This publish is dropped at you by TradingAlpha Securities.

What does your dealer do you for you?

These days, each dealer competes for your enterprise by taking a race-to-the-bottom method on worth. TradingAlpha is taking a special method by offering cutting-edge instruments that allow you to turn into a bionic skilled dealer with fashionable analytics at your disposal. An account with TradingAlpha comes with complimentary utilization of the proprietary THINKalpha platform–use it to backtest edges out there, design customized inventory filters, and create superior buying and selling algorithms. After all, in addition they supply ultra-competitive costs as effectively (contact for particulars).

Use referral code PETERBLOG when opening an account and obtain $200 in fee credit score and a couple of months in platform charges–$500 in worth.

(continued from Fannie Mae)

I had my mild bulb second. I knew that I simply needed to repeat this one factor that works again and again. I’d undergo display screen data and charts each day to refine my OTC playbook. I figured that something that has quantity will commerce off the identical order move patterns–held bid/ask, then quantity, after which a clear development. My plan after the large FNMA commerce was to maintain following it each day for smaller trades till the amount utterly died and compelled me to maneuver on. I’d additionally setup an OTC scanner to seek out new shares with quantity.

In June, I give attention to base hits and scalp the smaller strikes. I’ve no qualms with making three cents or 5 cents on a commerce. All in all, I make $13,000 buying and selling on my retail. I solely have 5 purple days. Gradual and regular.

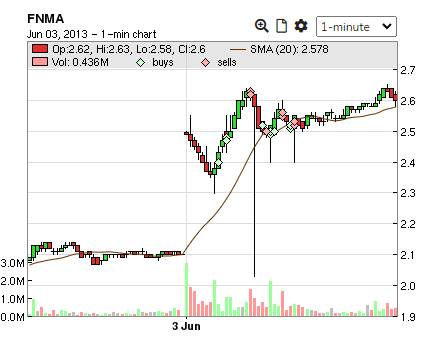

My finest commerce all month seemed like this:

$3,500 on a 20 cent transfer. This chart would appear like a complete nothing-burger to most merchants. It didn’t matter to me. The financial institution doesn’t refuse your cash as a result of it got here from scalping.

In July, the vary is all however gone. FNMA strikes about 10 cents a day with no quantity. I spend extra time on my MBC account buying and selling listed shares and I handle to grind out $6500. I solely have 3 dropping days. I really feel fairly good about my consistency. However I additionally really feel more and more fragile–my go-to inventory has run out of steam.

I had my methods down however what I actually wanted have been some good OTC shares with juice.

Three Totally different Flavors of Rubbish

OTC shares are far more liquidity-sensitive than different buying and selling autos. The liquidity is both there to commerce or it have to be prevented utterly. There are 3 sorts of shares that exist on the OTC.

1. Pump and Dump

Webistics is the choose of the week! “However why? Its obtained a 3 million float, the competitors’s sturdy and their know-how is three years behind. The inventory’s a canine.” Why, as a result of we’re paid to pump it, that’s why! First step of a Pump and Dump, there’s normally some profession prison making a shell firm and distributing the float to all his scumbag cronies. Then you’ve gotten tier-F broker-dealers, the JT Marlin’s and the Stratton Oakmont’s, chilly calling away and searching for any sucker they’ll persuade to purchase the inventory. Then they rent a “promoter” to create quantity and entice merchants. Inevitably, the inventory dumps to 0, by no means to be heard from once more. They are often good quick alternatives if you happen to can find the inventory. I traded many of those again in 2010, names like LEXG, JAMN, MSEH, NXTH. However the Pump and Dump’s heyday was lengthy gone, which is what prompted me to pivot and study to commerce actual shares at MBC.

