I’m positive you’ve heard of well-known candlesticks just like the hammer:

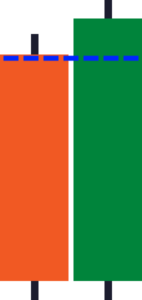

Or the bullish engulfing candle:

And rightly so, as these candlestick patterns are tremendous explosive!

Nevertheless…

There’s one other candlestick sample that’s the “handiest” out of all of the patterns on the market.

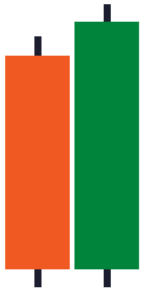

And that, my good friend, is the piercing sample:

And on this buying and selling information, I’ll share with you simply how helpful it may be to your buying and selling plan!

Nonetheless, right here’s what you’ll study for at present:

- What makes the piercing sample completely different from different candlestick patterns on the market

- The “secret” to utilizing the piercing sample on the way it could make your buying and selling life a lot simpler

- A time-tested system for buying and selling the piercing sample (and different candlestick patterns on the market)

- Two key issues NOT to do when buying and selling the piercing sample

In the event you’re a candlestick sample practitioner you then’re in for a deal with.

As a result of on the finish of this information…

I wager you’ll study one thing new even should you’ve been utilizing candlestick patterns for years.

So, let’s get began!

What’s the piercing sample and what makes it completely different from different candlestick patterns?

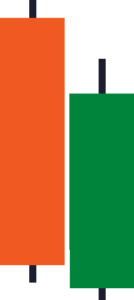

In textbook phrases…

A piercing sample occurs when a candle gaps down on the open:

After which closes again above 50% of the earlier candle’s physique!

The sellers dived into freezing waters and instantly jumped again up!

You could be questioning:

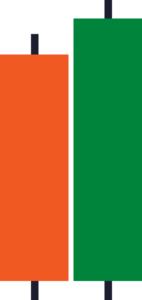

“Wait a minute, that appears like a bullish engulfing candle!”

Properly, not so quick, my good friend!

In the event you recall, a bullish engulfing occurs when the candle closes “past” the earlier candle!

It’s just like the sellers took a dive into chilly waters and instantly jumped out into outer house like Superman!

So, if it’s not just like the bullish engulfing sample…

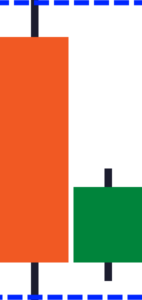

Then how about an inside bar?

Aha, fairly shut!

However as you possibly can see, the entire physique of the current candle is contained in the earlier candle!

Now I do know you could be considering:

“Why are we evaluating the piercing sample to different candlesticks?”

The reply is that this:

In the true world of buying and selling, our “textbook” definitions break down.

Due to this fact, there may be exceptions to our textbook definitions of them.

So, if I ask you…

Is that this an inside bar or a piercing sample?

Do you embrace the wicks in context or not?

In the event you answered contained in the bar then you’re right.

Why?

Due to this one easy rule:

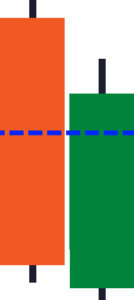

The candle should shut at the very least 50% of the earlier candle.

And sure, this excludes the wicks!

So, are you able to see how essential it’s to distinguish the piercing sample from different candlestick patterns?

Now a fast take a look at…

Which one among these candlesticks is piercing, inside, and engulfing?

In the event you’ve bought the next solutions:

- Bullish engulfing

- Inside bar

- Piercing sample

You then’re now prepared for the following part!

As a result of now that you simply’ve nailed down the way to spot a piercing sample…

I’ll educate you the way to use it to enter your trades precisely.

Prepared?

Then let’s transfer on…

Why the piercing sample is essentially the most handy candlestick sample to enter the markets

Let me ask you…

How do you enter off of a candlestick sample?

As a result of figuring out them is one factor, buying and selling them is one other!

So, how do you commerce them?

Market order

Let me clarify…

As soon as you see a sound bullish candlestick for instance:

What you do is place a market order manually on the subsequent candle open.

Easy as that!

We anticipate the candlestick to type and we place a market order!

Nevertheless, there’s a draw back…

You’d have to attend for the candlestick to shut and enter the commerce manually

Positive, ready for a candle to shut can assist you keep away from false indicators so that you don’t enter prematurely.

Nevertheless…

We are able to’t be on our screens on a regular basis!

And this methodology makes it even more durable for individuals who commerce the decrease timeframes!

So, how will we resolve this?

Enter, the piercing sample.

Purchase cease order

Piercing gives essentially the most flexibility.

As a result of as a substitute of putting a market order, we’d be putting a buy-stop order!

Right here’s what I imply:

That’s proper.

You’d need the piercing sample dedicated to you.

So, when you’ve noticed a sound piercing sample:

You place a buy-stop order proper above the earlier candlestick!

