(continued from Bitcoin II: The NO! Awakens)

Me: Some individuals don’t take it significantly sufficient. They’re not gonna make it.

Teddy: Oh yeah?

Me: Yeah. Your entire life must be about buying and selling. It’s important to endure for it each single day. It’s important to be obsessive about discovering methods to earn money.

Morning commute. Take into consideration shares.

Lifting session on the gymnasium. Take into consideration shares.

Night dinner. Take into consideration shares.

No time for tourism or Tinder. Simply buying and selling.

Me: “Should you’re not all-in, you’re not gonna make it. You’re gonna be one other Imran. One other Billy. God enable you to, you’re gonna be one other Terrance.”

Teddy: “Who’re they?”

Me: “Precisely. They’re no one. Now go over your buying and selling concepts for tomorrow.”

I needed to be a constructive mentor. I didn’t need to posture and act like I’m some hard-ass who thinks of buying and selling as a matter of life-and-death. However in the long run, there wasn’t a lot to say except for… motivation? Attempting to be relatable? Ideally, the mentor/mentee buying and selling relationship ought to unfold this like this: Constantly worthwhile dealer lends new dealer directions of his technique and new dealer copies it. In an ideal world, the directions would resemble an IKEA furnishings meeting handbook–you comply with each step precisely because the directions intend, with no discretionary enter of your individual. That might be the simplest path ahead for a brand new dealer and perhaps he can tweak issues later when he has each the cash and expertise. The precise reverse of IKEA handbook could be sandbox mode–the place you must create every thing by yourself with only a few basic rules to information you. There’s ranges to it however sandbox mode extra aptly describes how I began my MBC profession. We got here in at a time the place they weren’t any profitable methods to repeat. Perhaps for this new coaching class, it may very well be totally different.

I had jotted down all all my OTC setups and their execution procedures–the opening drive performs, the bounce performs, the parabolic shorts, find out how to discover and choose shares to commerce, and what to search for on the tape. Teddy may have the playbook and earn money straight away. But it surely was all for nothing.

Trainees have been to commerce strictly NYSE shares for 3 months, then NASDAQ, then eligible for OTC solely after 1+ yr expertise. Teddy and his coaching class have been going via the identical outdated coaching program that I had gone via 2 years in the past. Consequently, he was partaking in all the identical mediocre buying and selling that I had ditched a very long time in the past–discovering random giant cap shares and drawing random strains on the place to purchase and promote. I assume in some methods I used to be glad MBC wasn’t letting everybody commerce OTC and have all us all jockeying for the fills however it left me in a bizarre place as a mentor. So I simply find yourself doing what most mentors do when they’re unable to speak a concrete technique, I provided heartfelt basic recommendation and wished him good luck. I suffered for my present success and I needed him to know he in all probability must endure too. Perhaps there’s some “Completely satisfied Wanderer” on the market who additionally succeeded as knowledgeable dealer and he loved himself whereas residing a balanced life however I wouldn’t know. I can solely converse from my very own expertise–struggling and obsession.

Teddy: Pete, what do you consider this $328.42 stage on AMZN?

The place do I even start to reply that? The primary query you must ask is why is it a good suggestion to purchase or promote AMZN at this time? Why wouldn’t it have an outlier transfer from right here? Am I even certified to supply a solution on that assertion once I don’t commerce AMZN, ever? That is the murky world of discretionary buying and selling–sorry bro, I’ve no clue what to inform you. I attempted to re-direct the dialogue to larger image themes and context–what makes a inventory setup fascinating within the first place, earlier than you ever think about an entry (and thus begin drawing your strains or no matter)? Conversely–why do some trades simply find yourself being noise? Context is essential.

That is very true on the OTC the place shares alternate between fully useless and very alive. By December 2013, the OTC scans had died off and we very a lot wanted a brand new catalyst for order circulate.

The Yr of the Junk Inventory

Round Christmas, they have been going to launch the highly-anticipated The Wolf of Wall Road film. Marty Scorsese and Leo DiCaprio making a movie concerning the debauched world of promoting penny shares, ought to be nice proper? Effectively, I went to see it in theaters with my dad and mom… and that was a mistake. That they had some questions for me on the trip house.

No Mother and Dad, I’m not a dealer mendacity to promote penny shares to shoppers, I solely commerce the shares. I don’t do medication or rent hookers. I’m single man residing in a small house with 3 different individuals. I don’t exit a lot. I don’t keep out late. I don’t go on any dates. All I do is commerce, all I need to do is commerce. I feel they believed me. They didn’t need to not consider me, I’m certain.

