That is one setup you possibly can look to commerce the triple prime sample.

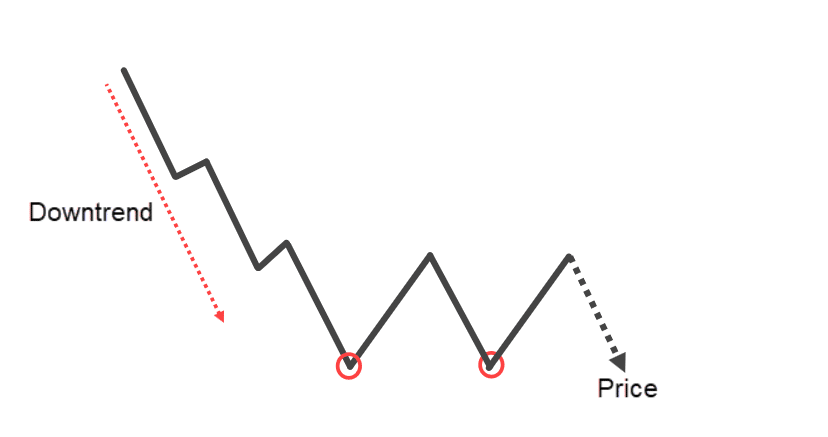

Triple Backside Chart Sample

It is best to know what to anticipate…

It is a bullish reversal sample.

The market is in a downtrend then it makes a low, bounces up larger, comes down and retests the lows, bounces up larger retests the lows as soon as once more.

Considering it might break.

The sellers thought…

“Hey, that is our time, It’s victory”

Guess what?

The market bounces up larger after which they fail to take the value decrease.

At this level, you must look ahead to what we name the neckline.

If the value breaks above the neckline, that is the place we are saying the triple backside sample is confirmed and the market may head up larger.

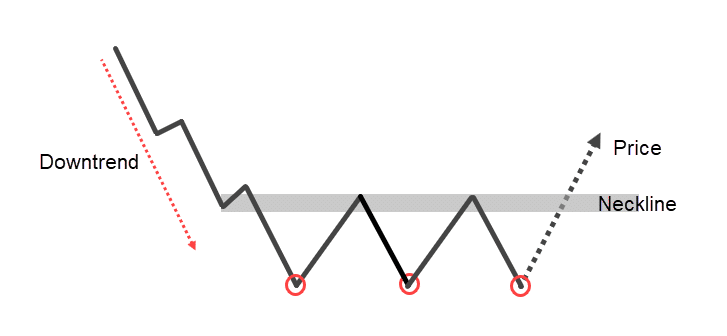

Chart Instance:

You discover how cute these three bounces are. The three makes an attempt to drive the value down however the market refused.

What’s that telling you?

If it might probably’t go down then it most likely ought to go up larger.

How will you commerce the triple backside sample?

You should use the break and retest, the first pullback.

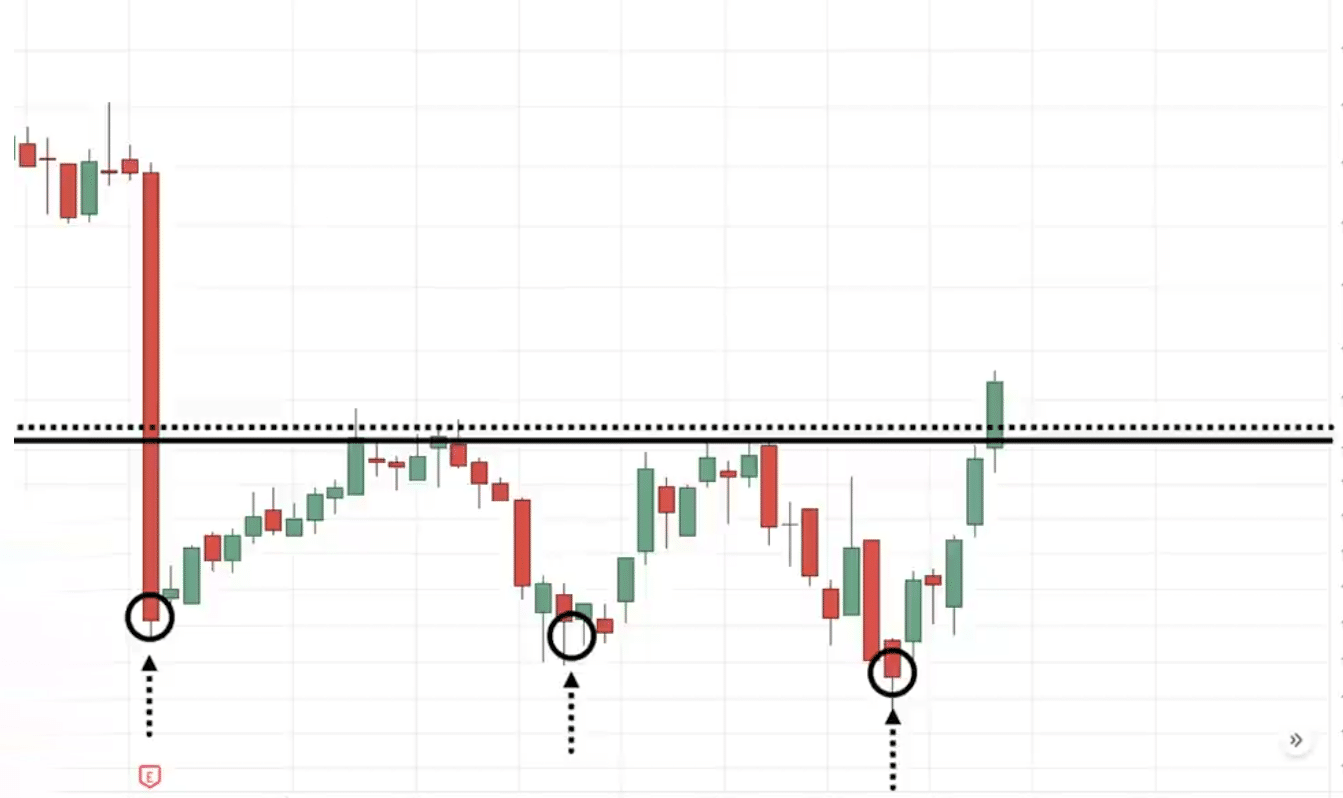

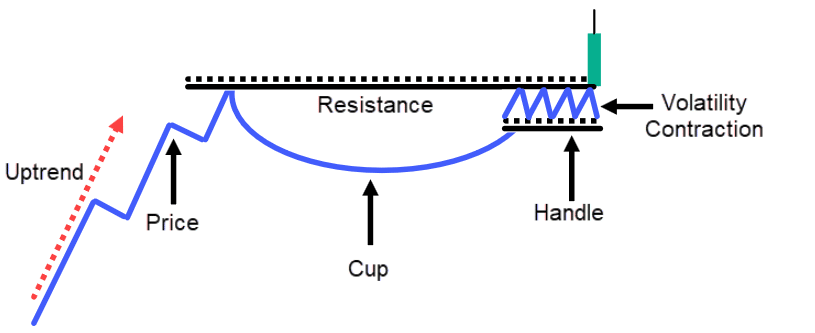

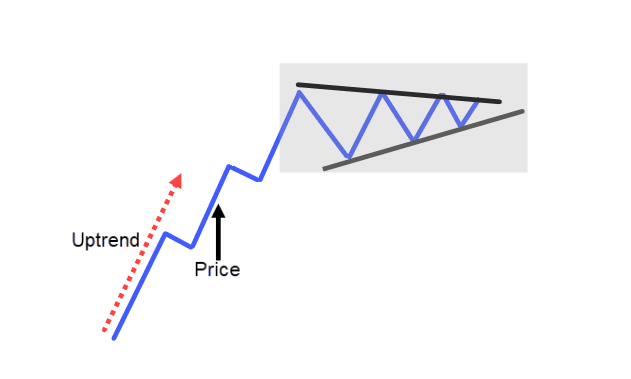

Cup and Deal with Chart Sample

It is a bullish development continuation sample.

The market is in an uptrend. goes up larger makes a pullback, goes up larger makes a pullback goes up larger.

This time, if you see a cup and deal with sample forming, you’ll discover that the pullback is for much longer when it comes to period in comparison with the sooner pullback.

Then it begins to consolidate barely.

The market continues to be bullish.

Sellers couldn’t push the value any decrease. It has problem breaking the swing low

This tells you that the general market continues to be bullish after which at this level you possibly can draw the realm of resistance or the neckline.

When the market breaks above the realm of resistance, we’ll say that the cup and deal with sample is shaped, and the market is prone to proceed up larger.