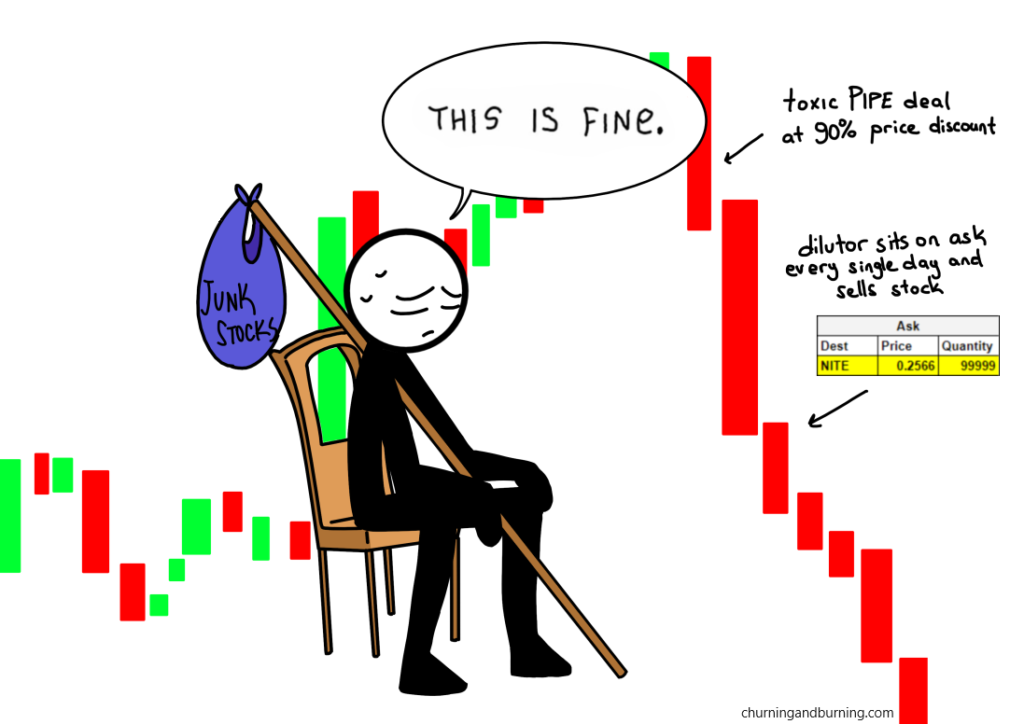

2. Junk Inventory

Junk Shares are fledgling corporations with actual operations not like the Pump and Dump. They normally have horrible financials and may’t get conventional financing from official underwriters in order that they usually depend on loss of life spiral financing from non-public traders. With a view to create buying and selling quantity, they generate hype by way of press releases and product launches. One subset of this class is the Delister–Junk Shares from the NASDAQ that failed to remain compliant with itemizing necessities. They’re normally some busted all-or-nothing idea like a one-drug biotech that failed scientific endpoints or an oil & fuel exploration that died on the vine. The Junk Shares normally want main themes or distinctive tales to generate severe liquidity–one good instance again then was a tech components firm referred to as Liquidmetal Technologies (LQMT) that ran on early iPhone information.

3. Fallen Angel

The Fallen Angel is a extremely distressed or bankrupt firm with a family title. They’ll put the little ‘Q’ on the finish of the ticker. One thing unhealthy occurred–fraud, mismanagement, laborious instances, or technological obsolescence. When instances get actually powerful like throughout 08′, you’ll get a flurry of ‘huge’ names like Blockbuster, Common Motors, and Lehman Brothers falling into the OTC gutters. Traders love a comeback story, irrespective of how implausible, so naturally all these shares had 500-1000% strikes from the underside earlier than going to 0. My opinion, backed by my very own P&L: the Fallen Angels are one of the best OTC’s to commerce when there’s actual liquidity.

There’s just one rule about buying and selling OTC that it’s essential bear in mind: By no means assume something is actual. Every part you see will ultimately go to 0. When attempting to catch a falling knife on a market index or a mega cap inventory with no information–that reckless WTG-style “it may well’t go to 0!” mindset in all probability works in your favor. However… “It might’t go to 0” is by no means a real assertion when attempting to dip purchase an OTC inventory. Oh sure it may well. 99% of those shares will go to 0 within the long-run. To generate profits, you must be an adept dealer who can flip them out shortly with none attachments.

August comes round. MBC lastly types out a months lengthy delay stemming from compliance points and allows the Knight Direct platform for OTC buying and selling, a separate platform from Pr0Trade. The MBC desk will now commerce OTC shares for the primary time. All of this stemming from that Could twenty ninth FNMA commerce that I made. It feels bizarre. Each of my buying and selling worlds have collided into one–OTC Bandit Pete and Professional Dealer Pete have been now one and the identical. I had some inside conflicts. I could be competing with others for fills. Administration may count on me to commerce 100% of my OTC quantity on the Knight Platform. Nonetheless, I strive commerce solely a token quantity on Knight Direct whereas nonetheless taking the majority of the danger on my retail account. I do appear to hold a wild quantity of unsupervised shopping for energy on Knight Direct although, which helps me spam orders on increased priced shares.

I wanted the Inventory Gods to ship me one other good one they usually did–zombie American Airways aka ticker AAMRQ, a class 3 Fallen Angel that really had an actual probability for constructive fairness redemption. Quite than simply clear all money owed and wipe out the shareholder like 99% of all bankruptcies, American was capable of conjure a miracle deal to merge with US Airways and kind an enormous $11 billion greenback new airline firm. The inventory, which at one level in 2012 had traded as little as $0.24, began buying and selling as much as $7. After all, nothing ever unfolds with out chaos on the OTC. Unfavourable anti-trust information got here out and crushed the inventory to $2 in mid-August..