Then that they had one other query: do common individuals really purchase these penny shares? My dad and mom grew up on a gradual weight-reduction plan of mutual funds and blue chip shares. Even that was thought-about “dangerous” by their era’s requirements as a result of most immigrant households come from international locations with unstable inventory markets the place purchase and maintain was emphatically NOT a factor. Buying and selling, particularly buying and selling penny shares, was like one other 261 ranges of gamble past their comprehension.

So I defined to them, that, sure, individuals really purchase these Junk Shares they usually aren’t merchants like myself who adhere to Rule 1. They’re precise traders who consider within the firm and maintain the inventory. There normally aren’t sufficient of them to influence the inventory value and take up all of the dilution and the Junk Inventory normally finds itself in terminal decline the place the traders will lose 90% or extra of their funding.

It could actually change for a second. Each canine can have its day when the precise situations come about. That’s when these shares hit my scans after which I take part to commerce the order circulate. That is when context is essential–understanding what can ignite shares for larger strikes. These shares simply wanted a bit of one thing, the equal of Ackman taking a stake in FNMA or the anti-trust information in AAMRQ. One thing really large, not simply one other empty promise within the type of a company-generated press launch. It must be a game-changer exterior of the corporate’s management. I don’t even know what it is going to be as a result of there are millions of these of Junk Shares they usually all do various things in several sectors. Lithium mines. Biopharma. Oil and fuel exploration. Dietary dietary supplements. Marijuana.

Marijuana…

This random shitco that made $258,000 in earnings final yr known as “Medbox” and their CEO by some means acquired an interview throughout Closing Bell. They NEVER put OTC shares on CNBC. May this doubtlessly legitimize OTC pot shares?

Sport changer. All it takes is one.

A Bud-ding Alternative

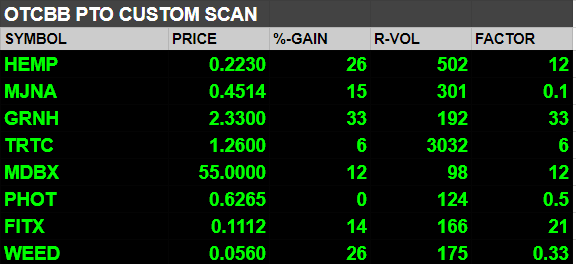

Let me offer you a brief timeline of the pot shares on the OTC. 95% of them fall into class of Junk Shares. Their ticker symbols would typically be abbreviated related phrases like PHOT or MJNA or HEMP. They’d run on favorable hashish legalization information, which had turn out to be a outstanding motion in America within the early 2010s. Governments needed to decriminalize it and early speculators have been on the lookout for firms that might make the most of the sector’s burgeoning free market. This was a very good recipe for short-term inventory hype. The one concern is that every one these weed shares had Tier-F fundamentals.

In 2012, Colorado and Washington have been about to go pro-cannabis amendments, which despatched these shares into hype-fueled features. But it surely didn’t final they usually rapidly reverted again to their pure terminal-$0 state. State laws was solely a primary step and most of standard society was nonetheless years away from a licensed retailer on the nook that offered them weed. Within the meantime, these Junk Shares would burn money and dilute the shareholder with limitless convertible debt. A few of these shares had an outrageous quantity of post-dilution shares–for instance HEMP had 1.6 billion shares excellent by This autumn of 2013.

In 2013, Vermont, New Hampshire, and Illinois joined the fray to legalize medical hashish. A lot of the weed shares reacted positively for a day or two after which trickled again down as convertible shares elevated provide. Sentiment gave the impression to be extraordinarily damaging and it appeared these junkers wanted one thing much more than political currents to maintain longer developments.

Then Medbox occurred and it appeared like every thing modified in a single day. MDBX went up tenfold in 8 days, peaking at a valuation of $1.5 billion. It was if this occasion signaled to all of the dummy traders a inexperienced gentle to purchase much more and never solely that, invite all their mates to the Junk Inventory purchaser’s celebration.

So that you had strikes like these throughout the board on the “main” pot names.

Consider these shares had a whole lot of tens of millions of shares within the float being traded with tight spreads. That allowed expert OTC tape readers like myself to search out every kind of layup scalps with good dimension.