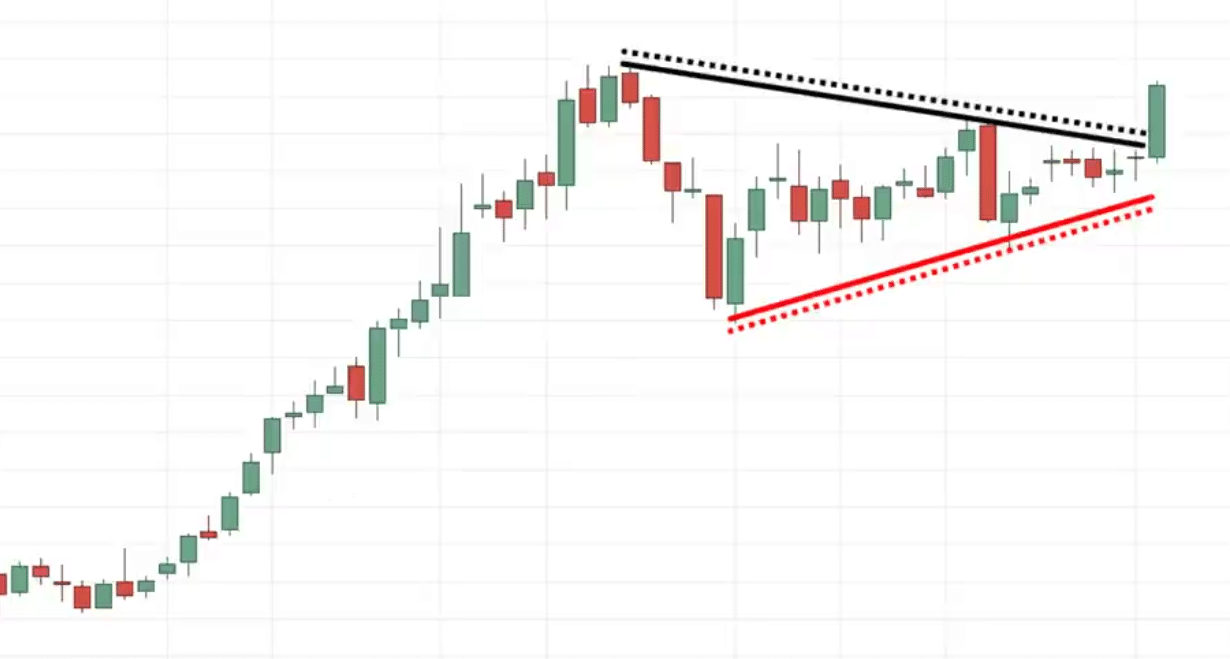

Chart Instance:

You discover how the market is in an uptrend, makes a pullback, and goes up.

This time you discover the period is for much longer in comparison with the earlier pullback, then it tried to interrupt out of the excessive however couldn’t.

As an alternative, it shaped a consolidation, and when the value breaks above the excessive, that is the place we are saying the cup and deal with patterns are full and the market may go up larger.

How do you commerce the cup and deal with sample?

You may commerce this by utilizing the break and retest or the primary pullback.

However one other manner you possibly can commerce it’s…

Discover how tight the consolidation is for this cup and deal with sample.

What you are able to do is that if you discover the deal with could be very good and tight. That is what we name a volatility contraction.

It’s also referred to as build-up.

The place the patrons and sellers are in equilibrium storing potential vitality to make the subsequent transfer.

Since the course of the development you most likely wish to be within the course of the development.

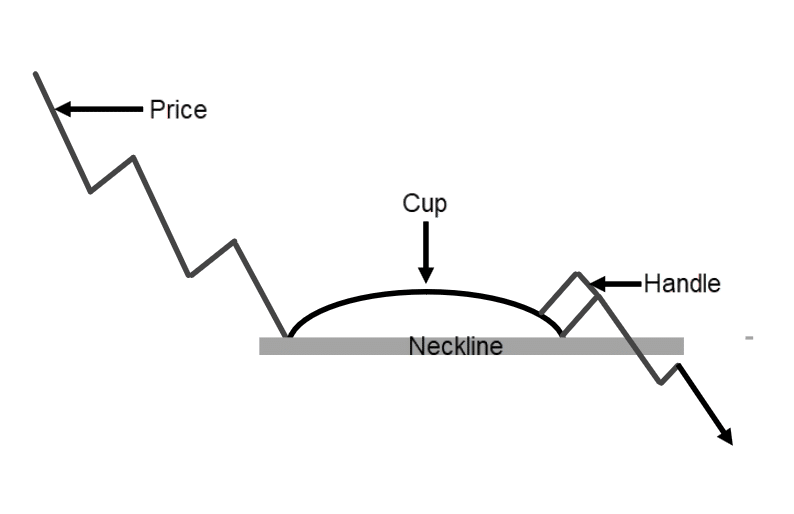

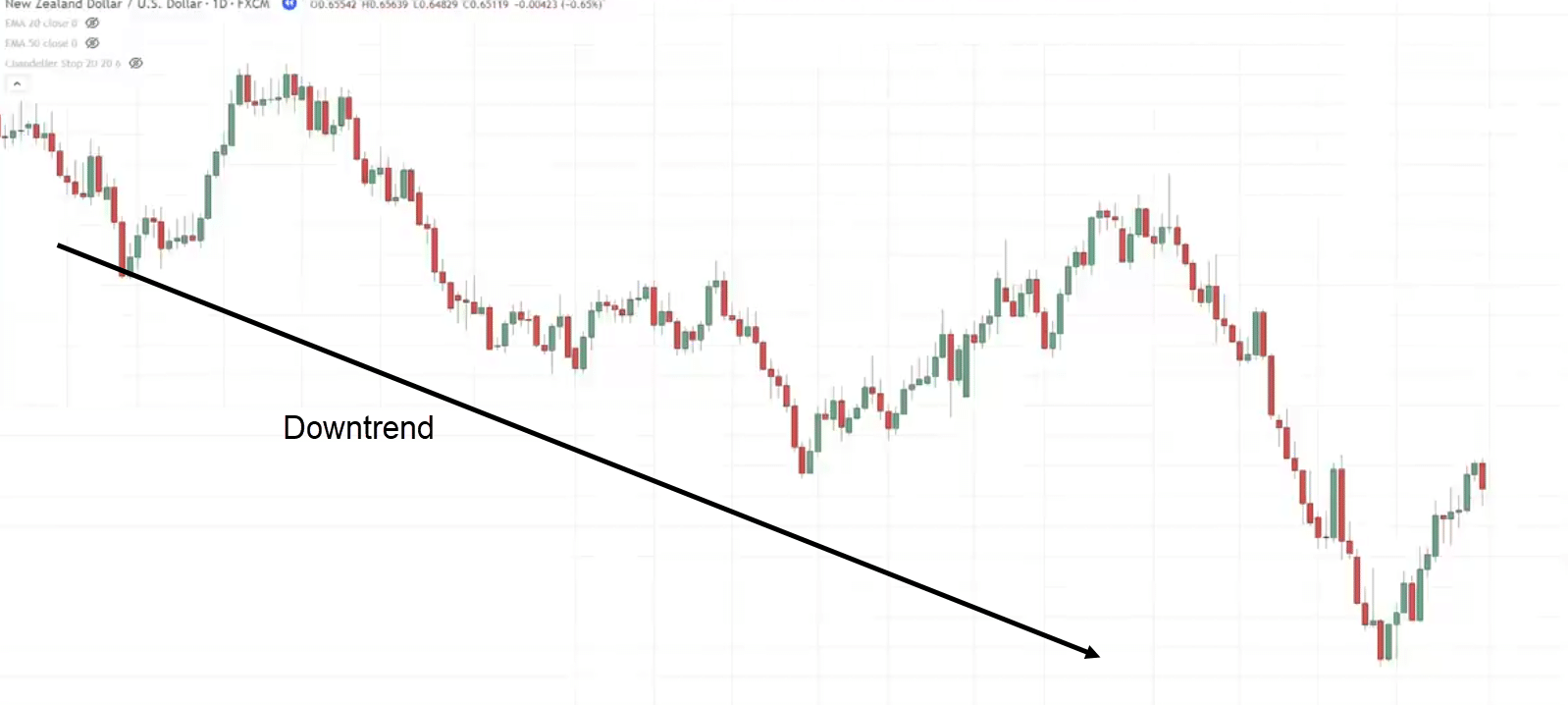

Inverted cup and deal with sample

It is a bearish development continuation chart sample.

The market is in a downtrend. It hits decrease after which makes a pullback, this time across the pullback is longer than the previous pullback.

It makes one other pullback, it’s so weak that it couldn’t even take out this earlier swing excessive

At this level, you may have what we name a neckline or an space of assist.

If the market comes down decrease and breaks under these lows of assist, you possibly can count on the value to hit decrease.

Chart Instance:

Think about a cup and deal with with out consolidation, the subsequent logical place to set your cease loss can be on the swing excessive which goes to be giant.

However a consolidation offers you a related place to set a good cease loss, which affords you a positive danger to reward on the commerce.