AAMRQ was harder than FNMA. It had some traps and didn’t transfer as clear. However it traded on the identical rules and I nailed the inventory’s rhythm down shortly. I had a brand new favourite play referred to as the Opening Drive Play–all of the orders flood into the inventory at 9:30 with a wall of consumers and sellers duking it out. Whichever aspect wins, play the primary transfer. The opening drive play was normally, although not all the time, a continuation of the day past’s development. Although AAMRQ was already down enormous from $6 to $3 and had most retail merchants tunneled in for the knife-catching play, my transfer was to quick the primary held ask and letthe sellers stroll it down.

I shorted 32,000 shares at 2.88 and coated the bulk within the 2.10s. I revamped $17,000 with out ever being in any drawdown.

For all the month, I had 55 trades on AAMRQ netting $45,000 whole. My largest loss was only a hair over $1000. Web income for August from each accounts mixed: $63,152. I’ve now surpassed six figures in buying and selling income for the primary time in my life.

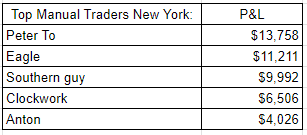

I open an e-mail titled ‘High Merchants of August’. The highest-10 Austin-based WTG merchants internet the most important figures, totals starting from 50k to $150k a month. They’re the adults within the room. We get a token point out in our personal seperate column as “High NYC merchants”, simply to be ok with ourselves. We’re nonetheless on the youngsters desk.

I’m hungry for extra. I’m locked in each day and I don’t power a factor as a result of I hate drawdown and I hate dropping. I discover myself hooked on this order move pushed buying and selling the place I don’t should take any ache and it virtually appears like I’m assured to win. However September isn’t nice. AAMRQ loses its juice. Lack of alternatives come up and my outcomes fall again right down to Earth. $12,500 mixed to finish the month.

I believed after spending some vital P&L milestones, I’d really feel completely different. Perhaps that nagging insecurity goes away. Perhaps the despair monster is gone for good. I believed sleep would enhance with extra monetary safety nevertheless it really obtained worse the extra my income elevated. I spent so many nights restlessly in mattress, dwelling over micro worth motion and my place sizing decisions. AAMRQ again in August, that held bid commerce I took at 3pm, why didn’t have I double the scale? FNMA in July, why didn’t I purchase extra when it sprung off help? Little shit like that protecting my thoughts awake. I’ve ideas much more dire: What if the great instances are over already? Did I do sufficient to take benefit? The dearth of satisfaction itches at me.

It’s the start of October. FNMA begins to spring to life once more. I can’t consider what number of lives this inventory has, it refuses to die off. I muse on whether or not I’ve this guardian angel from above trying over me, reasurring me…“Pete, you want one thing? We obtained you buddy! Right here’s some new quantity in Fannie so that you can play with!

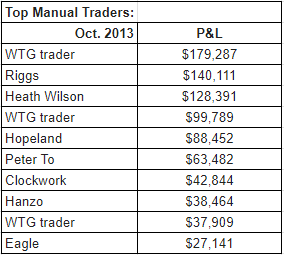

We didn’t comprehend it on the time, however a BIG HONCHO hedgie was barging into FNMA and resurrecting the order move. There have been many alternatives–none practically nearly as good because the Could twenty ninth bounce commerce however nonetheless loads of cash for everyone. I give a handful of merchants my OTC playbook. Clockwork and Eagle particularly choose it up actual shortly.

Breakout Play — purchase a inexperienced day by day candle that breaks a horizontal line (ideally with quantity and expanded vary affirmation) and maintain for swing commerce.

Clockwork: Simply purchase above this 1.50 degree proper P-To? It’s the excessive of this weekly vary.

Me: Yep.

Gapper Play — let’s say you miss the unique breakout ranges and it’s essential chase it. Straightforward, simply purchase the closing print and catch a 5-10% hole.

Imply Reversion Play — inventory goes up 3-4 days in a row. Quick for a correction and watch the sellers clear up any steep worth strikes. Then go lengthy for the micro-mean reversion when the promote correction over-corrects.

Eagle: P-To that is the place we quick it proper? They may take it again right down to $2.

Me: Yeah that sounds proper.

It’s easy and simple and after a pair days I barely needed to clarify something. See it, commerce it, crush it. That’s peak day buying and selling.