Every single day the very first thing I might do is take a look at my OTC scan on the lookout for quantity, tight spreads, and gaps.

Then I’d simply purchase the opening print on the strongest shares with one of the best quantity and trip the opening drive for the primary half-hour. The remainder of the day was spent on managing my positions and ensuring I didn’t give again earnings on an sudden rug pull.

Then I’d take a look at the OTC scan on the shut and purchase 5-6 totally different shares closing robust anticipating a spot up the subsequent day.

February 2014 was my first six-figure month ever. I had one purple day that month. Total, I made $222,168 within the first 2 months of 2014. And truthfully… each shut I might evaluation my work and assume to myself… I ought to have made a lot extra.

Quickly after, everybody else needed within the OTC recreation. At the least ten different merchants opened Knight Direct accounts. One veteran dealer flew from Austin to NYC, going on to me to speak about find out how to commerce the pot shares. We had a each day inventory report e-mail after the shut, summarizing essentially the most traded shares on the desk. Up to now essentially the most energetic names could be the key tech names, essentially the most energetic %-gainers of the day, and a few random imbalance names. Nearly every thing over $5. Throughout these two months, you’d open the inventory report and also you’d typically see so many junk pot shares–HEMP, PHOT, CBIS, MDBX, NVLX, PLPL, GRNH, DEWM, ERBB, FITX, ELTP, TRTC, simply to call a number of. Guys I’d by no means met have been buying and selling them.

I had my outdated mentor Jimmy in my ear on a regular basis asking me my opinion on no matter shitco he was enamored with. For no matter purpose, I may sense Jimmy didn’t need to grind anymore. His WTG account was firmly within the damaging and he needed a giant play that would wipe the slate clear. I’d present him the straightforward cash I made simply by scalping the main shares that already went up 200-500% however he’d be preoccupied with discovering shares that had no quantity or momentum but, making an attempt to anticipate the preliminary breakout. He purchased tens of millions of shares of this illiquid pot inventory at 2 cents and paid hundreds in commissions as a consequence of our per-share value construction. I shook my head. At this level, the roles had reversed fully–the coed had now turn out to be the instructor.

Jimmy you’re being an fool. Why would you pay these commissions to purchase a brilliant low cost inventory like that? Why not not less than purchase that place in your private account and pay a flat charge?

He tried to persuade me it will go to $1. Too many late-comers creating new OTC account and now I see Jimmy tremendous bullish after so many shares had already flown up 10x. At this level, I knew the hype cycle was near being over and I began on the lookout for brief alternatives. I caught some good strikes and made $25k brief in per week when most weed shares skilled parabolic correction. I keep in mind considering how I used to be approach too cautious with my threat.

Our success was not with out some sudden resistance.

Poisonous Order Stream

“They’re shutting you down. They don’t need your trades.”

That’s our Director of Buying and selling Operations, managing the connection between WTG and Knight Direct. He simply advised me and Clockwork that our accounts have been being terminated as a result of Knight didn’t need any of our “poisonous order circulate”.

Poisonous order circulate? Are you fucking kidding me?

Right here’s the factor: we didn’t commerce OTC like the common retail dealer the place they simply purchase breakouts for multi-day swing trades. That’s what you do with penny shares proper, you purchase at .1 and promote for 5-10x? Yeah, we did that too however we additionally needed to juice the order circulate like we did on FNMA. We needed to purchase one million shares and promote it for the incremental .01-.10 strikes. This normally meant on the time when order circulate was most chaotic, like unstable dips or opening prints, we’d leap in and snipe the final orders earlier than the value turned. We’d jam the order blook with 20 totally different orders, after which cancel all of them when the value took off as a result of we didn’t need to backfill something if the momentum died off. Then when the micro swing had ended, we’do the identical factor and unload all our shares onto the bid to take out revenue, once more jamming in with 20 orders. We didn’t realize it on the time however this fashion of buying and selling acquired below the pores and skin of the market makers. It wasn’t an issue on FNMA/AAMRQ months earlier however the market makers dealing with the shitco names like HEMP and MJNA have been apparently far much less geared up to deal with it.So that they went to Knight Direct to bitch about it and shut off our accounts. They really used the phrase “abuse” to explain our buying and selling. We’re like the cardboard counters being thrown out by the indignant on line casino as a result of they don’t prefer it while you win.

IT’S NOT MY FAULT THEY’RE TOO SLOW!