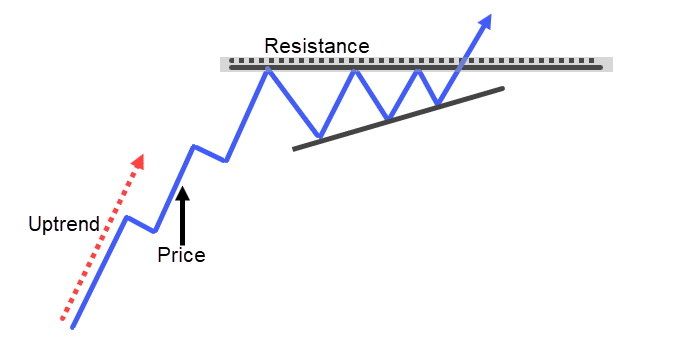

Ascending Triangle Sample

That is considered one of my favourite chart patterns to commerce as a result of it’s a bullish development continuation chart sample.

I discover that it’s probably the most highly effective ones to commerce.

The psychology behind this sample is simply so important.

How the Ascending Triangle Sample works

The market is in an uptrend, goes up larger makes a pullback, then it begins to go up larger once more however fails to take action then makes one other pullback.

What’s fascinating is that this pullback, now didn’t take out these lows.

At this level, you may have what we name an space of resistance and typically we would have one other smaller pullback earlier than the value breaks out larger.

When it breaks out, that is what we name an ascending triangle chart.

To me is an indication of energy as a result of it tells you that…

“The patrons are prepared to combat to remaining for each inch attempting to push the market up larger”

You may see the customer is attempting to push the value up larger even in entrance of resistance, they’re nonetheless prepared to purchase at these larger costs.

Why would individuals wish to purchase in entrance of resistance?

In all probability as a result of they count on larger costs to return, that’s why you’re prepared to purchase in entrance of resistance since you suppose that the market is prone to escape.

Earlier than it breaks out, you rapidly get on board.

It is a signal of energy.

Think about somebody shorts at resistance, the place will your cease loss be?

In all probability your cease loss goes to be above the best of resistance.

That’s what most gurus will inform you to place your cease loss above resistance. Think about when the value breaks above the resistance, it’s going to hit this cluster of cease loss.

When it hits that cluster of cease loss, that’s sturdy shopping for strain to push the value additional up.

This is the reason I like buying and selling the ascending triangle chart sample.

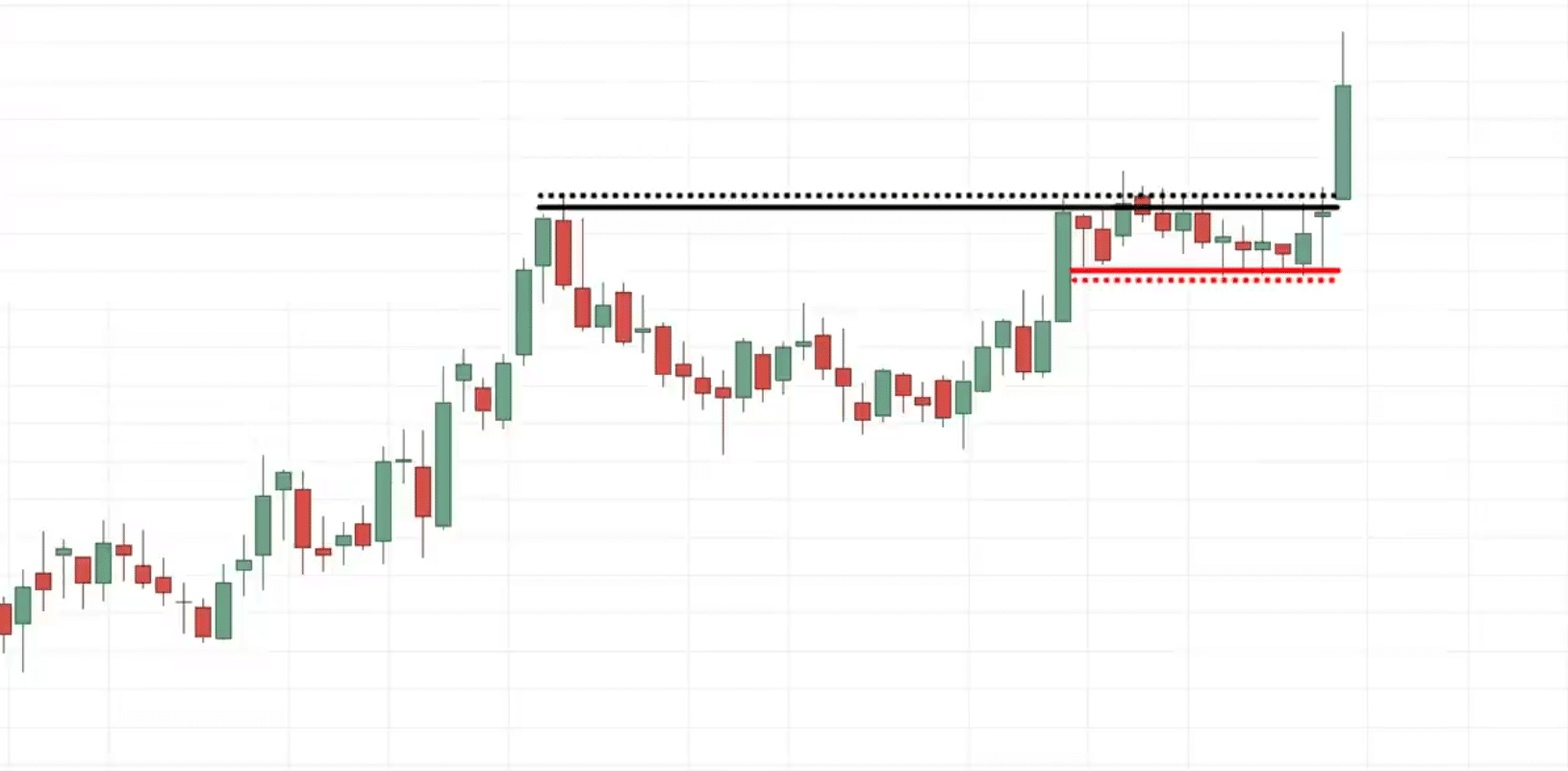

Chart Instance:

How will you commerce the ascending triangle chart sample?

You may look to commerce the retest the break and retest.

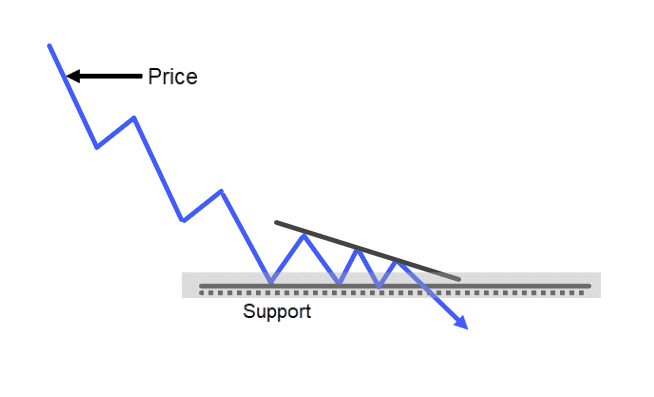

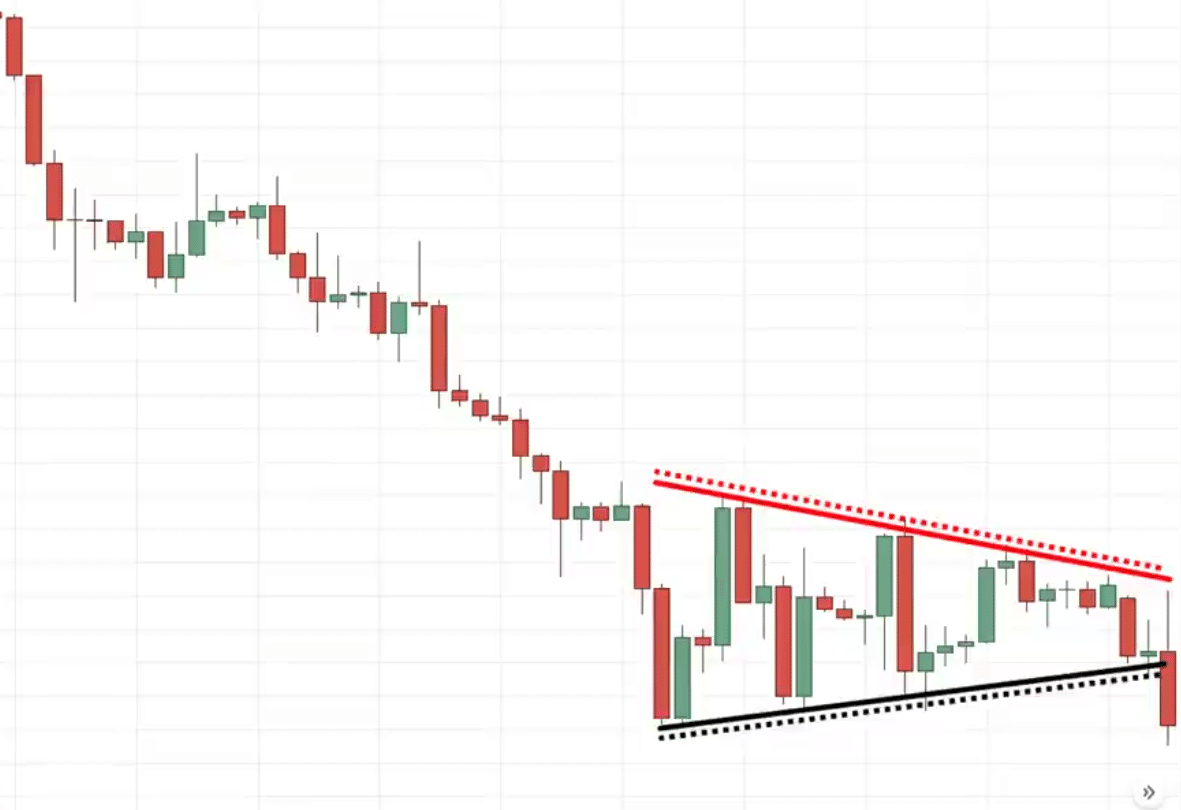

Descending Triangle Sample

It is a bearish development continuation chart sample.