However right here’s the factor…

What if the market stored going decrease with out hitting your cease order?

Easy!

Simply hold shifting your buy-stop order, due to this fact, you get an excellent higher entry worth!

Till it will get triggered…

P.S. Solely shift your buy-stop order decrease solely once you spot a sound piercing sample once more!

Now right here’s one other query that’s essential to reply…

How lengthy is your buy-stop legitimate?

Right here’s the tough half.

However the reply is that this:

When the piercing sample is not at an space of worth:

Let me let you know extra within the subsequent part…

A step-by-step framework for buying and selling the piercing sample

Entries are solely a small a part of a buying and selling plan.

Do you agree?

(Say sure)

Good, you agree!

One mistake candlestick sample merchants usually make is that they rely an excessive amount of on candlestick patterns!

However the reality is, a single candlestick sample received’t dictate a market route.

It’s the entire market construction itself!

So, how can we use market constructions to our benefit?

On the identical time…

Complimenting what you’ve realized up to now with the piercing sample?

The M.A.E.E. system

This easy framework will save your buying and selling portfolio!

However, what does it imply?

It stands for 4 issues…

- Market construction

- Area of worth

- Entries

- Exits

So, how will we combine the piercing sample into this framework?

Let me educate you…

Step #1: Determine the market construction

This half is fairly essential.

Why?

As a result of should you spot a pleasant uptrend:

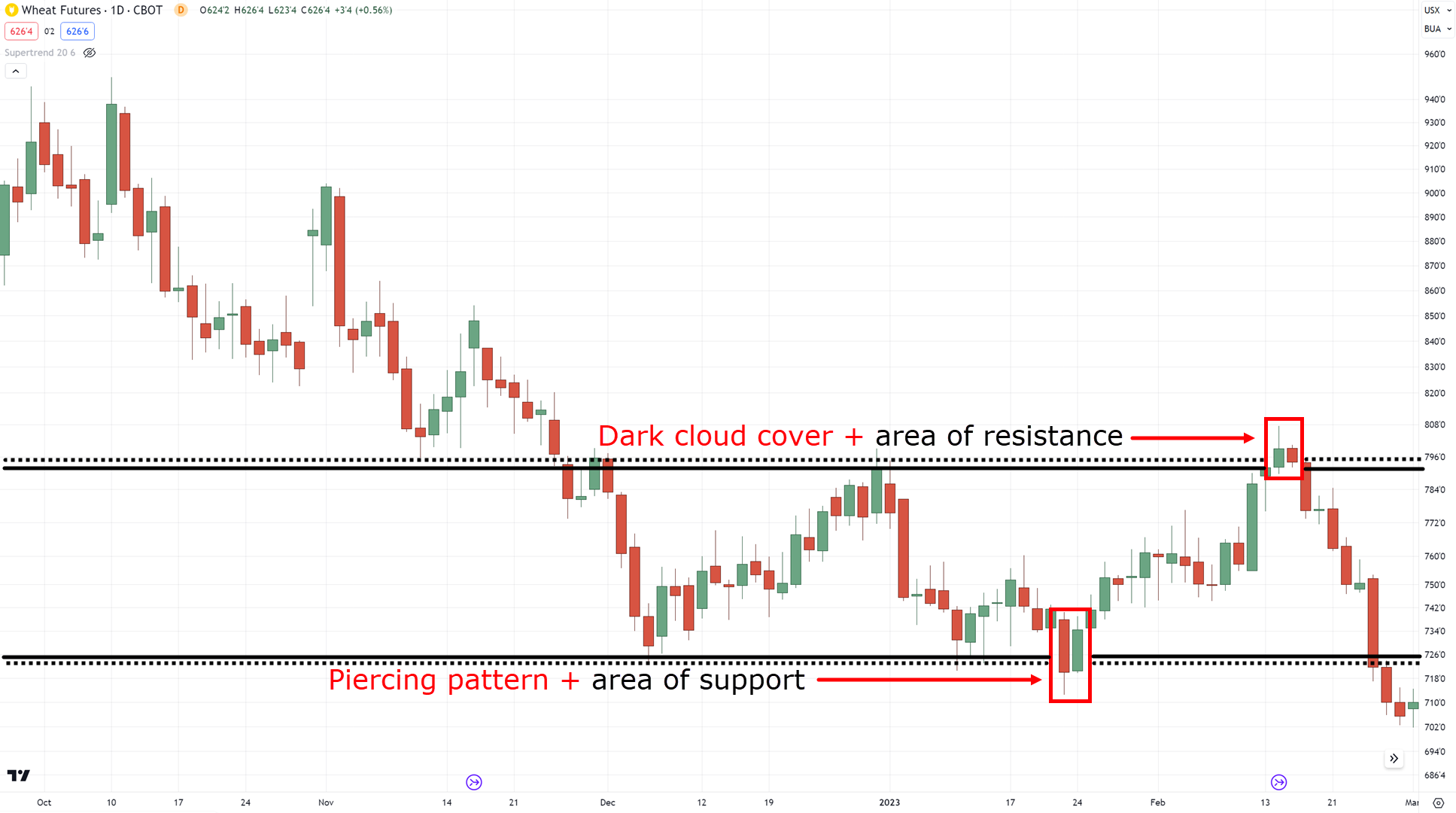

You then’d wish to search for bullish piercing sample setups to hop into the uptrend.