That’s Clockwork, incredulous, when the scenario was defined to him. After all we’d cancel our orders that didn’t fill. Why would we need to take the shedding fills when it went again down?

Our Ops Director went hat in hand to Knight Direct on our behalf and we managed to get off with warning. Don’t cancel any orders or we’ll finish you. This additionally appeared absurd. So we would have liked a dialog after which extra individuals acquired concerned–Victor and Avery, a number of operations guys, and even Mr. West. Nobody desires to kill the golden goose.

For a very good 2 weeks, there was all this backwards and forwards negotiation on the “appropriate process”. They’d suggest options like we may solely cancel 10 orders in a day. Or we needed to wait 90 seconds to cancel our orders. Or we needed to enter orders in a single giant bulk order moderately than layering it. Or we needed to commerce on ARCA and pay much more in ECN charges. In the meantime on my retail buying and selling supplier, I had zero pushback buying and selling the very same approach I at all times did. Being a so-called “skilled dealer” generally looks like it has extra negatives than positives.

Poisonous State of Thoughts

Let’s get one thing straight–OTC market makers aren’t the great guys. They screw merchants on a regular basis when panics occur; I do know as a result of it’s occurred to me a lot. They only didn’t just like the tables being turned. It resolved itself however it’s one thing that pissed me off. We additionally had points with Goldman Sachs altering the buying and selling charges on ARCA and retroactively passing via the associated fee to us–that sucked too as a result of if we knew the true value we wouldn’t have been so aggressive on sure trades.

I discovered myself aggravated on a regular basis. Perhaps it was the poor sleep I used to be getting. Perhaps it was how a lot power I burned whereas looking at quotes continuous from 8am till 4pm. Perhaps it was the nervousness of buying and selling round different individuals on a desk, which hadn’t actually gone away even after newfound success. I took such a conservative method to all my trades, in the meantime in all this pot inventory fervor, I used to be listening to about different merchants holding enormous positions for doubles and triples. And I may get so tense whereas anticipating an entry on a giant play.

One time, I had this commerce the place I used to be on the lookout for a bounce on one of many pot shares that over-corrected. I’m watching it tick by tick, doing every thing in my energy to not give into temptation and purchase it too early. I solely needed to see my sign to make a commerce. There’s a self-discipline to the method. After which I hear–

Hey Pete, the place are you shopping for this inventory?

This fucking fool. What did he simply say?????????

Then I circled. Simply glared at him. Like come on dude! I don’t know till I do know! This trainee newb behind me who’s buying and selling 500 shares max and never even concerned on this play is interrupting my psychological course of and dude COME ON, that’s not the way it works, OK??? Please simply STFU.

Then I felt dangerous 5 minutes later. It was not neccesary to lash out like that. I get all self-conscious that everybody can see what a raging lunatic I’m–an all too acquainted feeling. The whole lot’s going so properly, why am I so indignant anyway?

We’ve one other nice week and Victor will get pizza and beer for all of us. Everybody’s all joyful however I’m drained AF. I would like a breather from all of the newb trainees pestering me with the identical outdated questions so I acquired up and went to tempo round in our foyer space.

I began considering to myself… every thing that’s occurred has occurred due to me. That Fannie Mae commerce virtually a yr in the past, it began every thing. Everybody buying and selling OTC after that. Eagle and Clockwork following the next pnl trajectory and making month-to-month top-10s–that’s all due to me. None of it occurs with out me.

And what do I get for it? These newbs interrupting me. Different merchants competing for my fills and crowding me out of larger positions. Market makers threatening to remove the Knight Platform as a result of they don’t need our order circulate. I’m at all times feeling like shit as a result of I’m within the rat race, wanting on the leaderboard day by day. On prime of all that, I’ve to surrender 50% of my PnL for this.

Typically I simply need commerce alone all on my own. The prop buying and selling mannequin is for the quants and the cowboys, and I don’t commerce something like them as a result of I’m a wimp who desires to take ZERO drawdown–and this eliminates one of the best a part of buying and selling at WTG, which is to take reckless pictures and get a bit of the upside. I’ve the cash at this level. I ought to simply depart. I’ll run the bitcoin fund and commerce on retail and hold all of it. I’m sick of this shit. I DON’T EVEN LIKE NEW YORK.

Teddy: Rattling Pete, I didn’t know you are feeling that approach. You sound confused.

Me: I’m simply venting… I’m not really going to go away.

(to be continued in Danger Restrict Exceeded)