It’s simply the inverse of the sooner one.

Chart Instance

How will you commerce the descending triangle chart sample?

You should use the break and retest technique as shared earlier or the primary pullback technique

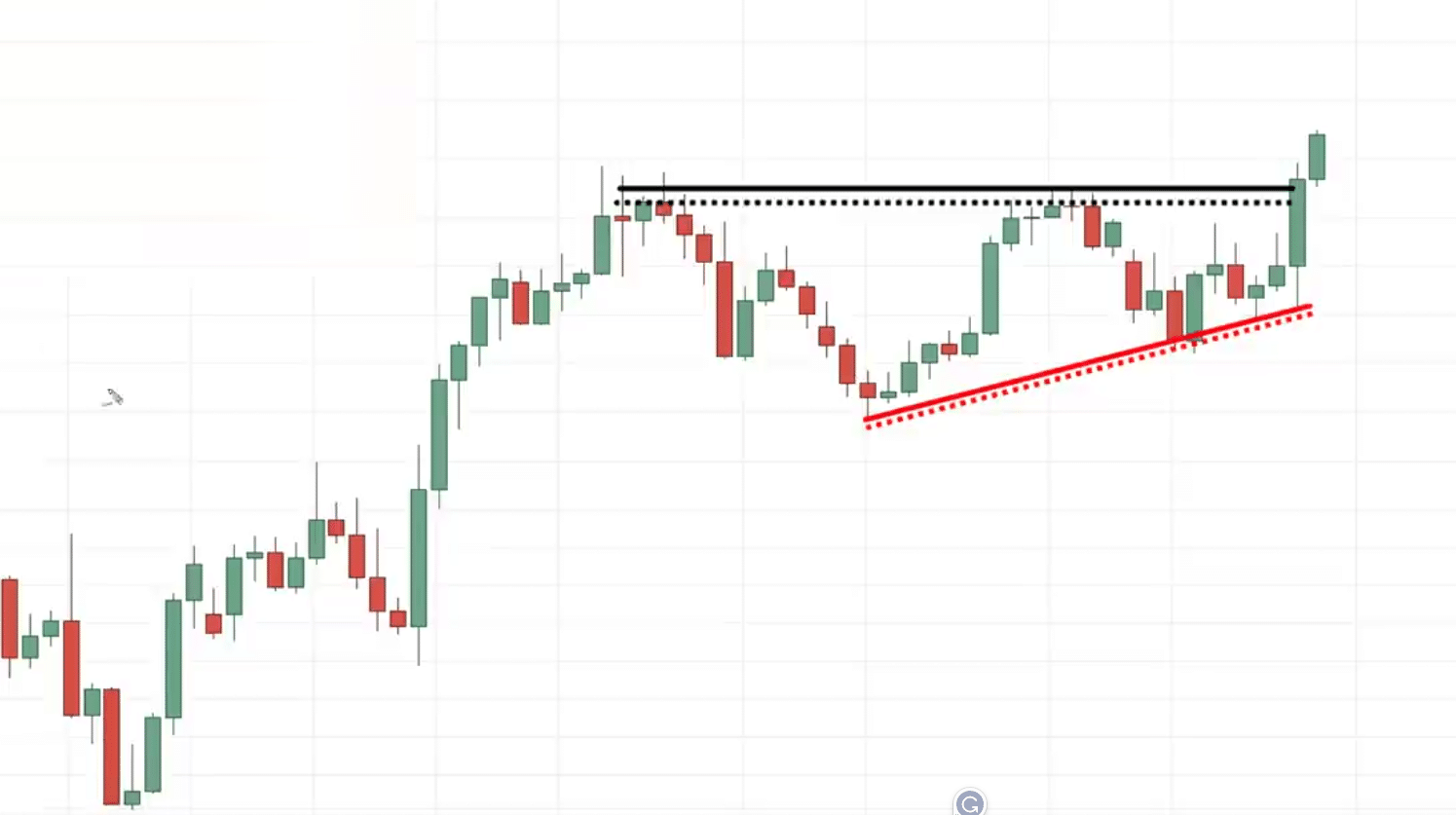

Bullish Pennant chart sample

It is a bullish development continuation sample.

The market is in an uptrend, goes up makes a pullback however can’t escape of the highs. You may see that the volatility of the market is shrinking in case you simply join the strains

This seems like a smaller asymmetrical triangle sample.

The sort of value motion tells you that the volatility of the market is getting smaller.

As the volatility out there is rarely fixed. It strikes from a interval of excessive to low and vice versa.

That is what we name it bullish pennant.

Chart Instance:

Often, if you commerce such development continuation chart patterns it’s helpful to path your cease loss. You should use issues like a shifting common to path your cease loss

You may maintain that place till the value breaks and shut under your shifting common in order that’s one method to go about trailing your cease loss.

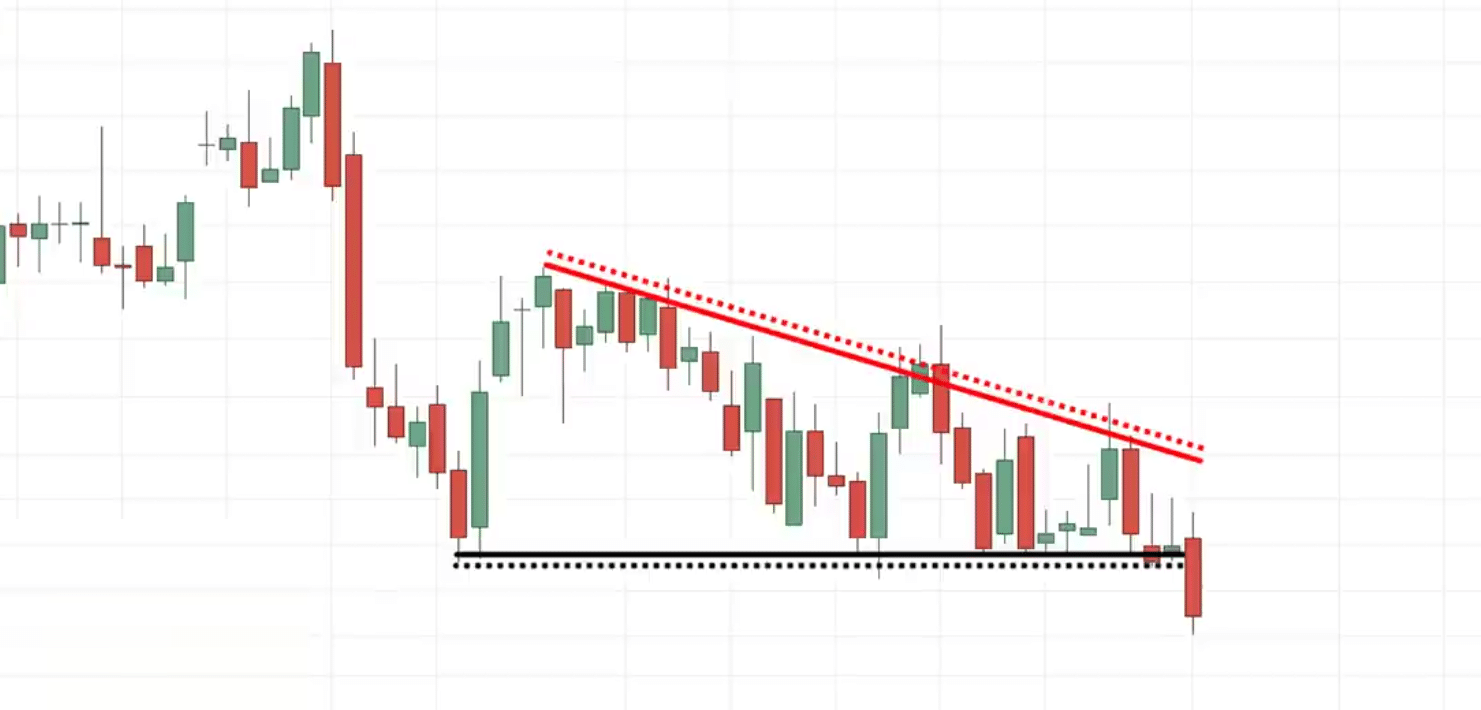

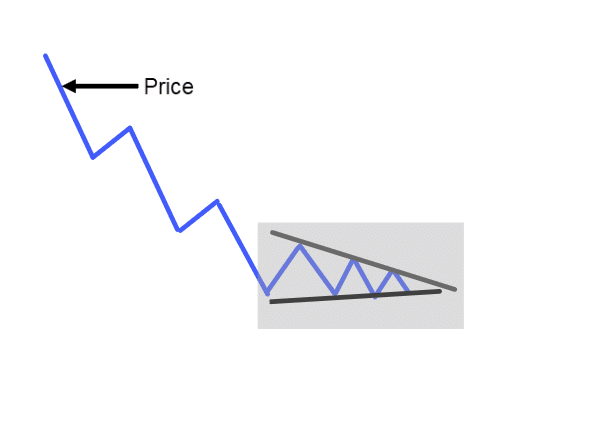

Bearish Pennant Chart Sample

It is a bearish development continuation chart sample.

