it.

Hardly ever happens in sure markets

As acknowledged within the article, gaps are important to this sample, making it a uncommon prevalence in property like foreign exchange.

Nevertheless, on property like shares, the place gaps are frequent, these patterns can happen fairly steadily on the each day timeframe.

Conclusion

So, in conclusion, the Darkish Cloud Cowl Sample emerges as a useful software in inventory evaluation.

This sample serves as a strong entry set off, shedding mild on the continuing wrestle between bulls and bears at key areas on the chart.

By combining the Darkish Cloud Cowl Candlestick sample with different technical analyses, merchants can precisely establish entries and enhance their odds throughout numerous market situations.

This strategic edge affords merchants the arrogance to decipher market momentum successfully and make knowledgeable entry selections.

To summarize, on this article, you’ve:

- Gained actionable knowlegde concerning the Darkish Cloud Cowl Sample and what it may appear like in numerous eventualities.

- Explored the varied market situations during which the Darkish Cloud Sample may be utilized and the way it might seem.

- Discovered new methods for buying and selling the Darkish Cloud Cowl with real-life examples.

- Understood the constraints related to utilizing candlestick patterns alone and the way necessary contextual evaluation is inside the total market

Lastly – congratulations!

With this new addition to your candlestick sample arsenal, I encourage you to search out some real-life examples in your charts, grabbing some extra layers of technical evaluation to refine your methods.

I’m keen to listen to your ideas on the Darkish Cloud Cowl Sample, too!

Have you ever used it earlier than, or do you lean in the direction of different reversal patterns for entries?

Which candlestick patterns do you are inclined to favour?

Be at liberty to share your insights within the feedback beneath!