In the event you spot a downtrend:

A darkish cloud cowl setup is the other of the piercing sample!

And if it’s a spread:

Then search for each piercing sample setups however solely when they’re on the highs and lows of a spread:

Is smart?

However for the following steps, we’ll use an uptrend as our instance:

Subsequent…

Step #2: Determine the world of worth

That is in the end the bread and butter of the piercing sample.

Why?

As a result of any candlestick ought to by no means be traded in isolation!

That’s why it’s essential to all the time determine an space of worth.

Now, since our instance is in an uptrend we’d wish to search for an space of assist:

P.S. There’s a couple of sort of space of values which you’ll be able to study extra right here.

Onto the guidelines…

Market construction?

Examine.

Space of worth?

Examine.

Subsequent?

Step #3: Determine your entry (piercing sample)

At this level, this requires no additional rationalization.

We are able to discover this setup right here:

Fairly easy, proper?

The piercing sample should all the time be traded solely when an space of worth is current!

Now…

It’s straightforward to enter trades, however just a few (new) merchants ask:

When will we exit?

Step #4: Determine your exits

This doesn’t solely imply once we take earnings, it additionally means once we minimize our losses.

That’s proper!

It’s not all the time concerning the money, but in addition the way you handle your danger!

So, as for our cease loss…

Subtract 1 ATR from the lows:

And for taking earnings (the very best half, I do know) you’d wish to take revenue earlier than the closest excessive:

When buying and selling vary markets, the identical precept applies.

However sure, I do know…

The danger to reward doesn’t look too fairly.

That’s why you possibly can partially take earnings after which path your cease loss:

Is smart?

Now, I do know I’ve skimmed previous many factors equivalent to danger administration and commerce administration.

However to not fear as you possibly can study extra about it right here:

How you can Use Trailing Cease Loss (5 Highly effective Methods That Work)

The Full Information to ATR Indicator

Earlier than I allow you to go into the wild…

You need to understand how NOT to make use of the piercing candlestick sample as nicely.

So, learn on!

How NOT to make use of the piercing sample within the markets

In any buying and selling idea…

It’s essential to understand how that idea is supposed for use, in addition to how to not use it.

Why?

Easy, as a result of the piercing sample itself is a instrument!

And the effectiveness of such a instrument will depend on how nicely you utilize it.

So, when or how do you NOT use the piercing sample?

Don’t use the piercing sample cease order methodology on gapping markets

In the event you usually end up ending up on charts like this:

Then neglect about utilizing candlestick patterns basically.

Why?

Since you’re merely getting a TON of false indicators there!

Because of this a line chart would supply higher data when buying and selling on charts like these.

(although these sorts of charts are sometimes widespread in penny shares or illiquid crypto cash)

Subsequent…

By no means use the piercing sample in isolation

That is the large gap that I’ve taught you the way to plug all through this information.

But it surely must be stated one final time:

At all times use the piercing sample within the context of the market.

In brief?

Don’t commerce the piercing sample like this:

Commerce it like this:

Realizing your areas of worth is essential!

That’s just about it!

A fast and snappy information to figuring out the piercing sample!

So, let’s have a fast recap of what you’ve realized at present.

Lets?

Conclusion

With a ton of candlestick patterns to memorize on the market…

The piercing sample gives you with nice flexibility to enter your commerce in your phrases.

Nonetheless, right here’s what you’ve realized in at present’s information:

- A piercing sample is shaped when a candle closes 50% of the earlier candle (this key rule is what differentiates the piercing sample from different patterns on the market)

- The piercing sample can be utilized to enter your trades by profiting from the buy-stop order or sell-stop order to make your buying and selling simpler

- A confirmed solution to commerce the piercing sample is to make use of the M.A.E.E system, a step-by-step to analyzing, coming into, and exiting your trades

- A piercing sample (or any candlestick sample) just isn’t meant for use on illiquid markets, in addition to being traded in isolation, or utilizing it with out the context of the market construction

Over to you!

Do you assume you possibly can apply some ideas right here to different candlestick patterns?

Additionally, do you favor to enter your commerce on the present worth?

Or do you favor to place restrict or cease orders to make issues straightforward for you?

Let me know within the feedback beneath!

Wow, incredible weblog structure! How lengthy have you been blogging for?

you made running a blog glance easy. The overall glance of your web site is magnificent, let alone the content!

You can see similar: sklep online

and here sklep internetowy