The market is in a downtrend, goes down decrease makes a pullback tries to go down decrease however can’t break under the lows then pulls again up larger however once more fails to interrupt out of the highs.

Then it hits down decrease once more and may’t take up the low earlier than it makes a slight pullback which once more fails to take out these highs after which goes down decrease as soon as once more.

At this level, you possibly can join the highs and the lows.

At this level, the volatility of the market is shrinking.

If the value breaks and closes under, we’ll say that the bearish pennant is confirmed and the market may go down.

Chart Instance

You would possibly hear me saying issues like “may”

I’ll by no means say issues like assured, that doesn’t work in buying and selling.

We’re coping with chances, by no means certainty.

Buying and selling methods for chart patterns

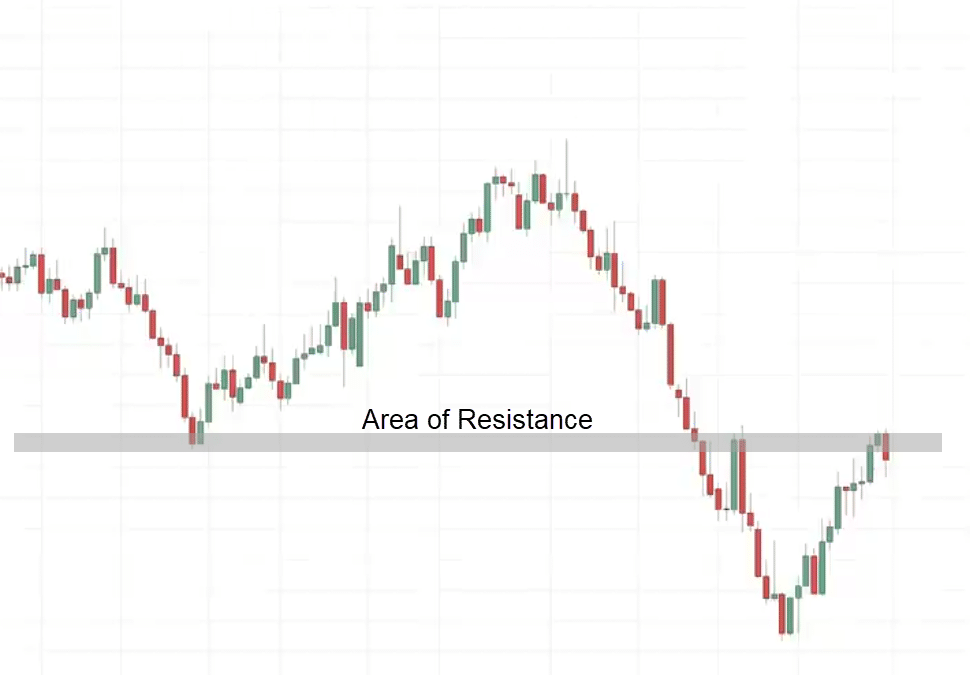

First on the technique…

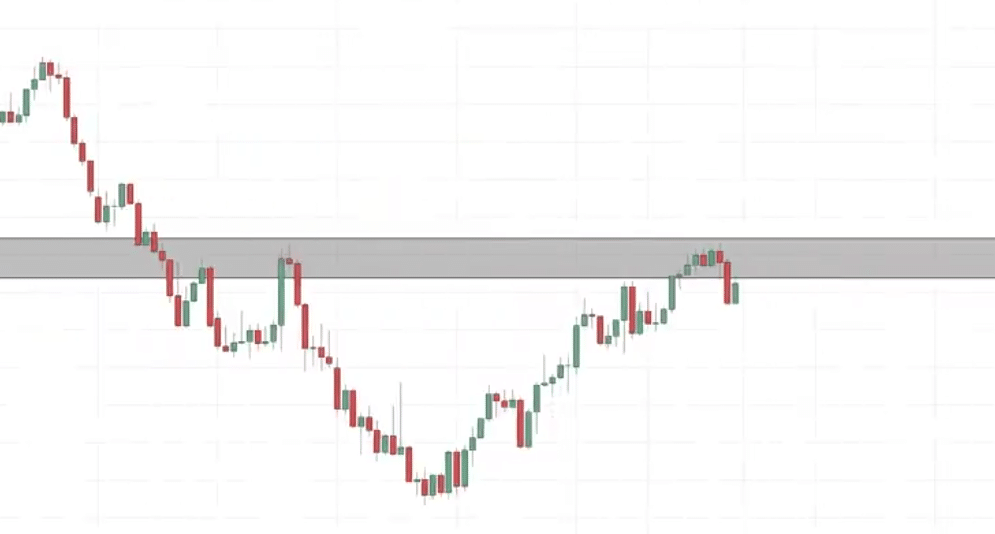

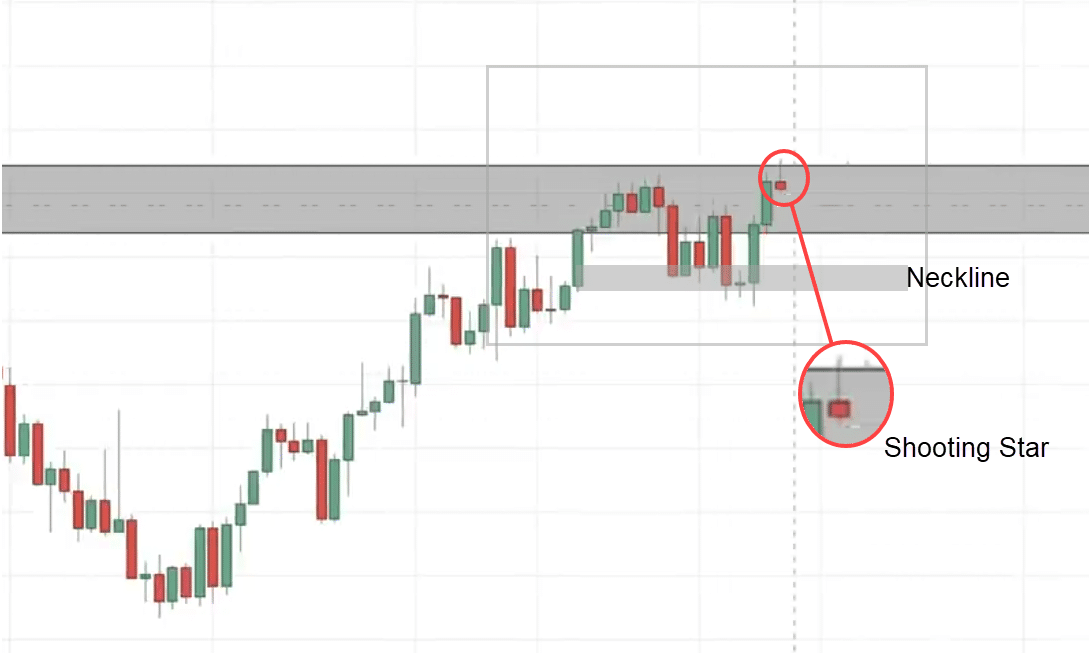

Double Prime False Break

In case you recall earlier, I talked in regards to the double prime chart sample and there’s a way that you should use to enter your commerce with low danger even earlier than the value breaks under the neckline.

How do you do it?

Let me clarify on this instance…

You may see that the general development of this market is in a downtrend and what’s fascinating is that this market has come in the direction of an space of worth.

In case you’re not accustomed to that time period, it merely means areas on the chart the place shopping for or promoting strain may are available.

As resistance is an space the place promoting strain may are available to push the value decrease.

As soon as I see this on the day by day time-frame, I wish to go all the way down to a decrease time-frame just like the 8-hour time-frame, and search for this particular chart sample.