We crack the top-10 with profession excessive months. The MBC Youngsters have lastly grown up.

There aren’t clear reduce guidelines on when it occurs however personally, I’d say it occurs round now. This was the purpose the place we grew to become CPTs — Persistently Worthwhile Merchants. We lastly made sufficient to reside and eat. This was the essential level if you happen to needed to maintain a residing as knowledgeable dealer.

There’s a passage about being a CPT in Victor’s first e-book, Two Nice Positions titled “Changing into One of many Chosen Few”. When you’re an official CPT™, you are feeling such as you’re part of an unique nation membership. It’s the results of years of laborious work and talent growth. It’s the results of adapting knowledgeable mindset the place you simply make good trades with sound danger administration and the remaining will fall into place. Victor makes it sound extremely course of pushed and he’s not flawed, it’s. However there may be an simple part of luck and happenstance concerned too–when do market alternatives lastly intersect along with your skillset? For us, the time was now. I’m wondering if he ever considered how MBC’s second act would play out–I think he thought we would have liked one other monetary disaster or one other flash crash. Just a bit particular one thing to spike volatility within the markets, get our confidence up after which we’d be off to the races. There’s no freakin’ approach he thought it might begin off together with his core merchants scalping bankrupt OTC shares. It simply goes to indicate you that this enterprise isn’t about predicting the long run. It’s nearly being prepared for no matter occurs.

November marks one other month of success. Bill Ackman of Pershing Sq. reveals he’s the large purchaser in FNMA and the inventory has a lot warmth behind it for the entire month. It’s one of the best inventory on the desk. All 3 of us end over the $25,000 mark to make the top-10 once more. I end 4th total at $46,604. I had 2 dropping days in all of October and November mixed. My danger administration and my execution proceed to be impeccable. I’m lastly validating the ‘huge dream’ of buying and selling in NYC.

December is a little bit of a down tick as order move dries up once more. We’re all again across the $10,000 PnL vary once more. We now have the restraint to not go loopy and provides all of it again out of greed–a central hallmark of being a CPT. I really spent most of December cashing in on one other aspect quest that will likely be advised within the subsequent chapter.

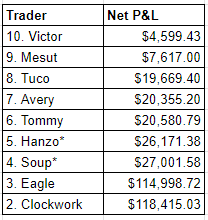

The yr ends for the MBC-WTG Joint Enterprise. I question the P&L outcomes for everybody within the agency from March twenty first to yr’s finish by way of the WTG Information Warehouse characteristic. 4 merchants at WTG in Austin surpass the $1 million greenback mark nevertheless it wouldn’t be truthful to check myself to those market killers with 10+ years of expertise. I simply needed to check the PnL outcomes inside the NYC department, apples to apples. The highest-10 merchants on the MBC desk for the yr 2013 have been as follows…:

And number one…

…you guessed it.

Yours actually, with a internet P&L of $150,448.43

I should have checked out these numbers 100 instances, questioning in the event that they have been actual after which soaking all of it in. Numbero Uno at MBC Securities for the yr of 2013, the yr the agency turned it round after an period of wrestle and turnover since 2010. I’ll admit, it’s a pleasant ego enhance. I felt rewarded for my efforts and I believed one of the best was but to come back. The vibes on the desk have been good once more, higher than ever the truth is.

On high of my MBC P&L, I tallied $195,400.26 on my retail account. Grand whole of all accounts mixed for the yr of 2013: $345,848.69. 24 years previous. Not unhealthy.

There was one notable dealer who didn’t capitalize on all this newfound OTC lucrativeness. As the times handed by, I’d see much less and fewer exercise on his blotter. He appeared utterly checked out. A pair days off grew to become a pair weeks off after which grew to become a pair months off. I didn’t hear the gratuitious profanity nor the abrupt pounding of the fist on the desk anymore.

Tuco, our exalted head dealer, was gone. He was going dissolve his partnership at MBC Securities. He argued passionately for the entire desk to get entry to the Knight Platform however left earlier than he might use it himself. He mentored many people however he by no means obtained to see us breakout and turn into CPTs. Tuco had sufficient with day buying and selling. He had sufficient with petty squabbles and mundane enterprise selections. He felt destined for greater issues the place he would run the present. He left to accomplice up with Rowboat and begin a brand new hedge fund referred to as Inexperienced Ivory Capital. He took a handful of MBC merchants with him. He despatched me an e-mail in July:

Pete, you’ve gotten a spot at my new fund if you need it. In the intervening time, swing away my buddy. Bear in mind, it’s not your cash!

(to be continued in Bitcoin II: The NO!!! Awakens)