You see that this market is respecting this space of resistance

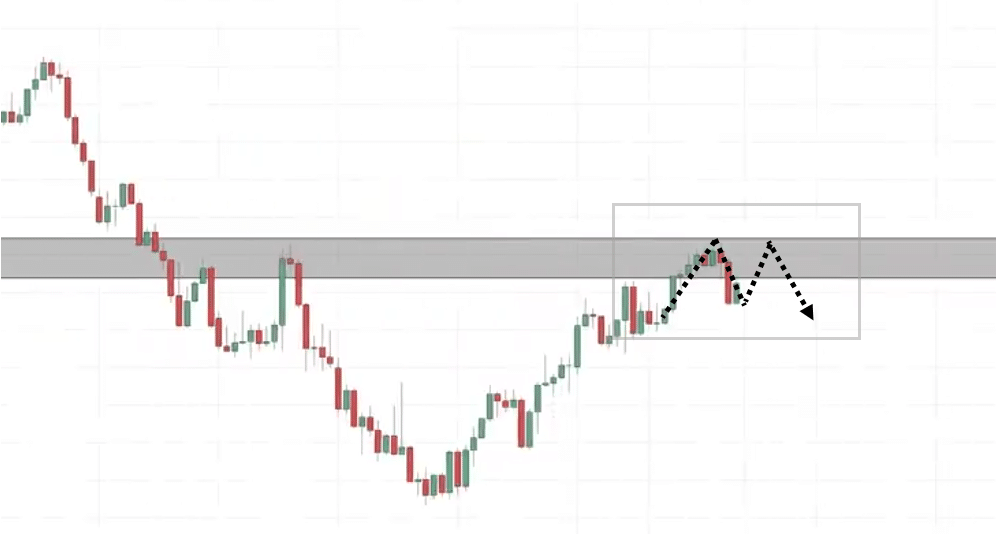

8-Hour Timeframe:

In case you take a look at the newest value motion, what do you see?

You will note that it’s a bit too early. Half of the double-top sample is already being shaped.

We may get one other one coming.

What we’re on the lookout for is the second portion to type to indicate us a bearish value rejection.

Let’s see what occurs…

On this case, the market goes down and begins to rally larger.

We’re again on the highs once more.

The double-top sample is close to completion.

That is legitimate provided that it breaks under the neckline. That is what I imply:

However since we’ve quite a few components working in our favor…

Is it doable to enter the commerce earlier than the value reaches the neckline?

Sure.

How do you do this?

Wanting on the total market on the day by day timeframe, it’s in a downtrend and that is an space of resistance that I’ve highlighted.

You may see we’ve an entry set off generally known as the taking pictures star. Telling you that the sellers are stepping in and about to push the value decrease.

That is an entry set off to go brief.

What you are able to do is go brief on the subsequent candle open.

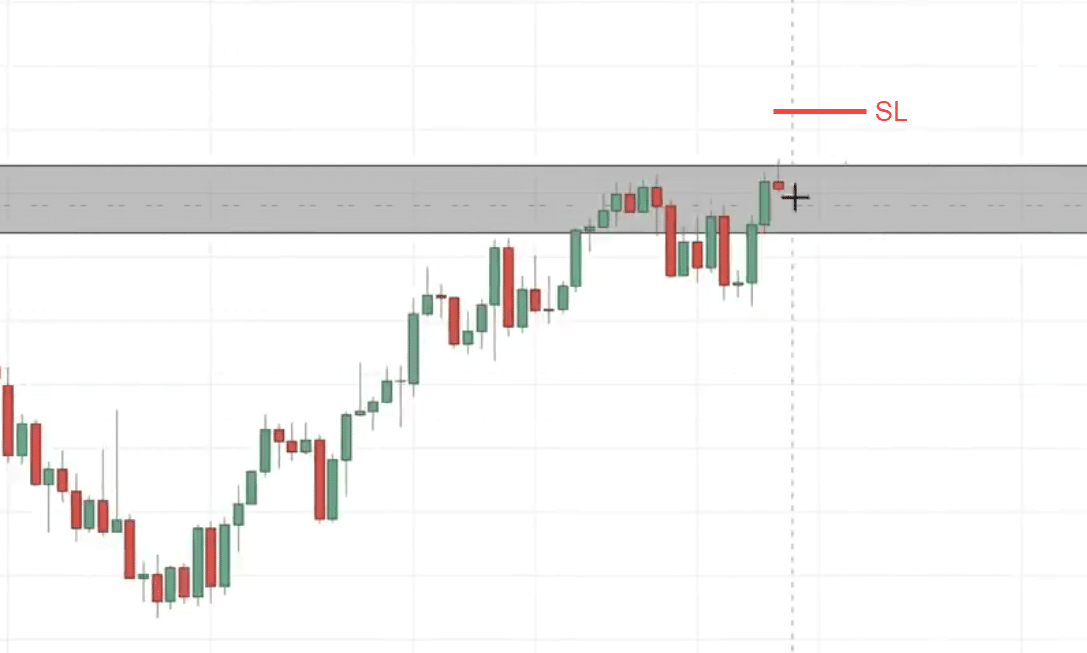

I set my cease loss a distance away from the value construction. a distance away from the highs the gap away from resistance:

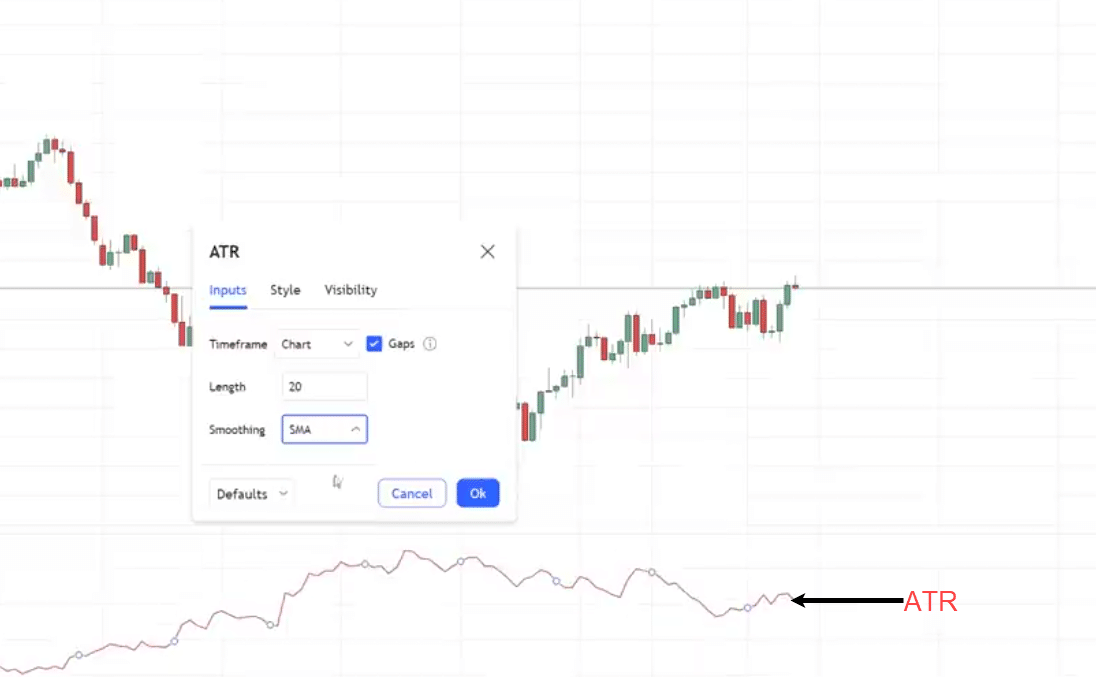

You should use an indicator known as the common true vary ATR

I like to make use of a 20-period SMA for the ATR.

What about our goal?

Because you at the moment are buying and selling even earlier than the double prime sample is accomplished, you may be in revenue earlier than the value breaks under the neckline.

Right here’s the factor in regards to the neckline…

Generally it’s not the perfect time to brief the market as a result of the value breaks under the neckline.

If you concentrate on this logically, the neckline is an space of assist.

The worth would re-test the neckline after which bounce up larger and proceed.

That would occur.

If you wish to be slightly conservative, you possibly can have your goal on the neckline the place individuals need to brief the market in an uptrend.

You may take revenue and exit half of your place.

Hopefully, this illustrates the ability of buying and selling the double-top sample.

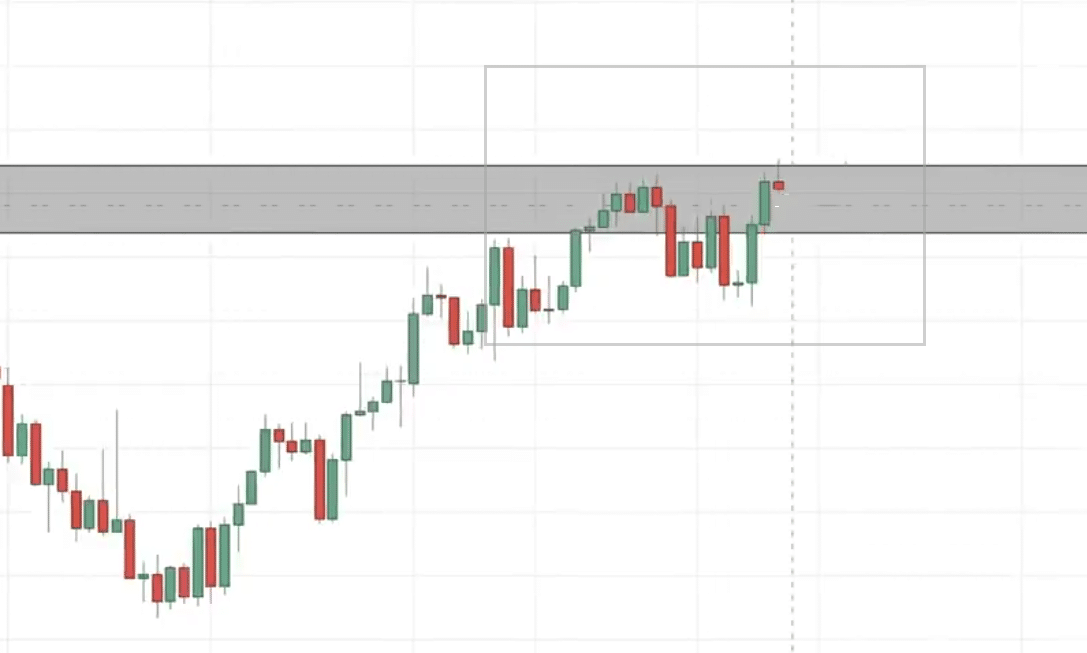

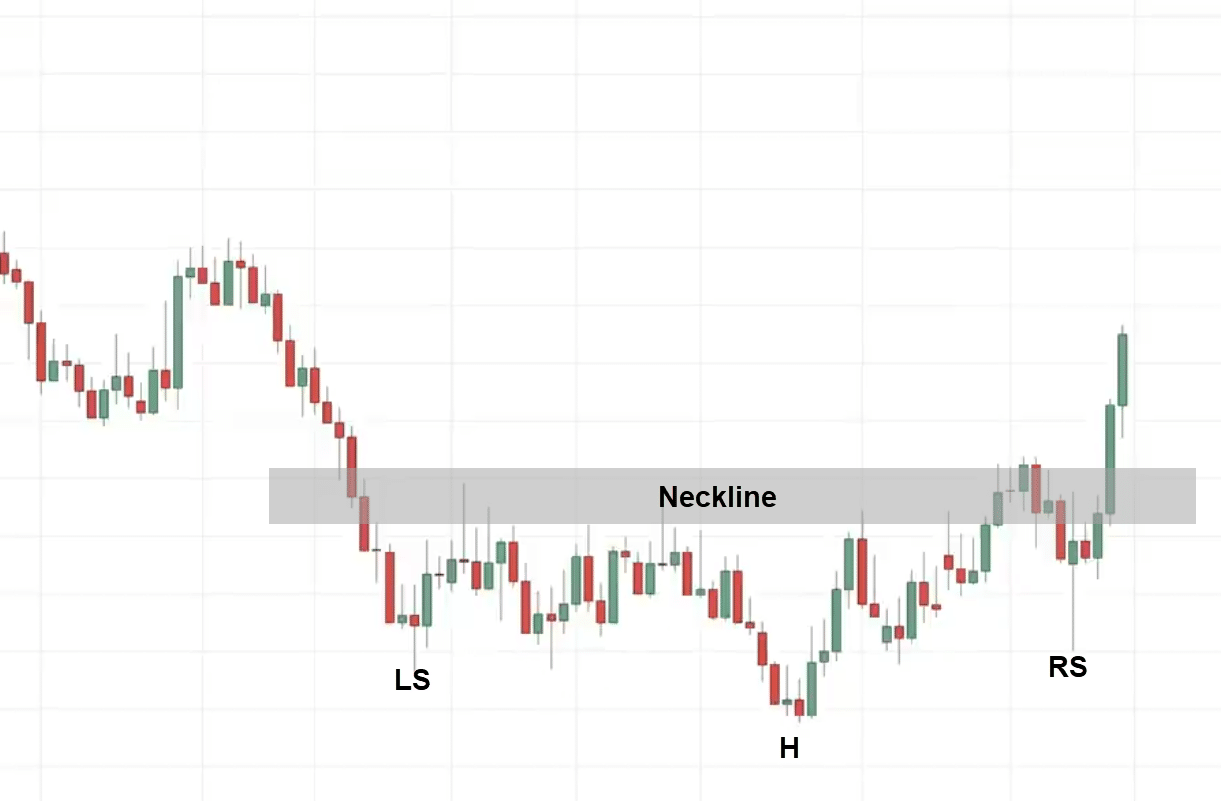

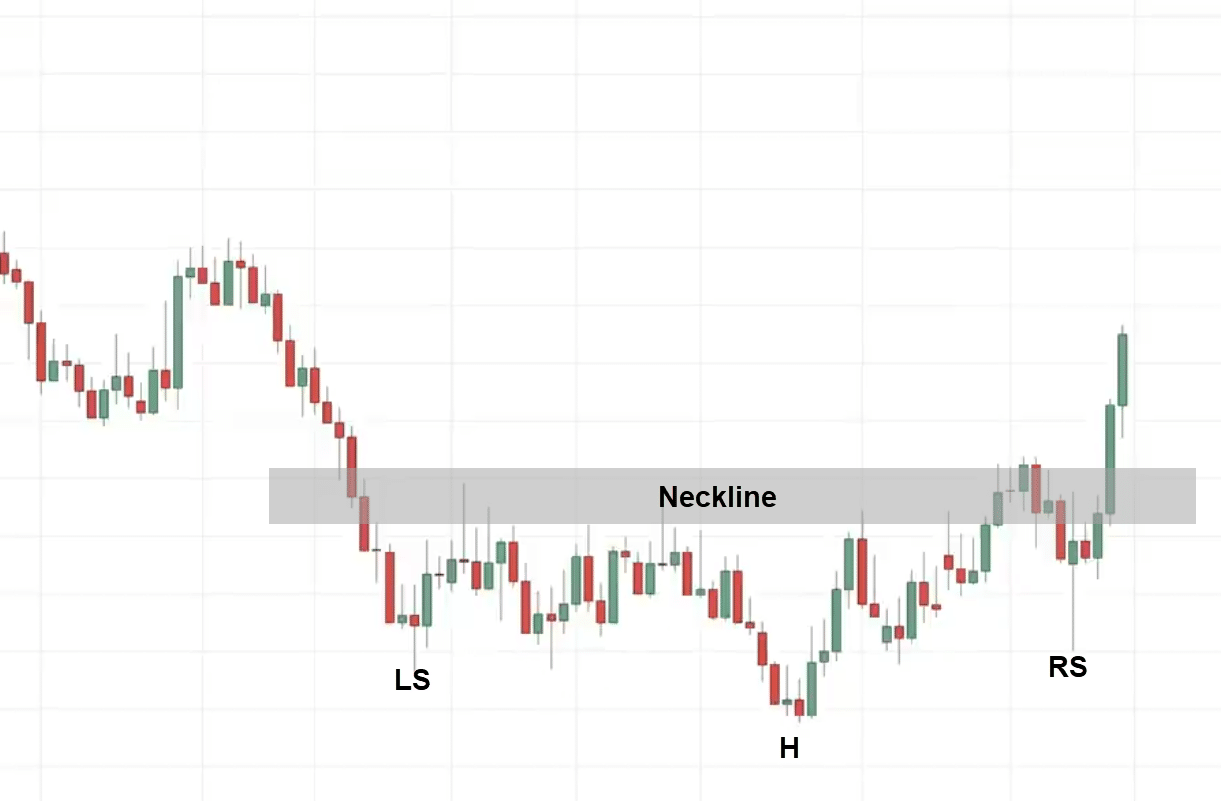

Inverse Head and Shoulders sample

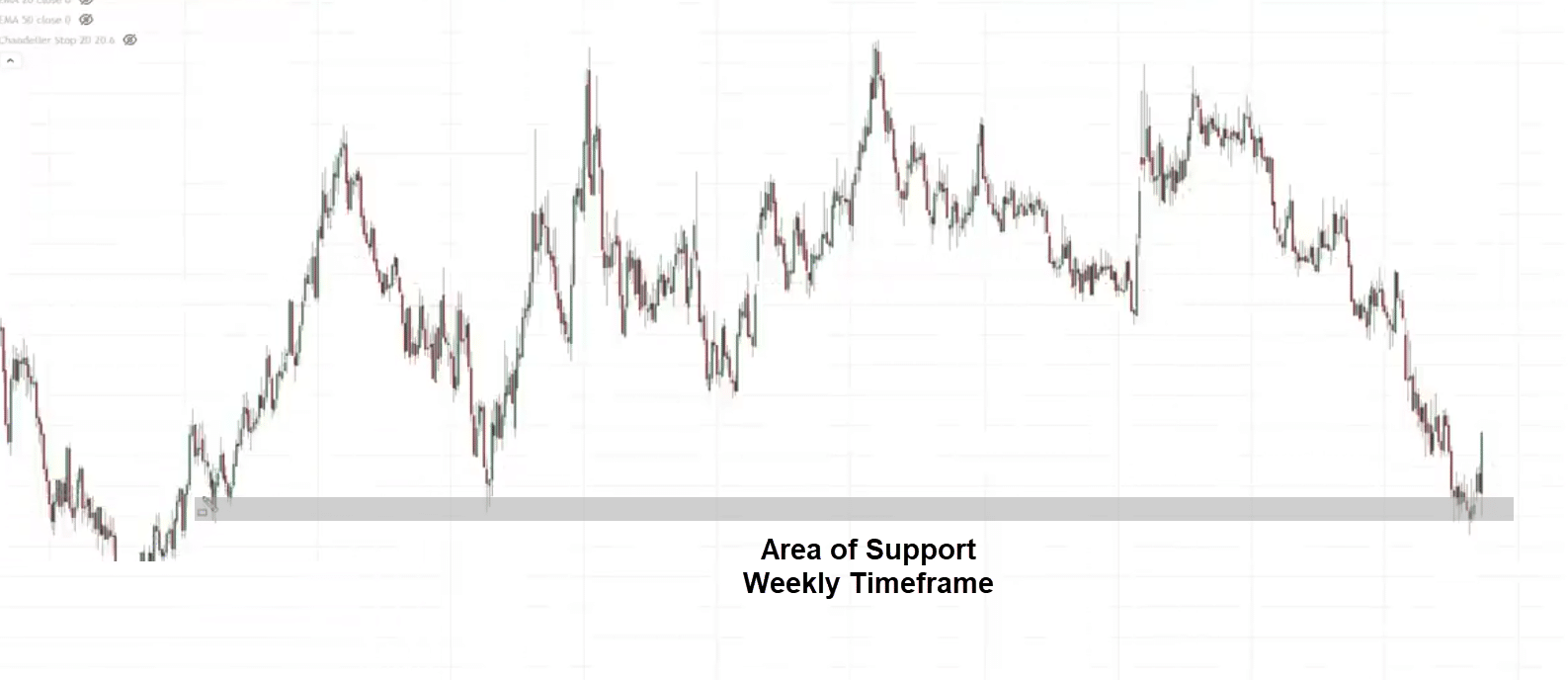

EURCAD Every day

Now we have an inverse head and shoulder sample, there’s a left and proper shoulder and this might be the neckline.

One factor I wish to spotlight is that, to know whether or not the market is prone to reverse or not, you wish to see the place the reversal sample has shaped.

Is it leaning in opposition to any larger time-frame value construction?

Instance

On the day by day timeframe, in case you take a look at the weekly timeframe you’ll discover that the inverse head and shoulder sample leans on the areas of assist on the weekly timeframe.

That is important and may very well be the long-term reversal on a better time-frame.

Let’s learn how can we get on board a commerce with low danger to commerce this reversal chart sample.

Going again to the day by day time-frame.

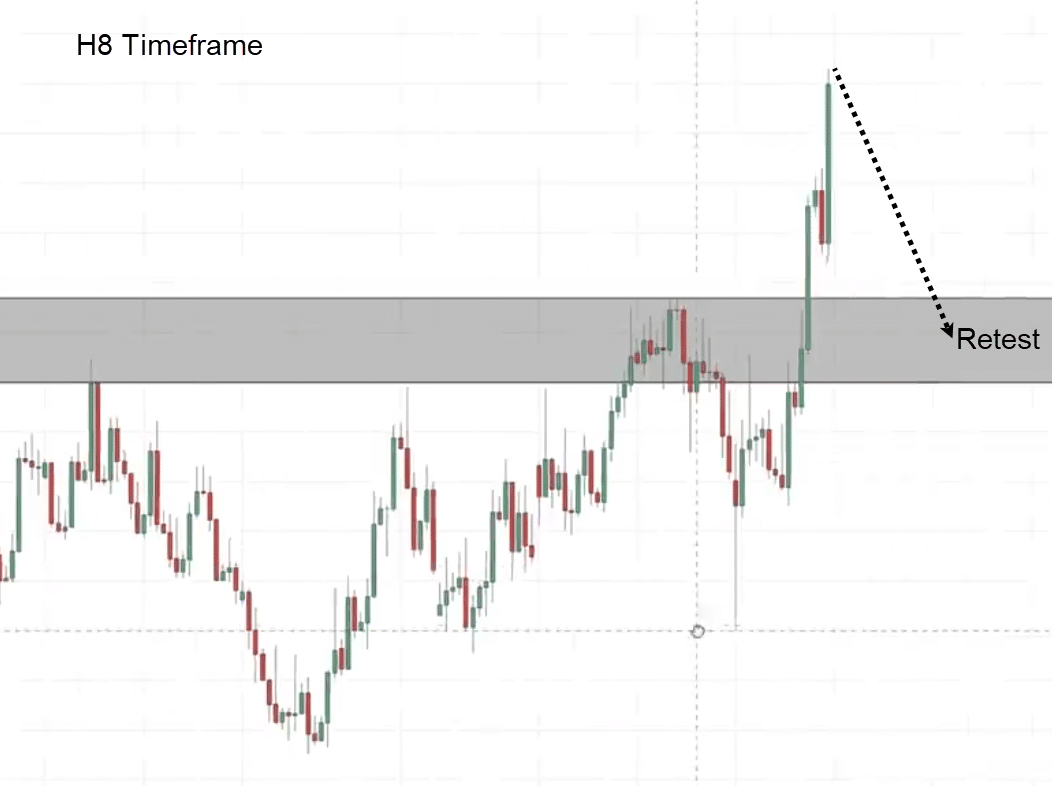

The subsequent factor that you are able to do is if you wish to discover a low-risk entry, you possibly can go all the way down to a decrease time-frame just like the 8-hour time-frame, and search for an entry set off to go lengthy.

My recreation plan over right here is that since I do know that is an space of worth, The neckline may turn out to be earlier resistance which may turn out to be assist.

I’m on the lookout for buying and selling alternatives across the neckline.

What I’m pondering of is for the market to do a retest into this space, come again in, after which shut again above it giving me an entry set off to go lengthy

The market appears to be breaking down, it retests the lows.

You wish to be being attentive to this degree as a result of it is a swing low and patrons may are available to push the value larger.

What we’re on the lookout for is a rejection for the value to shut bullishly above the lows signaling shopping for strain is coming in and the market may go up larger but it surely failed.

The market broke decrease:

Let’s see what occurs subsequent:

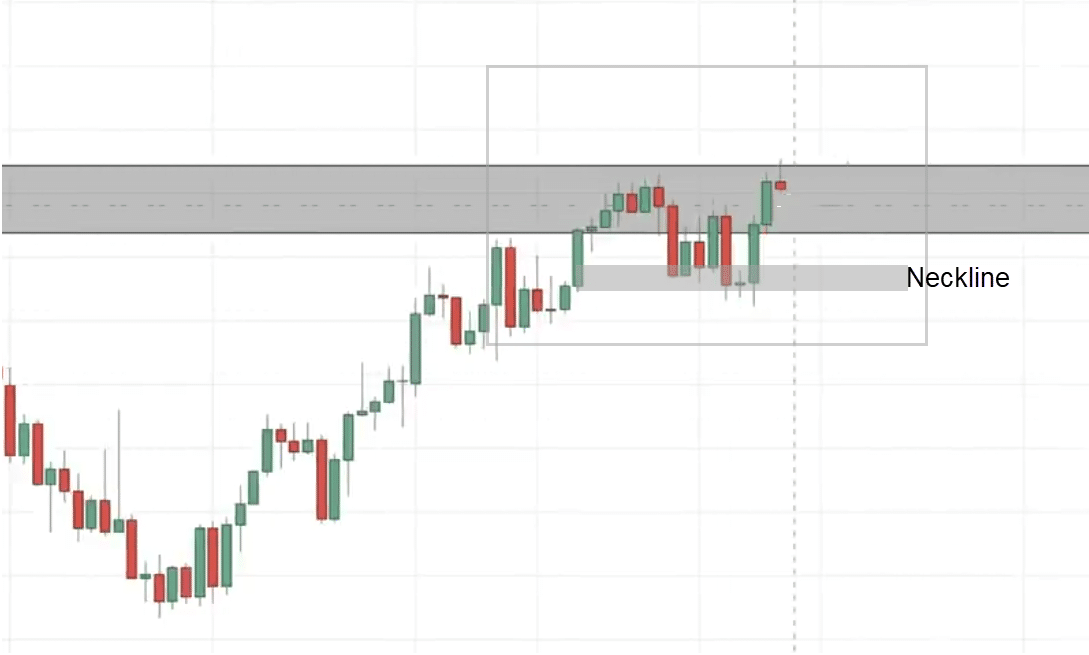

That is what I name a false break.

You may see that the market took out these lows making merchants suppose that…

“That is going to be a breakdown”

This to me is an entry set off to go lengthy.

Right here’s what I’ll do…

Let’s put it in inexperienced that’s our entry value level

Then as for our cease loss, we set at a distance under the lows utilizing the ATR methodology I shared with you.

We will have our first goal simply earlier than the latest swing excessive.

What’s important about this entry set off is that if you commerce this inverse head and shoulders sample, you’re now not simply shopping for the breakout of this neckline.